In a massive decision to ease crypto regulations, the US Federal Reserve Board announced on Thursday the withdrawal of crypto-related guidance for banks associated with crypto activities. The new rule also puts an end to dollar token activities.

A press release issued by the Fed stated that the latest decision ensures the Board’s stance works well with the changing nature of cryptocurrencies and “support innovation in the banking sector”.

@federalreserve announces the withdrawal of guidance for banks related to their crypto-asset and dollar token activities and related changes to its expectations for these activities: https://t.co/v1MwuswOlE

— Federal Reserve (@federalreserve) April 24, 2025

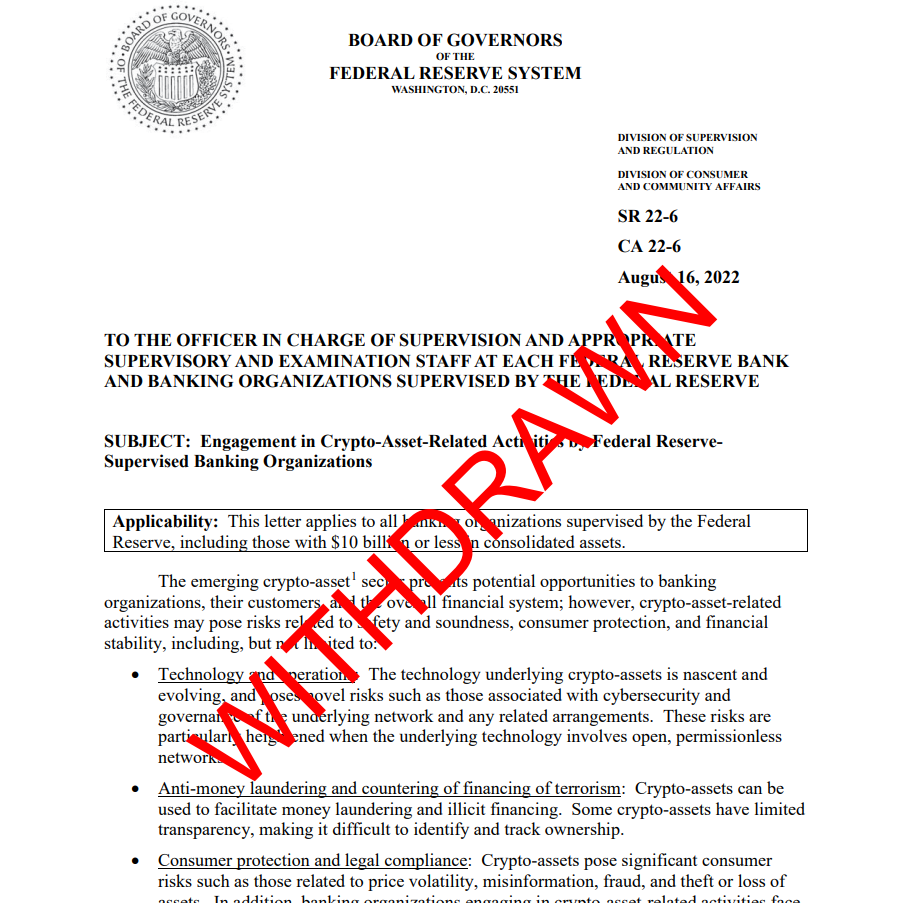

Although the Fed will not request state member banks to update on activities, it will keep track of banks’ crypto-asset operations using a normal supervisory process. Also, the board expects banks to inform about “planned or current crypto-asset activities”. That said, the Fed will repeal its 2022 supervisory letter.

Moreover, the board will annul its 2023 supervisory letter related to the risks of crypto-assets to banking organizations. In short, the 2022 supervisory letter intended to alert Fed-supervised banks regarding their engagement with crypto-asset-related operations, while the 2023 supervisory letter emphasized the risks associated with crypto-assets, such as fraud and scams.

The board informed that it will collaborate with federal bank regulatory agencies to determine if more guidance is required to bolster innovation in the banking sector, including crypto-asset dealings. The rescission of crypto guidance marks another milestone for the crypto sector in the US, as President Donald Trump has recently introduced several crypto-friendly initiatives.

In January 2025, the Securities and Exchange Commission (SEC) also rescinded a banking rule — Staff Accounting Bulletin 121 — that required banks to consider Bitcoin and other cryptocurrencies as a liability on the banks’ balance sheets. This decision was a great relief for several crypto companies in the country.