Ripple Labs joined the bandwagon of cryptocurrency companies applying for a banking license. The Ripple CEO, Brad Garlington, tweeted, “ True to our long-standing compliance roots, @Ripple is applying for a national bank charter from the OCC [Office of the Comptroller of the Currency]. If approved, we would have both state (via NYDFS) and federal oversight, a new (and unique!) benchmark for trust in the stablecoin market.”

True to our long-standing compliance roots, @Ripple is applying for a national bank charter from the OCC. If approved, we would have both state (via NYDFS) and federal oversight, a new (and unique!) benchmark for trust in the stablecoin market.

— Brad Garlinghouse (@bgarlinghouse) July 2, 2025

Earlier in the week via… https://t.co/IdiR7x3eWZ

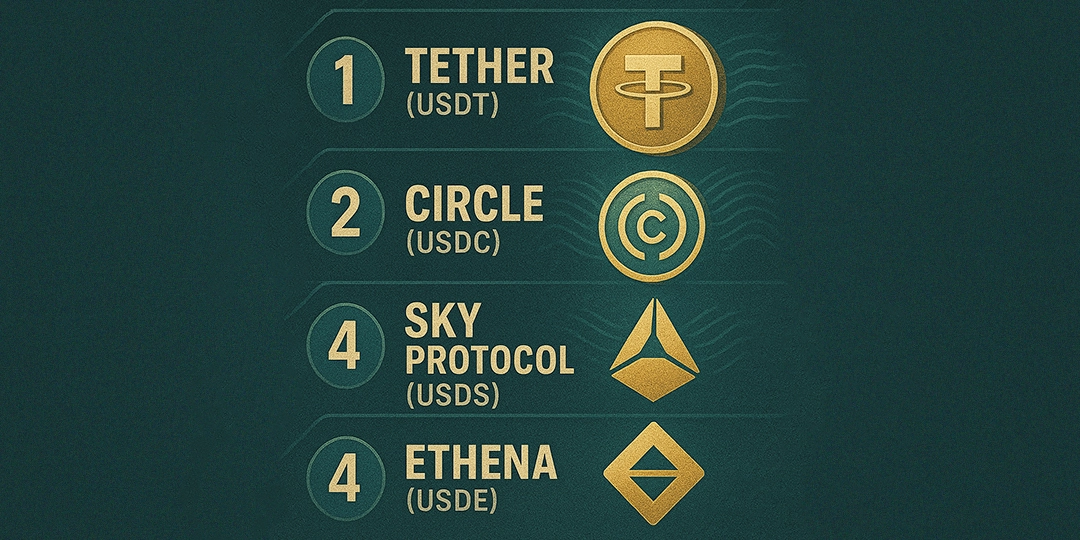

This comes in the wake of stablecoin issuer Circle applying for a license to create a national bank that would oversee its stablecoin reserve.

So why are cryptocurrency companies applying for this license?

The benefit of applying for this license is that it gives recognition in the financial sector. When the companies have the license, it meets that have met the requirements as the Fed and state level regulators have oversight. When a company is under the scrutiny of these institutions, it builds investor confidence.

Additionally, the bank license will give the company the authority to hold safeguards and manage fiat deposits and digital assets, without relying on third parties. Holding a license also enhances partnerships with hedge funds and asset managers as these entities try to avoid unlicensed crypto firms.

The XRP community was excited after the CEO announced about applying for the license. Ripple’s token XRP, which was trying to find some momentum for the past week, finally got going with this news. After many failed attempts to keep the momentum gained, XRP is currently making higher lows and higher highs. The token gained almost 6% during the past 7 days, while its trading volume increased by 54% to 4.4 billion.

Rising Wedge, Golden Cross makes a complicated situation, what’s happening?

Market conditions are quite complicated as we observe the 4 hour chat. The buyers are trying to push the price higher inside the rising wedge. However, the bulls power is reducing with every push, and the range of fluctuation is narrowing. The Balance of Power indicator has gone into the negative zone signalling that the bull power is waning and the bears are taking over.

With the bears taking over and the Bollinger bands signalling an overbought condition where the price of the token is too high since many are buying, XRP will be set for a retracement. As such the token could fall back towards the lower trendline.

But will it happen? Here’s why the retracement is doubtful. The 50-day EMA has crossed the 200-day EMA from below and Golden Cross (bullish crossover) has happened. Since, this is a bullish sign, the bears pull down could be neutralized. Hence, XRP may consolidate and move sideways in a tight range between $2.27 and $2.33 before a large move.