Validators are waiting in line to lock their coin in the Ethereum network as the prices start to recover slowly. However, in the broader picture, the coin price has once again climbed above the lower trendline of the broadening wedge.

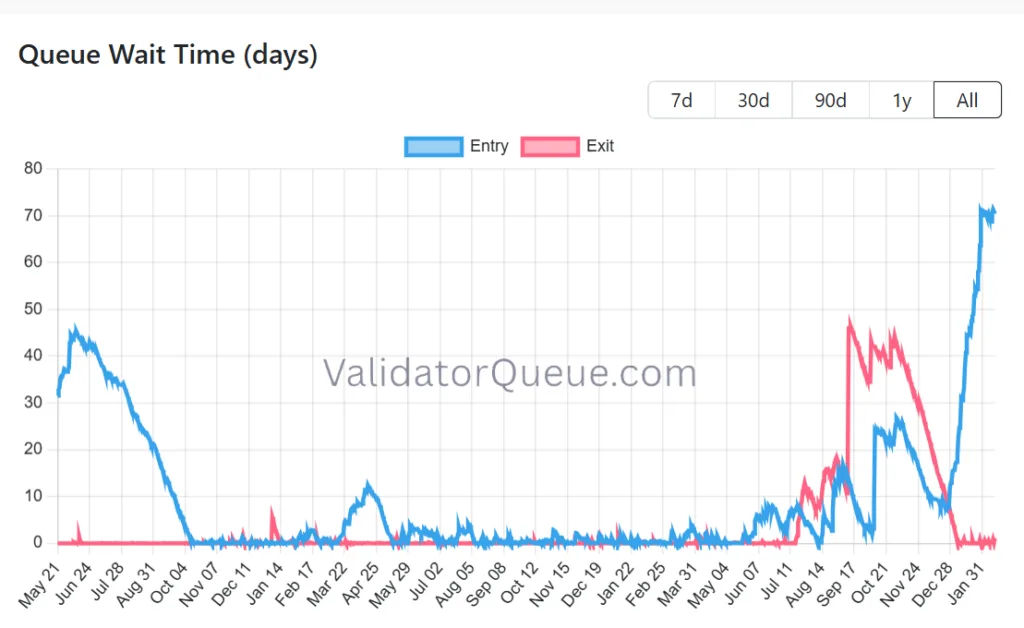

Even as the crypto market condition gets a little bit better, though, the traders are still in extreme fear; ETH is starting to show early signs of recovery. There are over 4 million ETH waiting to be locked into the protocol. Despite the wait time of 70 days to become a validator, the entry queue is still congested while there’s no one exiting. When there is more ETH waiting in the validator queue to be locked despite the wait time of 70 days, it shows a long-term conviction.

The lack of validators pulling out their coins, shows that they dont care about selling; they are happy to be locked in.

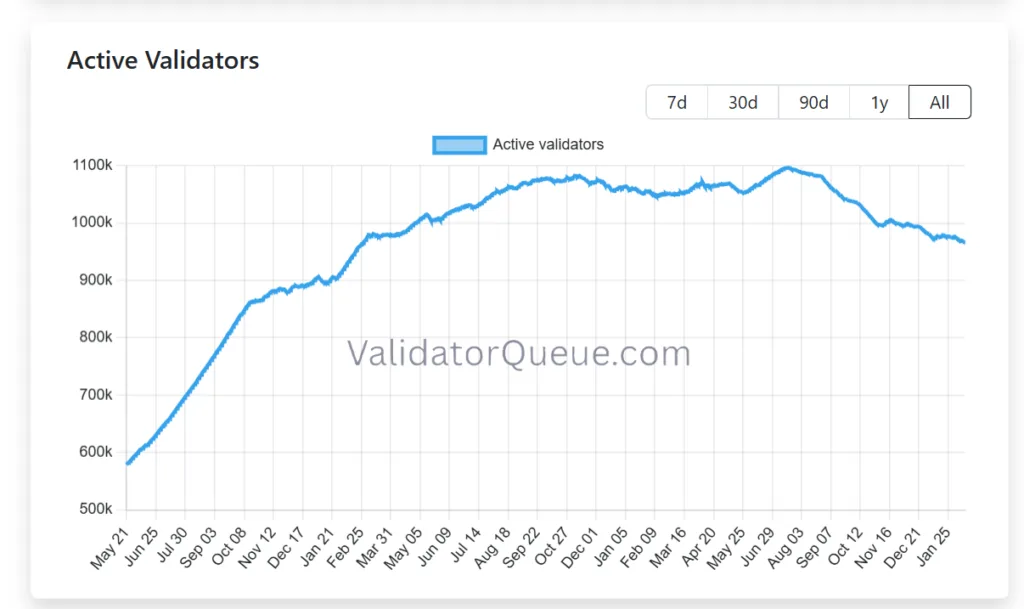

Active validators drop below 1 million ETH

When there’s more ETH waiting to be locked, however, the active validators have reduced from over 1 million ETH to just over 966K ETH. Although there is more ETH waiting on the outside to be locked, ETH has a churn limit—only a limited number of validators can become active per day. This means that the network is in a transition phase.

In other words, there was a large exit before, then the active validator dropped, and now there are more waiting to enter, and once these get activated, the active validators will spike again.

ETH shows signs of recovery

Meanwhile, Ethereum prices are showing very early signs of recovery. The coin recovered from its weekly low of $1.9K and once again climbed above the psychological $2K level.

As shown in the chart above, ETH has currently gotten back into the groove of the broadening wedge pattern. With the ETH prices back inside the pattern, the coin should naturally rise towards the top trendline. The top trendline is miles apart at $4.8K; however, as ETH approaches this level, it will first test the 50-day moving average at 2.6K and then move ahead.