Ethereum could be reaching its floor price, as the ETH whales’ losses are at a similar level to that of previous ETH bottoms. Despite experiencing unrealized losses, the whales are still accumulating Ethereum, as they expect an oncoming rally.

Whales don’t get a window to profit from

As the whales continue to accumulate Ethereum, they still haven’t gotten a window to take profits from their holdings, as the market has been crashing.

Had the whales taken profits earlier in the cycle, there might be a distribution phase or price corrections happening now. But here, they are accumulating continuously, meaning selling pressure is low. Low selling pressure near historical loss levels often signals a floor or bottom.

When whales hold record amounts without selling, it indicates confidence that prices won’t go much lower. Meanwhile, a crypto netizen expects the next 6-10 months to have a bullish rally.

ASI indicator maintains uptrend

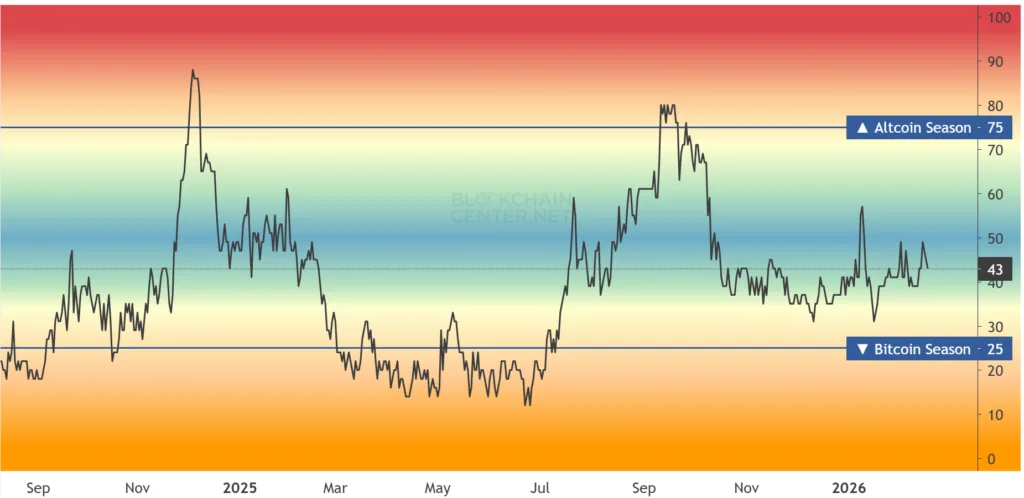

According to the crypto netizen, even the altcoin season index, which gauges the price action of altcoins against Bitcoin, has maintained an uptrend.

Currently showing a value of 49, the ASI line is about to make a new higher low. Once the ASI hits 75 on its scale, the altcoin season will begin, and investors will rotate their funds from Bitcoin to altcoins.

Ethereum price show early recovery signs

Looking at the price action of Ethereum, the whales are right about waiting for the bull run. As shown in the chart above, ETH has currently fallen below the macro broadening wedge pattern.

In particular, ETH breached the lower trendline, and now is in the process of recovering to get back above this line, which is considered a plus point for Ethereum.

From a technical point of view, the recovery has already started. The Relative Strength Index, which measures the gains against the losses, has started a new uptrend.

This shows that the ETH is gaining and will soon be above the lower trendline. Once the coin reaches above this, it will test the 50-day moving average, which is at $2,500, and after breaking above this, it will form a new macro higher high at the top trendline of the pattern.