Avalanche (AVAX) token crashed to 2023 price levels after the macroeconomic factors impacted the crypto market as a whole. The price failed to recover despite VanEck asset management issuing a VanEck Avalanche ETF (VAVX).

AVAX crashes to October 2023 levels

Avalanche’s token AVAX has crashed to the October 2023 level as the broader macroeconomic factors continued to spill into the crypto market. Extreme fear took hold of the market, and the traders stepped away from risky assets in search of a haven. The token crashed hard and fast. From a price of about $35 in September last year, the token is currently priced at $8, levels seen back in October 2023.

The crash continued despite VanEck issuing an AVAX ETF. In late January 2026, VanEck launched this new ETP focused on providing investors with exposure to the price return and potential staking rewards of Avalanche’s native token, AVAX. However, even the excitement of this new ETP could not stop AVAX’s crashing price.

Stablecoin supply on-chain shows impressive growth

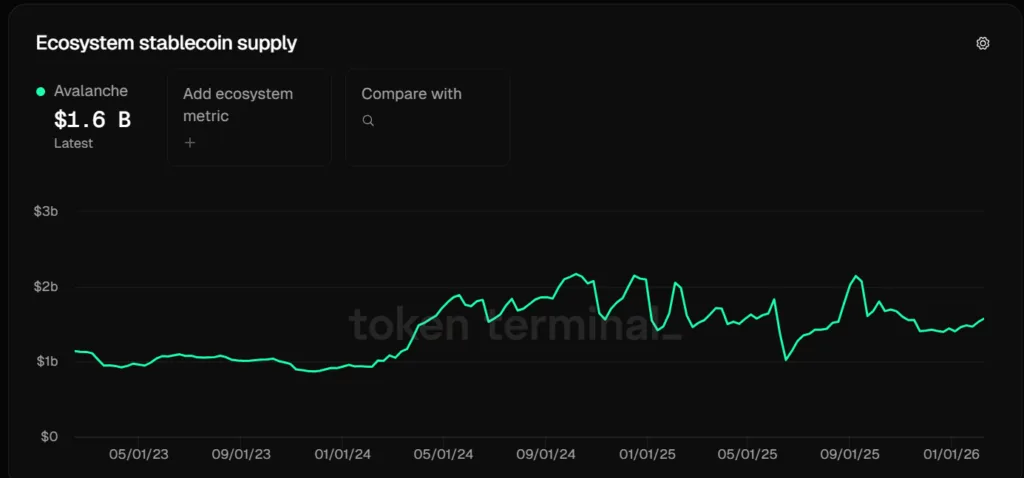

However, the stablecoin supply on the Avalanche blockchain has been increasing. Though lower than the September 2025 level, when the stablecoin supply was above $2 billion, the current $1.57 billion is quite impressive from where it has grown since last December. From $1.40 billion in December, the stablecoin supply hit $1.57 billion, which is quite significant given the timeline.

On-chain growth overshadowed by market conditions

The increase in stablecoin parked in the Avalanche blockchain shows that traders trust the infrastructure, and they are holding it until the uncertainty in the market disappears. However, this confidence in the blockchain has not reflected on the prices, as the broader market conditions have overshadowed it.

Once the market conditions clear out and there is a clear trajectory, the AVAX price will start to recover.

From the technical point of view, the recovery seems to have already started, as the relative strength index (RSI) indicator has changed its direction of motion. The RSI, which was in the oversold zone, has now turned upwards and is heading into the neutral zone. As the days go by, the markets will clear, and the investors will come out of their fear and invest in risky assets, pushing AVAX prices higher.