Recent data from cryptocurrency exchanges suggests that the withdrawal of stablecoins is steadily reducing. The slowdown in stablecoins being pulled from crypto exchanges shows that selling pressure in the current market conditions may be stabilizing rather than accelerating.

Binance continues to offer deep stablecoin liquidity

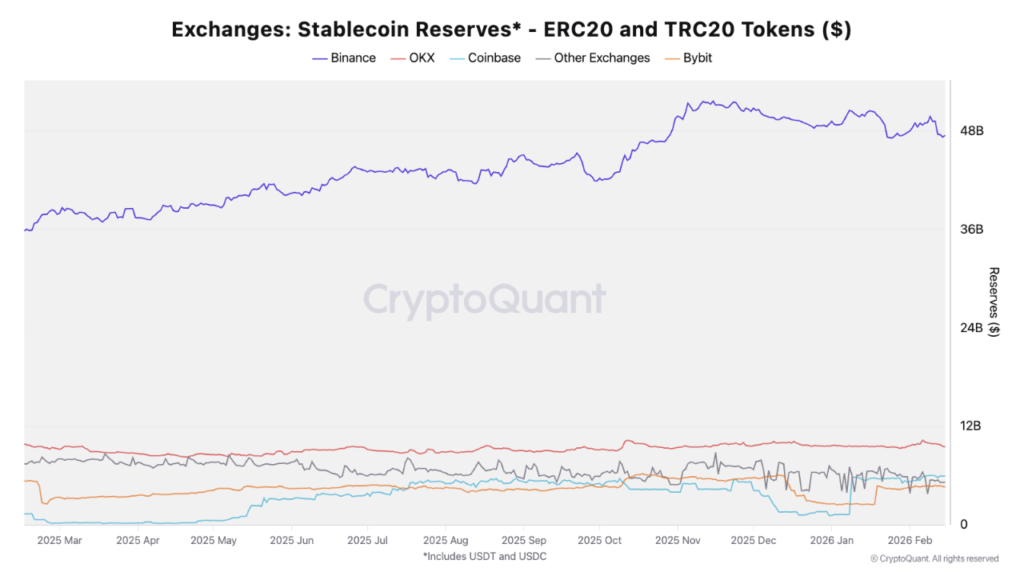

According to data from leading crypto trading platforms like Binance, OKX, and others, the growth in stablecoin reserves peaked ahead of the late-2025 crypto price decline. It surged $11.4 billion in 30 days to November 5, before sliding $8.4 billion by December 23 as the bear market took hold.

However, fresh data shows that the pace of decline in stablecoin reserves has slightly slowed down, with reserves only down $2 billion over the past month. Unsurprisingly, Binance remains the leading hub for stablecoin liquidity.

Binance holds a total of $47.5 billion in USDT and USDC reserves, an increase of 31% on a year-over-year basis over $35.9 billion. Binance controls 65% of all the USDT and USDC holdings across all centralized exchanges.

Binance is trailed by exchanges like OKX, Coinbase, and Bybit crypto exchanges, which hold $9.5 billion, $5.9 billion, and $4 billion in stablecoin reserves, respectively. The majority of these stablecoin balances are held across the Ethereum and Tron networks.

Going a level deeper, it appears that Binance’s liquidity is overwhelmingly USDT-driven, with $42.3 billion in USDT, up 31% YoY from $31 billion. In contrast, only $5.2 was in USDC, whose growth has remained flat YoY.

The presence of such large stablecoin reserves across exchanges denotes that investors still hold the ‘dry powder,’ which can be quickly deployed into the market if the overall sentiment improves.

Stablecoin adoption on the up

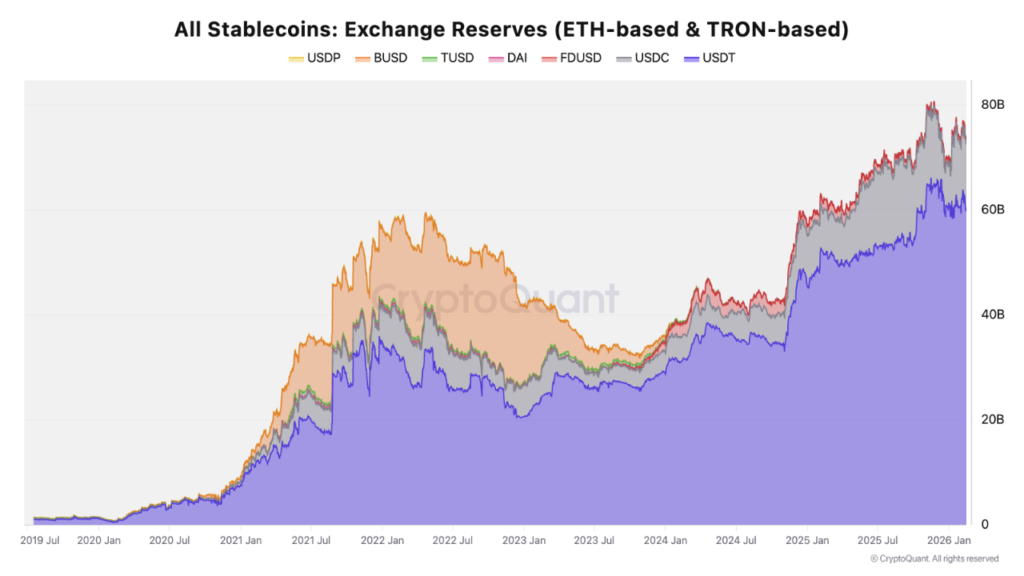

The high amount of stablecoin reserves on exchanges is a testimony to the greater adoption the fiat-pegged digital assets are enjoying following regulatory clarity in the form of GENIUS Act and other similar favorable regulations.

In a recent exclusive interview with AltCoinDesk, Dr. Bhaskar Dasgupta, Chairman of the Middle East Stablecoin Association, made the bold claim that stablecoins can outgrow crypto’s original use case.