They say defense is the best form of attack—but in markets and policy battles, defense wears many faces. Sometimes it’s about standing firm, other times it’s about stepping aside, and occasionally it means playing dead until the storm passes. This week, Coinbase showcased its own version of defense, pushing back against U.S. banks that claimed stablecoins were siphoning deposits under the newly introduced GENIUS Act. Meanwhile, market sentiment steadied as the Fear and Greed Index slipped back to neutral, and Bitcoin mounted its own defense by holding critical ground amid the noise.

Bitwise files for AVAX spot ETF

Bitwise Asset Management Company applied for a spot AVAX ETF with the US SEC. Bloomberg Intelligence gives a high probability of approval to the ETF, which still lacks a ticker symbol. The ETF is said to closely mirror Avalanche’s token (AVAX) price minus the operational expenses, and Coinbase Custody will serve as the digital asset custodian.

According to Yahoo Finance, “The trust will hold only AVAX tokens and use the CME CF Avalanche-Dollar Reference Rate as its pricing benchmark, calculated daily at 4:00 PM ET from multiple constituent platforms,”.

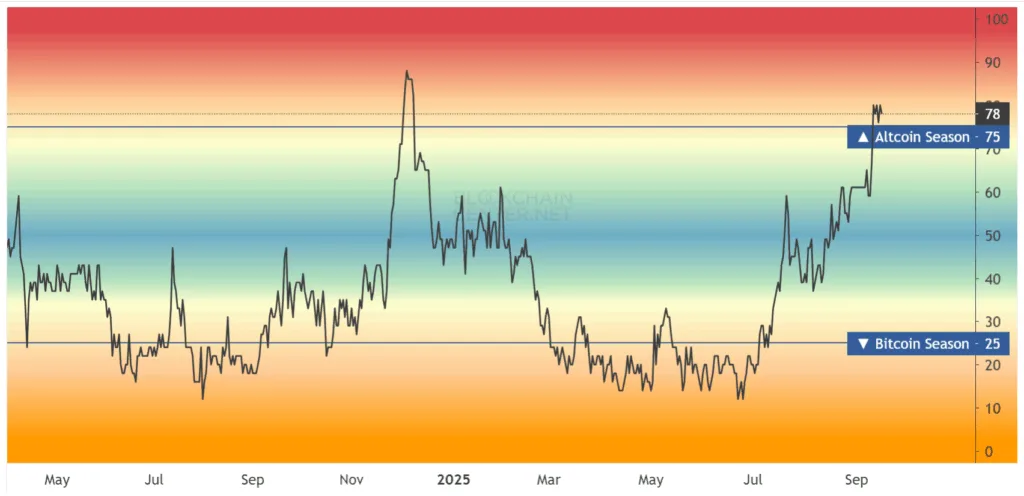

The Altcoin Season Index (ASI) recovers

The altcoin season index recovers and gets back to 78 after falling to 76. The altcoin season index is a measurement stick to gauge whether it is altseason or Bitcoin season. When the ASI crosses above 75, it denotes that at least 75% of the top 50 altcoins have outperformed Bitcoin.

Long position liquidations rise

Since September 12, the long position liquidations have shown a significant rise, while the short position liquidations have fallen drastically. The long liquidations rose from $87 million on September 12 to $347 million on September 15, while the short liquidations dropped from $397 million to $76 million during the same time period. When the long liquidations are rising while short liquidations are falling, it usually means the market is selling off and bearish pressure is stronger, with bulls being forced out.

Fear and Greed Index flashes

The CoinMarketCap (CMC) Fear & Greed Index is a sentiment indicator that measures the emotions and attitudes of crypto investors toward the market. It helps show whether traders are being too fearful (bearish) or too greedy (bullish). 50 on its scale shows that buyers and sellers are evenly matched. The market might be in a consolidation phase (sideways trading).

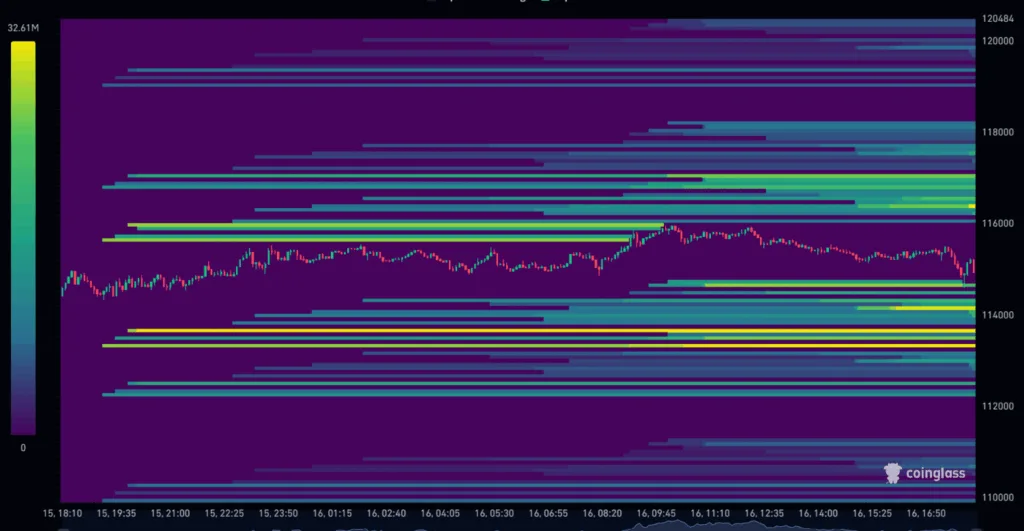

Bitcoin may hit resistance at $118K

The flagship cryptocurrency will crash into resistance at $118K as the BTC/USDT liquidation heatmap shows a high concentration of liquidations around $118K, suggesting that it’s indeed a significant resistance level. Although the coin is far below $118K, at $115K, an analytical platform still expects BTC to hit $118K within the next one or two days, after BTC defended the $115K.

📈#Bitcoin LTF game plan 📈

— AlphaBTC (@mark_cullen) September 16, 2025

No change to my plan, I still think that 118K level gets taken out in the next 24-48hrs, then we see how much conviction or sell pressure comes in as the FOM Rate Decision is confirmed.

Can #Bitcoin hold 115K post the decision? Or will it sell off… https://t.co/7JleDfrKgR pic.twitter.com/x6d9EB9pTW

Polygon to improve fast finality

Polygon developers are planning to amp up the transaction throughput rate on the network by 33% by increasing the block gas limit, which, if implemented, would increase the number of transactions in each block.

“The key requirements for a successful payments-oriented blockchain are things like fast finality, and also stronger guarantees or expectations around block inclusion,” Adam Dossa, senior vice president of engineering at Polygon Labs, told DL News.

Coinbase defends the GENIUS Act

Coinbase exchange refuted claims by the U.S banks that stated stablecoins were draining deposits from the traditional banking system. The U.S. banks’ argument came after they sought changes to the GENIUS Act, which regulates stablecoin, after it was enacted into law. Coinbase has argued that the ongoing “deposit erosion” had no concrete evidence, as on-chain data and banking statistics fail to show a shift of funds away from banks.

Financial institutions to launch ETPs

Financial institutions, Rex Shares, and Osprey funds are set to launch two exchange-traded products this week. Traditional investors in the United States will be able to access Ripple-related XRP ETFs and memecoin DOGE ETFs this week once these firms launch these Exchange Traded Funds (ETFs). Registered under the Investment Company Act of 1940, the funds, like other crypto ETFs, will hit the market as they are considered commodity trusts via the Securities Act of 1933.

Fed rate cut expectation hits 96%

The Federal Open Market Committee will gather together tomorrow and the day after to decide on the interest rate cuts. The probability of the first rate cut for 2025 has hit 96%.

The weak job data is believed to be the main factor that would be considered if the Chairman Jerome Powell opts to go for rate cuts. With the interest rate cuts, there will be a spike in crypto prices, and you will be pushed to decide what form of defence you would need to take when the markets enter a chaotic phase.