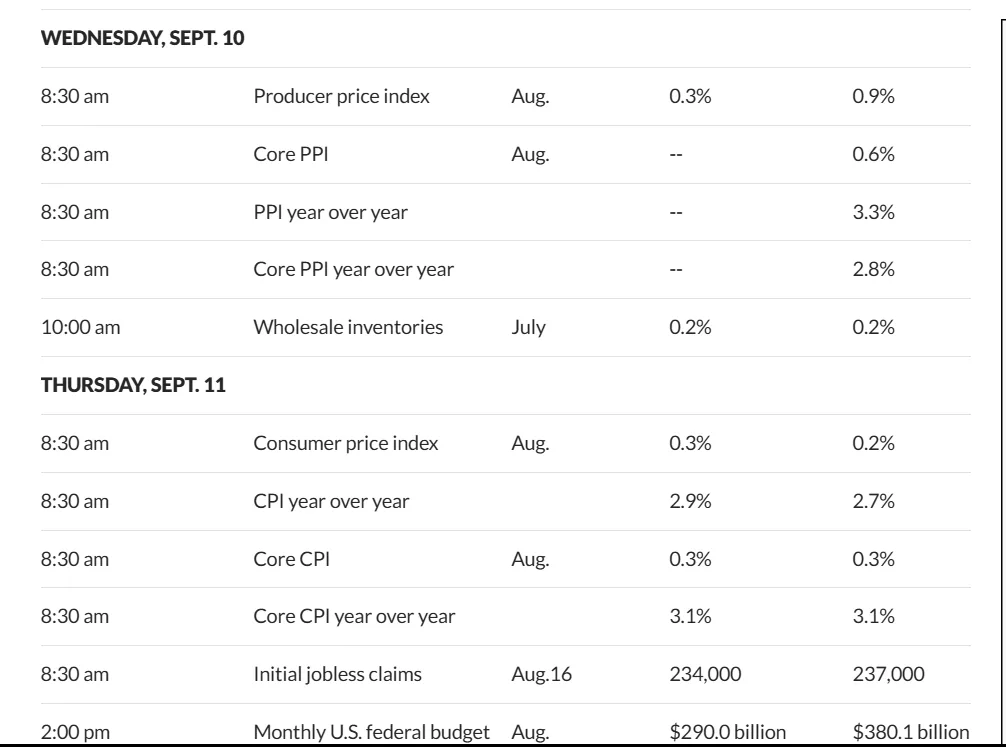

The cyclic September curse that pursues every year after the BTC halving might just be disabled next week. However, the Federal Reserve Chairman is the only appointed person who can switch on the curse disable mode. But just like a pilot does the final checks in the cockpit before takeoff, the Chairman Jerome Powell will need to look at the Consumer Price Index (CPI), Producer Price Index (PPI), and other indicators on his dashboard before turning on the main switch–interest rate cuts. So fasten your seatbelts, read the market’s manuals carefully before takeoff — and, God forbid a crash happens, at least you’ll know where the exits are.”

With the release of the U.S jobs data yesterday, another indicator blinked green on Powell’s dashboard. According to The New York Times, “The labor market appears to be stalling.

The economy added only 22,000 jobs in August, well below the number that forecasters had expected. That suggests employers’ appetite for new recruits has faded markedly in the last several months. The unemployment rate rose very slightly to 4.3 percent, and wages grew at 3.7 percent over the past year, the lowest growth since July 2024.”

U.S. Jobs Data Report:

— philip 🚀💯 (@FaschingPhilip) September 5, 2025

🇺🇸 Nonfarm Payrolls: 22K vs. 75K est. (prev. 73K)

🇺🇸 Unemployment Rate: 4.3% vs. 4.3% est. (prev. 4.2%)

🇺🇸 Hourly Earnings: +3.7% vs. 3.8% est. (prev. 3.9%)

👉 Much weaker job growth – Fed rate cuts coming closer. Markets reacting fast!

Weak NFP = Bad… pic.twitter.com/NzPzg320n0

So, how have the risky crypto markets responded to the weak job data?

Weak jobs = a weak economy. Traders are taking precautions and are showing risk-off behavior where they move away from riskier assets (like stocks and crypto) into safer ones (like U.S. Treasuries, gold, or the dollar). This behavior is clearly visible with the consolidating crypto prices and the skyrocketing Gold prices.

Bitcoin braces for one last strike to hit a new all-time high before a crash

Bitcoin is rising after breaking out of a falling wedge. Inside a falling wedge, bears maintain the pressure, but it weakens as bulls quietly accumulate. At the threshold point, the market feels compressed, then breaks out and releases the tension towards the upside.

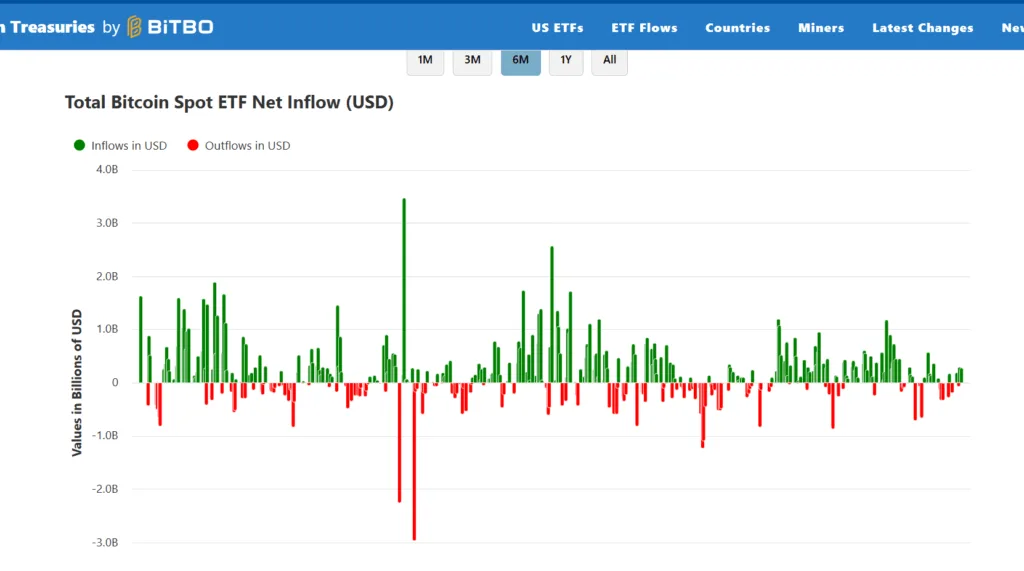

However, despite the investors taking a risk-off stance, Bitcoin is holding its trend of making higher lows after breaking out. This uptrend was sustained due to institutional acquisition and establishment of Bitcoin reserves– Microstrategy, etc. The ETF inflow has risen to more than $280 million.

Unemployment Rate (UNRATE) finally just ticked up to 4.3 after breaking through the plateau of 4.2 after a long time.

— Colin Talks Crypto 🪙 (@ColinTCrypto) September 5, 2025

Why is this significant?

Unemployment is one of the key metrics in the grander market cycle pattern of macro tops and bottoms, combined with the Fed Funds Rate… https://t.co/6zXcZNqxRc pic.twitter.com/MuaaPDhzGK

A market commentator who goes by the pseudonym Colin Talks Crypto mentioned that a major crash is coming. He expects the full impact of the crash by next year; however, the beginning of this crash could be sooner. The silver lining of the crash is that BTC will see its cycle top before that major crash.

ETH netflows negative, supply shrinks, demand rises– breakthrough?

Key Opinion Leader (KOL) by the pseudonym Jack, stated that Ethereum could be gearing up for a breakthrough as the leader saw some symptoms. Jack stated that the net flows were in the negative zone for the first time, and the supply was shrinking while the ETH reserve was staying flat when the accumulation or the demand was increasing. With a supply shrinkage and an increasing demand, Ethereum will eventually gain value.

$ETH signals are turning bullish.

— Jack (@WispOfDeFi) September 6, 2025

▪️ Net-flows negative for the first time

▪️ Supply squeeze building as reserves stay flat

▪️ Accumulation on the rise$ETH may be preparing for its next major run.#ETH pic.twitter.com/hp67M5xX7x

On the four-hour chart, Ethereum is trading inside a bearish descending triangle, where the prices will fall further once it breaks. Inside a descending triangle, buyers are holding the line at support, but sellers keep pushing lower highs. It’s usually a sign of building downward pressure, with a breakdown more likely than a breakout upwards.

So was Jack wrong in saying that ETH was gearing up for a rally? The KOL was spot on and here’s why. If you observe closely, ETH has been making lower lows—lower than the previous lows, while the relative strength index (RSI) has been making higher lows. When the RSI makes higher lows while ETH makes lower lows, it is called a bullish divergence, which leads to ETH gaining value. So, ETH breaking downwards from the descending triangle will be invalidated.

Altcoins season delayed as investors take a risk-off stance

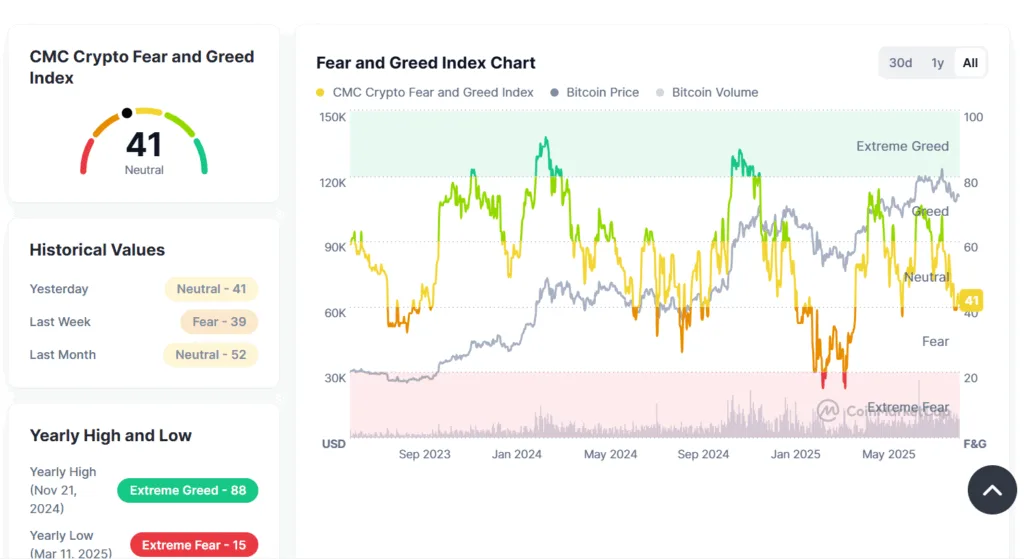

As mentioned above, the crypto market is in a cautious mode, not overcommitting or taking risks. CoinMarketCap’s Fear and Greed Index, which gauges the market sentiment, reads 41 on its scale, holding at the edge of the neutral zone. And the altseason might be delayed because of this risk-conscious approach by the investors.

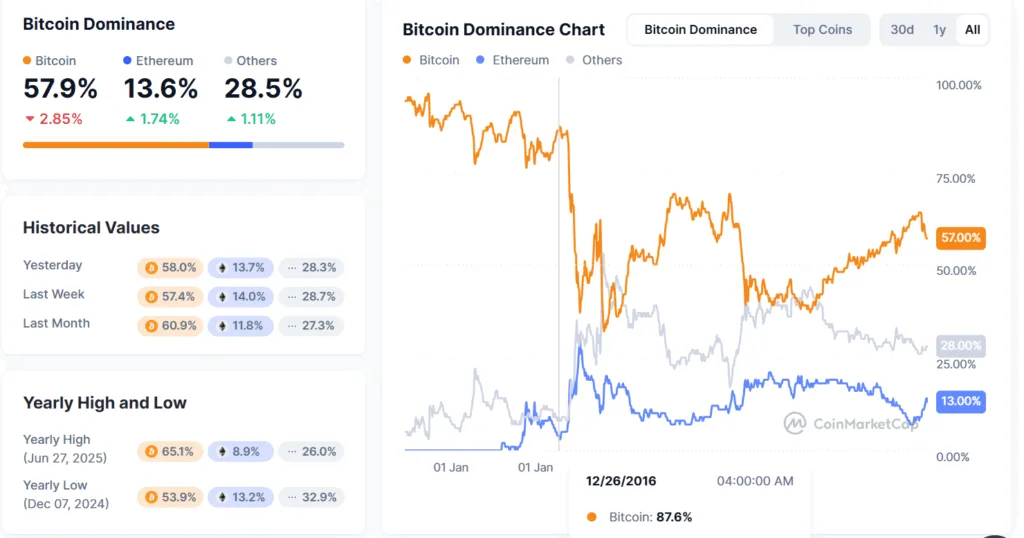

The Bitcoin dominance, which is a major parameter that determines the altcoin season, has not moved much since last week, as the market is quite dormant. The Bitcoin dominance, which is Bitcoin’s market cap against the aggregate of all other cryptocurrencies, falls drastically, giving way for the altseason to start. However, BTC’s dominance has hardly moved because of the dormant market, and some analyst expects it to rise above 60%, which may delay the altcoin season.

The rotation back to #BTC should continue here through September and October.

— Benjamin Cowen (@intocryptoverse) September 5, 2025

I know dominance still has not really moved much, but it should be back above 60% in the coming weeks pic.twitter.com/C54726HZcu

When the altcoin season comes menacingly close, Ethereum strengthens against Bitcoin. The above chart shows that the ETH/BTC pair has been crashing, or Ethereum is getting weaker against BTC. However, there’s hope for the altseason as ETH is trading inside a falling wedge, which is a bullish pattern. At the breakout point, ETH will start to strengthen against Bitcoin, ushering in the era for altcoins to rally. The Moving Average Convergence Divergence (MACD) is approaching the SMA from below, and if it crosses above the SMA, it will confirm the beginning of a bullish rally.

Gold reaches an all-time high courtesy of a risk-off stance

Although the crypto markets moved quite lethargically, the commodities arena has been in full swing. Gold reached a new all-time high of approximately $3,600, while Bitcoin was hovering close to $110K, clearly showing the investors opting for less volatile assets.

Gold bug, Peter Schiff, stated that Gold is doing what it does best in the face of an oncoming interest rate cut, which will eventually end up in inflation. However, Schiff’s post was filled with comments saying Bitcoin was better than Gold.

Gold just hit $3,600, a new all-time record high. It's doing exactly what one would expect with the Fed about to cut rates into rising inflation. But Bitcoin is doing nothing. Priced in gold, it's down 15% from its 2021 high. If you picked Bitcoin, you bet on the wrong horse!

— Peter Schiff (@PeterSchiff) September 5, 2025

Another netizen stated that 30 days after Gold reaches its all-time high, Bitcoin will follow.

Gold Rips to another new ATH!

— InvestAnswers (@invest_answers) September 2, 2025

We know what follows 30 days later ⚡️#Bitcoin pic.twitter.com/sFaNsNgyey

So what’s the bottom line?

Investors usually stay away from crypto during market turbulence. Especially, trading a Federal Open Market Committee (FOMC) decision on interest rates could be a make-or-break situation. Therefore, as an alternative to crypto, many would have found gold a go-to solution at least temporarily. In such a scenario, comparing crypto with Gold in a time when the market favors commodities and saying that Gold is better than Bitcoin does no justice.

However, as said above, there’s still a bandwidth for Bitcoin to reach higher and may hit a new all high before the altcoins season creeps in, or at least the altseason starts to show up on the charts.

What to expect?

The upcoming week will have the add-ons to the big day, September 17, when the FOMC will announce the rate cuts. The Producer Price Index, Core Consumer Price Index, etc, will all go into consideration when Pilot Powell does his math about cutting rates. These will help the pilot adjudicate whether there are headwinds or tailwinds ahead of us in the market.

What to do?

#Altcoins continue to bleed, with most Holders down 70–80% on average since the 2021 peak.

— Captain Faibik 🐺 (@CryptoFaibik) September 6, 2025

Despite this long drawdown, many still hope for an #Altseason to recover their losses.

I Know Patience has its limits, at some point, most investors lose Hope.

Hold your Altcoins with…

During these turbulent times, a crypto netizen advises, “Hold your Altcoins with Patience, and keep Accumulating according to your risk tolerance.” In addition, the netizen suggested practicing the Dollar Cost Average Strategy of investing a set amount over a set timeframe.

“If you bought an altcoin at $100 and it’s now trading around $10–15, keep accumulating gradually. This way, when the recovery comes, your average entry will be much lower and the Upside potential much higher.”