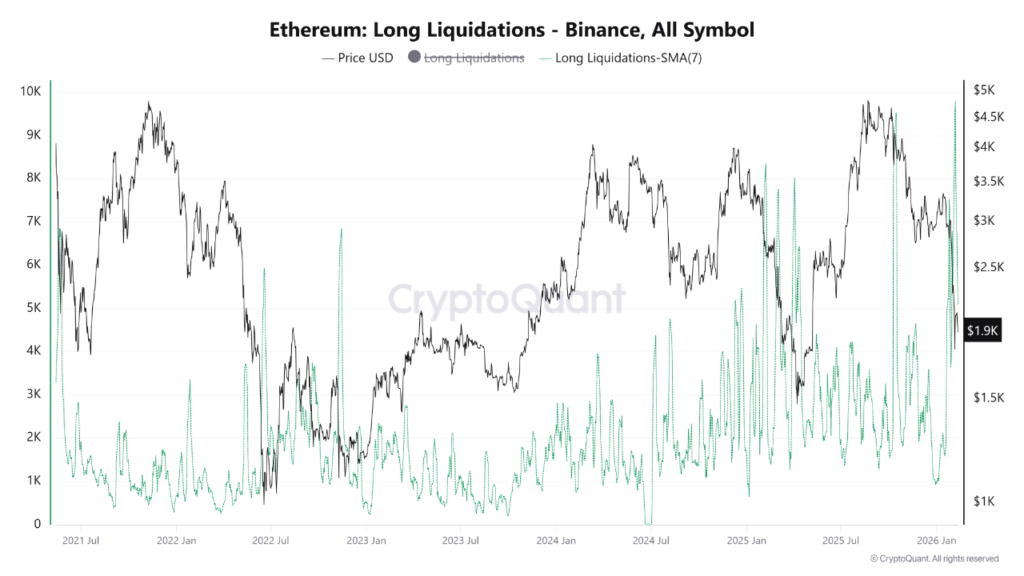

Ethereum, the second-largest cryptocurrency by reported market cap, is down 33.4% over the past two weeks. Similarly, the digital asset’s 7-day simple moving average (SMA) of long liquidations on Binance surged to 9,000 ETH, the highest level in four years.

Ethereum sees historic capitulation level

According to a CryptoQuant Quicktake post by analyst CryptoOnchain, the Ethereum market recently experienced a major sustained liquidation event. Specifically, the cryptocurrency’s 7-day SMA hit its highest level since June 2021.

Since the level is a 7-day SMA, it reflects a persistent and multi-day cascade of forced liquidations, rather than an isolated flash crash. As a result, some investors and traders argue that the continual sell-off in ETH may be nearing an end.

To clarify, the decline in the price of ETH from approximately $3,000 to $2,000 was not linear. Rather, it fell steadily, eliminating long positions with every slight tumble. Eventually, traders had to endure a week-long period of ongoing margin calls.

From a historical perspective, this degree of sustained liquidity activity eclipses that of the major capitulation events observed during the 2022 bear market. Such persistently high liquidation averages can indicate that seller exhaustion may be approaching.

In essence, the wave of cascading liquidations has removed all the weak hands from the market. The following chart shows that high liquidations have typically been followed with a rise in the price of ETH in the coming months.

ETH whales are biding their time

Another on-chain development that points toward a potential bullish rally for ETH is the whale wallet behavior. According to recent on-chain movements, ETH’s price plunged below the realized price of accumulation wallet addresses, holding a cumulative 27 million ETH.

Similarly, fresh data shows that ETH withdrawals from exchanges recently topped 220,000 ETH, the highest level since October 2025.

The high level of ETH being pulled from exchanges shows that investors are choosing to hold the digital asset for the long-term instead of liquidating it at current market prices.