After declining 34.4% over the past month, Ethereum (ETH) is starting to show signs of capitulation, according to the latest on-chain data. The second-largest cryptocurrency by market cap hit a local low of $1,747 on February 6, its lowest price since April 2025.

Ethereum starting to show signs of capitulation

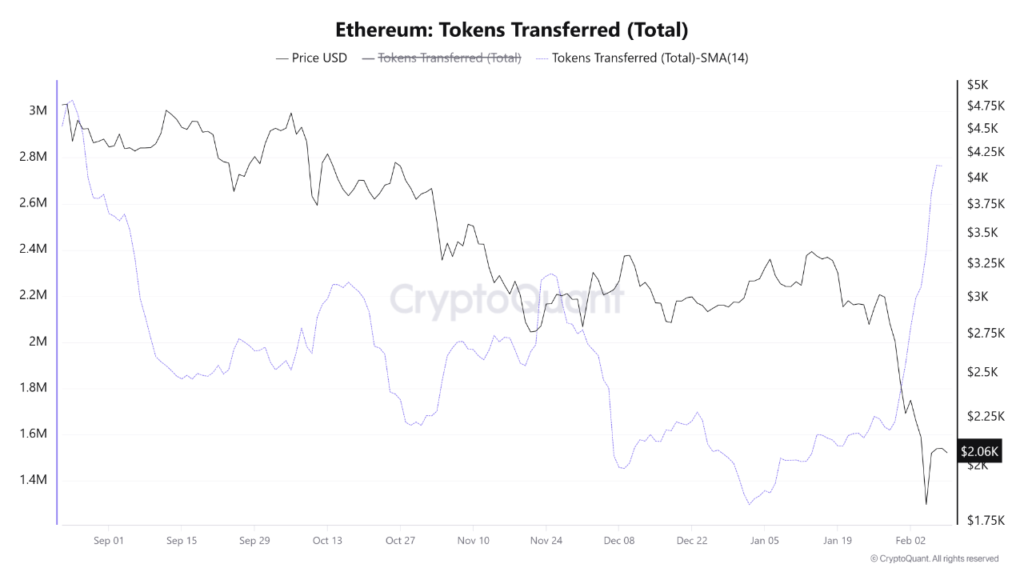

According to a recent CryptoQuant Quicktake post by analyst CryptoOnChain, ETH is showing a divergence between its market price and on-chain activity. The analyst states that this could point toward a potential capitulation event.

The analyst shared the following chart, which shows that the network experienced a massive surge in token movement during its slide from $3,000 to $2,000. Specifically, the 14-day Simple Moving Average (SMA) has gone parabolic.

From an analysis standpoint, a parabolic rise in the 14-day SMA of token transfers shows a sudden surge in network activity driven by panic selling, position unwinding, or large-scale fund rotation during heightened market stress.

The metric increased from around 1.6 million on January 29 to as high as 2.75 million on February 7. This is also the highest point this metric has reached since at least August 2025.

It shows that investors are choosing to convert their holdings into stablecoins or transferring funds to crypto exchanges to sell. Past data suggests that such a high spike in transfer velocity during bear phases means the “flushing out” of weak hands.

Essentially, the ETH market is currently absorbing massive sell-side pressure in a very short period of time. In addition, since the metric tracks token transfers, it could well include several liquidations and collateral shifts across DeFi protocols due to the drop in ETH’s price.

Market still in peak fear mode

CryptoOnChain concluded by saying that despite the recent recovery in ETH price, the wider crypto market is still likely in the ‘peak fear’ phase.

That said, whenever token transfer activity creates such a ‘blow-off top’ during a market downtrend, it indicates the selling pressure is nearing exhaustion – potentially setting the stage for a local bottom.

In related news, ETH reserves on crypto exchanges recently hit the lowest level in almost a decade. The low ETH supply on exchanges has reignited the case for a potential ETH ‘supply crunch’ that could drive up the digital asset’s price in the short term.