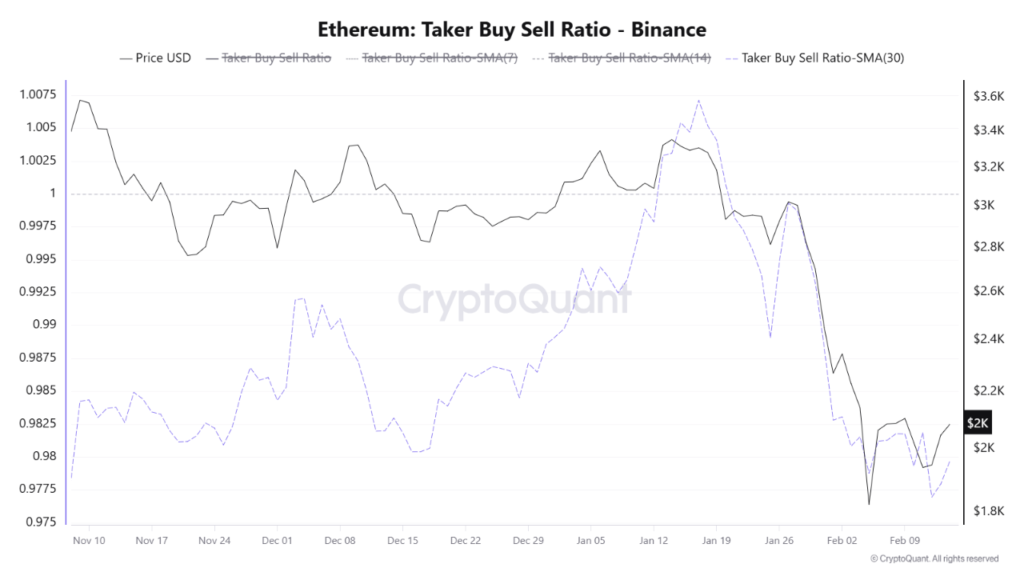

Latest data from Binance shows that Ethereum (ETH) is still facing a strong sell-off. The Ethereum taker buy/sell ratio fell below 1.0, recording the lowest value since November 2025.

Ethereum Binance taker ratio falls to a three-month low

The Ethereum taker buy/sell ratio has plunged below 1.0, recording its lowest value in close to three years. After applying a 30-day moving average, the metric has tumbled to 0.97 on Binance crypto exchange.

For the uninitiated, the taker buy/sell compares market buy orders with market sell orders to determine whether the buyers or sellers are driving current price action. A ratio of more than 1 shows that buyers are overpowering, while a ratio below 1 suggests that sellers are in control.

In simple words, when the Ethereum taker buy/sell ratio falls below 1, it shows that the “taker sell” volume is outpacing “taker buy” volume. The use of the 30-day moving average further filters out daily discrepancies and shows a structural change in behavior.

Since the Binance ETH taker buy/sell ratio has fallen to 0.97—a three-month low—it shows that the stronger selling pressure is not merely a momentary reaction but proves a sustained shift in futures traders’ sentiment over the past month.

To conclude, a taker buy/sell ratio of 0.97 shows that frustration might not yet be over for ETH bulls. The subpar price action is likely to last longer, which can create further downward pressure on the digital asset, potentially crashing it to its next major support area around $1,200.

All is not lost for ETH

Despite the bearish tilt shown by the ETH taker buy/sell ratio, other metrics suggest that the second-largest cryptocurrency by market cap has undergone a complete reset and is preparing for its next momentum wave.

For instance, an increasing amount of ETH continues to get staked on the Ethereum network. Recent data shows that over four million ETH is currently in queue waiting to be staked on the network. The validator queue time currently hovers around 70 days.