Ethereum has crashed below its 7-month low, and is now in danger of falling below the $2,000 price level. Despite the price crash, validators are flocking to stake the coin, pushing the validator entry time above 2 months.

Although Ethereum has a bearish outlook on the short time frame, the coin is still holding its bullish pattern on the weekly charts. As more validators stake ETH, the supply will dry out, and the demand for the coin will increase.

Macroeconomic conditions push ETH to edge

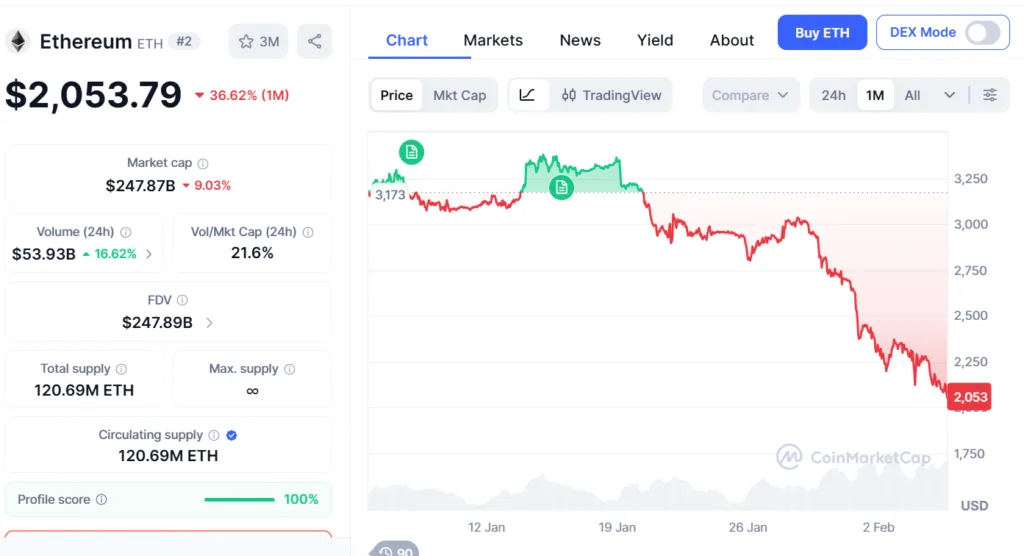

Priced at $2,053, ETH is barely holding above the $2,000 psychological price level as the broader bearish market sentiment suppresses the coin. Looking back at how ETH behaved a month ago, the coin was able to hold above the $3,000 level up until two-thirds of January.

But with tensions between the U.S. and Iran and Russia and Ukraine intensifying along with Trump’s tariffs, the investors exited the market in search of safe haven assets.

With this mass migration, Ethereum lost its hold as it tumbled, crashing below major support levels. As of the time of writing, the coin has lost more than 35% of its value during the past 30 days. Now the coin is barely just above the $2,000 level, as it still struggles to find the floor price.

The coin has now reached its 7-month low, as it ended a brief period of consolidation. Though the prices look like they are free falling, the RSI indicator shows that the coin is oversold and a market correction is overdue. As such, ETH could once again take off, testing the resistance level above.

Validator wait time elongates despite price crash

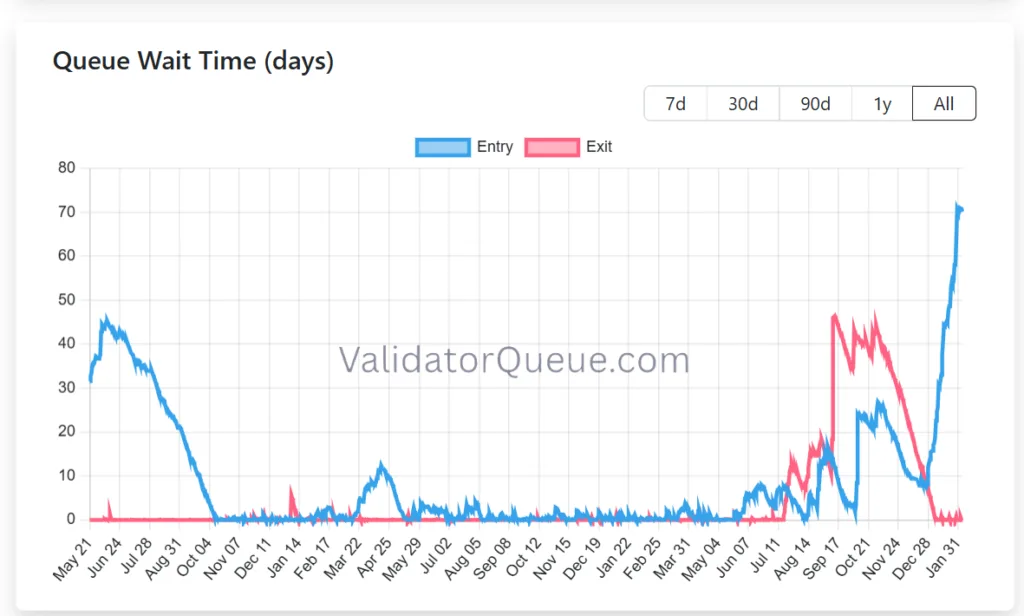

Despite the disappointing price displayed by ETH, the validator entry has reached nearly 70 days. This means that those staking the coin will need to wait in a queue for 70 days to be accepted as a validator.

The wait time of over 2 months shows that there is heavy congestion in ETH staking. This not only shows confidence in ETH staking yields, but with so many queuing up to stake their ETH, there might be a supply crunch, which could shoot up the prices.

Even on the weekly chart, ETH is supported by the lower trendline of the ascending triangle. It is very important that the buyers defend this level. If not, the bullish trend of ETH making higher lows might be discontinued.

The RSI indicator on the chart above is just about to sink into the oversold territory, which, if it does, the traders will step in to buy the dip. With the staking activity increasing and the buyers going all in, ETH prices could appreciate drastically.