Ethereum is down almost 30% over the past week, increasing fears in the wider crypto market of a prolonged downtrend. Exchange data suggests that sell-side pressure is currently dominating market orders.

Ethereum might be in a lot of trouble

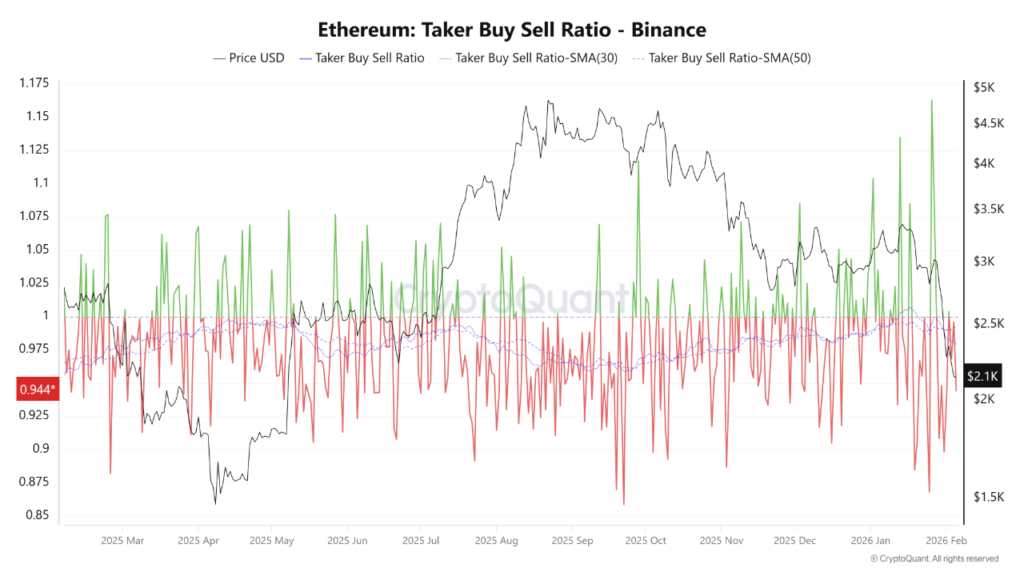

Recent exchange data suggests that the second-largest cryptocurrency by reported market cap may be on the cusp of a prolonged downtrend. According to crypto analyst PelinayPA, ETH’s Binance buy/sell ratio – also called the Taker Ratio – has fallen under one.

For the uninitiated, the buyer/taker ratio measures the balance between buyers and sellers in the market by comparing market buy orders to market sell orders. A ratio that’s above 1 indicates stronger buying pressure, and a ratio below 1 suggests sellers are dominating short-term price action.

Data from Binance is useful since the crypto exchange offers the highest liquidity and deepest order books, showing the sentiment of whales and similar institutional investors. Taker Ratio data from small exchanges is often misleading, so Binance is considered the industry’s golden standard.

Currently, the Taker Ratio is hovering around 0.94, showing that while buyers might be waiting with buy orders, sellers are already selling heavily.

In addition, the 30-day simple moving average (SMA) and the 50-day SMA are below 1, with no signs of any breakout to the upside on the horizon. In simple words, this confirms that the selling pressure is not temporary but persistent and structural.

ETH rallies are meant to be sold

The analyst said that even if ETH rallies from here, every rally is likely to be met with selling. Essentially, there is a clear downward trend bias. PelinayPA concluded by saying that “selling is aggressive, buying remains passive.”

Recent on-chain developments also point toward a true bear season for ETH. For instance, the recent spike in Ethereum transaction count (ETC) has reached a level that has preceded every major crash of the digital asset in the past.