Ethereum has had a history of pumping after the last three Federal Open Market Committee (FOMC) meetings, where the rates were held steady. With the FOMC meeting looming tomorrow, there are high hopes that the Fed will cut interest rates, which could lead to a spike in Ethereum.

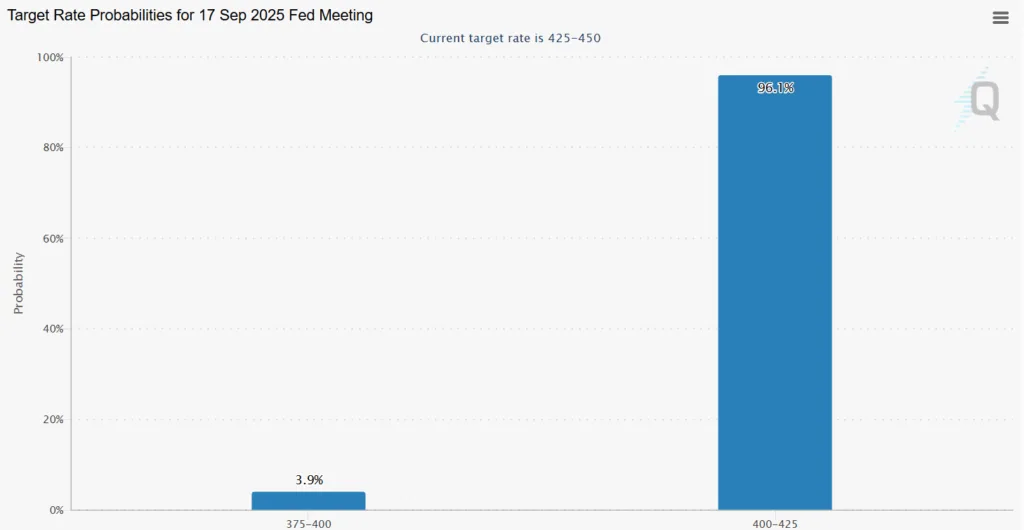

Crypto YouTuber, Crypto Rover, spotted this trend of Ethereum spiking after the last 3 FOMC meetings, where there was hardly any change to the rates. Given the probability of a rate cut reaching 95%, the market is anticipating a cut in the next two days, and the ETH prices could change drastically.

ETHEREUM PUMPED AFTER THE LAST 3 FOMC MEETINGS.

— Crypto Rover (@rovercrc) September 16, 2025

NEXT FED MEETING IS TOMORROW, RATE CUTS EXPECTED. pic.twitter.com/Nx64Ph2GJ5

What are these Fed rate cuts, and how do they affect crypto?

The Fed Reserve is an independent body which manages the nation’s money supply and interest rate. It has a dual mandate of maintaining maximum employment and low inflation.

With the release of the weak job data, and other contributing factors, the Fed may go with the option of cutting interest rates.

When the interest rates are low, borrowing money becomes less expensive. The interest rate when paying the loan will be less. In such a conducive scenario, traders will be open to investing in risky assets like crypto. With the demand for crypto creeping up, the prices will also increase.

ETH breakout could hit $5,600

The ETH/USDT trading pair is fluctuating inside a rising triangle. The rising triangle forms when the buyers keep pushing the prices higher while the sellers defend a resistance level, which is $4.85K in this case.

Since ETH has not fully formed the ascending triangle pattern, it may rebound off the upper and lower trendlines before shooting up. Ethereum might hit anywhere between $5,600 and $5,700, given that it breaks out by the book, where it spikes by the height of the wedge at the early stages of formation.