Layer-2 blockchain network Polygon recently topped the Ethereum (ETH) network in terms of daily fees collected from user transactions. The surge in user activity on Polygon can largely be attributed to the skyrocketing popularity of prediction market platforms like Polymarket.

Polygon topples Ethereum in daily fees

According to an X post by growthepie—an open analytics platform tracking the Ethereum ecosystem—for the past three days, Polygon has eclipsed the Ethereum mainnet in terms of daily chain revenue.

For the uninitiated, chain revenue refers to the total amount of network fees that are paid by users of a blockchain to execute transactions. These fees are typically collected by chain validators or sequencers.

The following chart shows that on February 15, Polygon earned $313,822 in daily transaction fees, while the Ethereum mainnet generated around $264,906 in the same period.

Analysts opined that the surge in Polygon’s daily transaction fee is primarily due to the immense popularity of the predictions market platform Polymarket. Matthias Seidl, co-founder of GrowthPie, remarked that Polygon’s recent increase in user activity is “fully driven by Polymarket.”

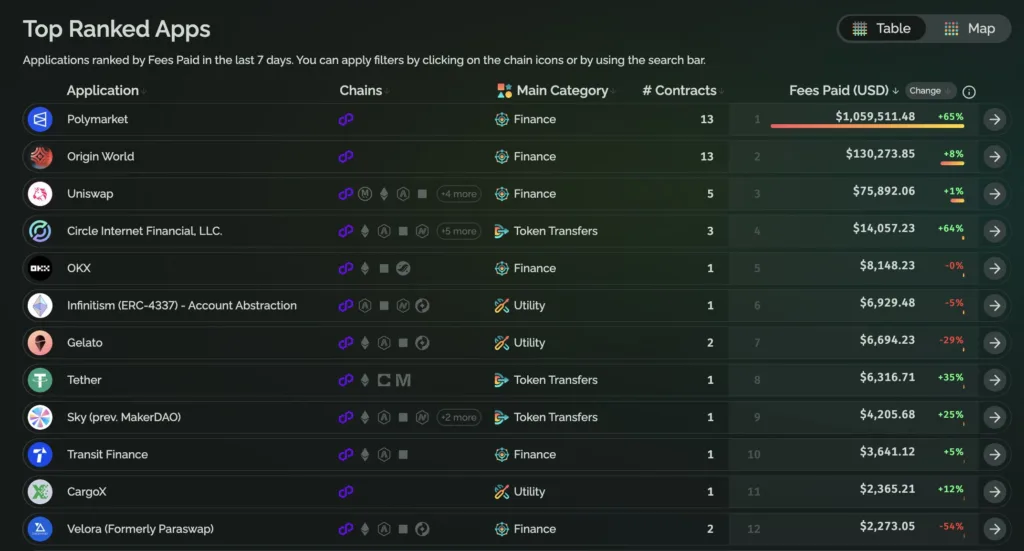

Seidl shared the following chart, which indicates that Polymarket was responsible for slightly more than $1 million worth of fees on the Polygon network over the past seven days.

The distance between Polymarket and the next most used application—Origin World—which generated close to $130,000. In a separate X post, Polygon stated that more than $15 million worth of wagers were placed on a single Oscars market category.

Will prediction markets dominate 2026?

Several popular crypto prediction market websites are likely to continue to dominate the emerging space in 2026. The skyrocketing popularity of prediction markets can be gauged from the fact that perpetual decentralized trading platform Hyperliquid recently integrated prediction markets into its platform, resulting in gains for the HYPE token.

In an exclusive conversation with AltCoinDesk, Olas co-founder David Minarsch stated that decentralized artificial intelligence agents can have a strong impact on how prediction markets operate. That said, recent trends show that prediction markets may be starting to lose steam.