Recent market developments have once again reminded its participants why being late to a trade can often be harmful for their portfolio. Recently, multiple major XRP liquidation events hit the XRP derivative market, catching late buyers unguarded.

Multiple long liquidation events punish XRP bulls

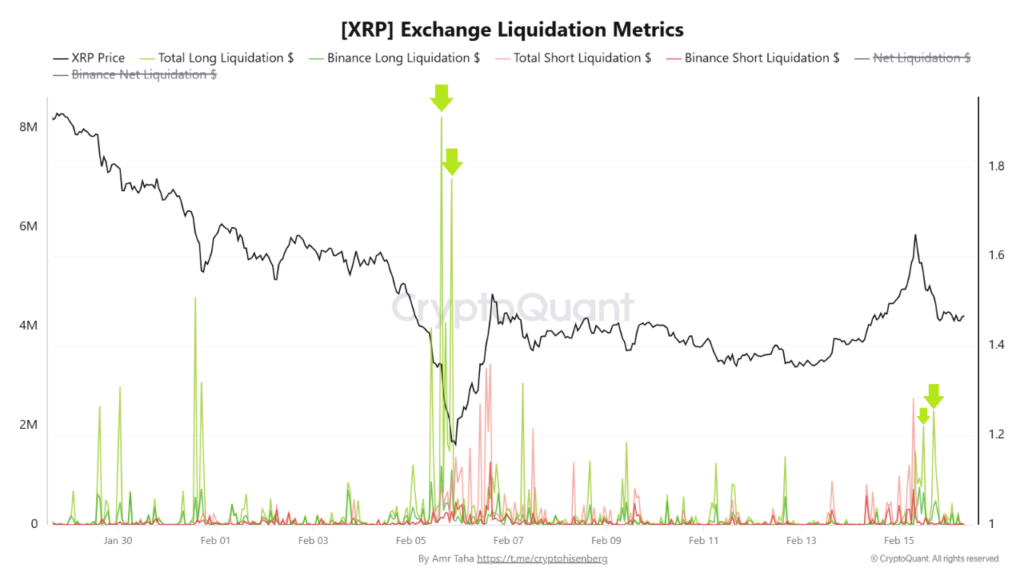

On February 5, multiple large liquidation events hit the XRP derivatives trading market, catching late market entrants offguard. The following XRP Exchange Liquidation Metrics chart tracks forced liquidations of both long and short derivative positions across leading exchanges.

In simple words, the chart shows what kind of traders are getting squeezed out of the market. It also indicates which cohort of traders is paying the price for poorly timing the market.

February 5 saw two major long liquidations. The first event that occurred on leading crypto exchanges liquidated $8 million worth of long positions. Binance accounted for $1.19 million worth of liquidations once the XRP price touched $1.35.

The second event saw more than $4 million worth of long positions liquidated, with Binance responsible for $1.1 million when the XRP price hit $1.18.

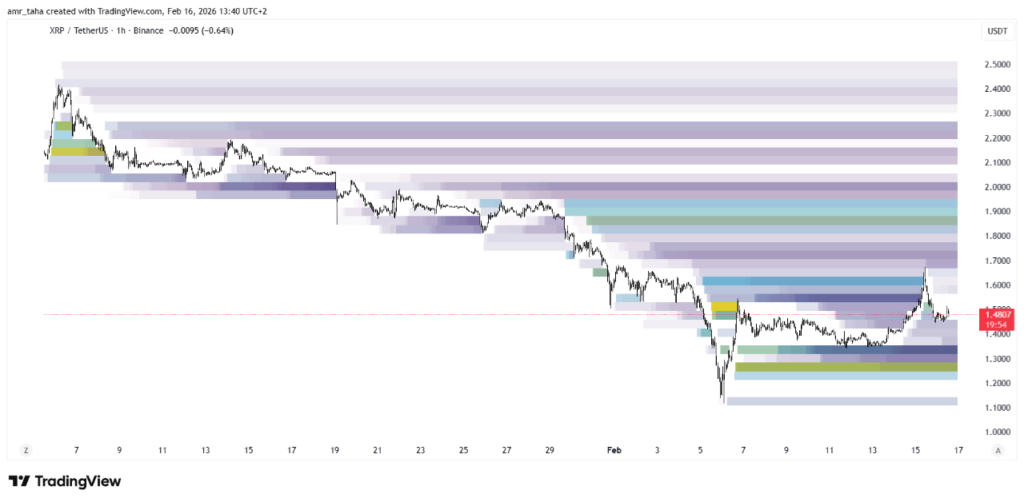

Another double liquidation event occurred on February 15, which again trapped the late long participants around the $1.54 price level. The following Liquidation Heatmap indicates where leveraged capital is concentrated among different price levels.

In simple words, when price gets closer to these price levels, liquidity tends to function like a magnet as it attracts price toward it to trigger stop-outs and margin calls. Fresh data suggests that almost all long liquidation pools have been cleared.

Will XRP surprise the bears?

In contrast, the current short-side liquidity pools are dominating above prevailing price levels, extending as high as the $2.2 price level. It can be said that multiple long liquidation events have spooked the market, pushing the funding rates lower – sometimes even into the negative territory.

If short positions remain active while funding rates turn even more negative, then the imbalance between price levels and funding rates can create conditions for a price rebound.

Recently, the XRP exchange reserves fell to 2024 levels, paving the way for a potential price appreciation for the coin due to ‘supply crunch.’