XRP reserves on several major crypto exchanges – including Binance – have tumbled to 2024 lows, marking a structural shift in the market investor sentiment surrounding the cryptocurrency.

XRP reserves fall to 2024 lows

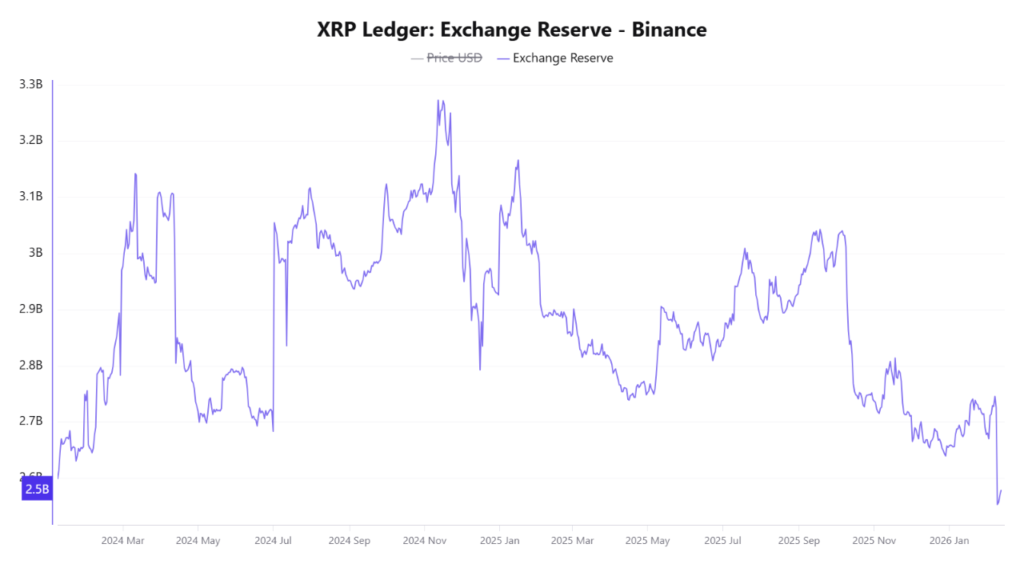

In a recent CryptoQuant post, analyst CryptoOnchain brought attention to the depleting XRP reserves on cryptocurrency exchanges like Binance. Specifically, XRP reserves on Binance have fallen to 2.5 billion XRP – hitting the lowest level since 2024.

Depleting exchange reserves are typically considered bullish for the underlying digital asset, as they indicate that investors are withdrawing cryptocurrency from exchanges to cold wallets or deploying it on on-chain financial protocols to generate passive income.

In November 2024, XRP reserves on exchanges peaked at more than 3.2 billion XRP. Over the past 15 months, holders have withdrawn almost 700 million XRP coins from leading exchanges, confirming a drastic fall in sell-side liquidity.

The following chart shows the ups and downs in XRP reserves across leading crypto exchanges. There is a clear spike in November 2024, when the reserves peaked at around 3.2 billion. Since then, XRP reserves on exchanges have made multiple lower highs, finally tumbling to 2024 lows earlier this year.

Despite the volatility, XRP exchange reserves hitting a two-year low creates the foundation for an impending ‘supply shock.’ With relatively fewer coins available on Binance for sale, any resurgence in demand for the digital asset could result in strong price appreciation for it.

XRP to buck the bearish trend?

Over the past three months, XRP has declined by more than 32%, suggesting a clear bearish force driving the digital asset’s price down. That said, recent on-chain and exchange metrics show that XRP may be on the verge of breaking its downward trend.

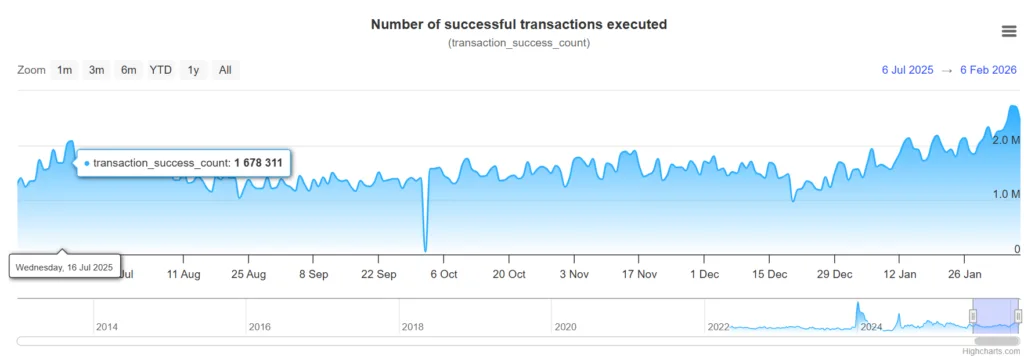

For example, the number of successful XRP transactions recently spiked amid heightened on-chain activity. The higher number of successfully executed transactions on the XRP blockchain suggests that user activity is heating up on the network.

In addition, XRP’s recent Z-score reading hints that the cryptocurrency is on the cusp of a major move. Further, recent analysis by Santiment showed that retail investors are actually more bullish on XRP compared to Bitcoin and Ethereum.