Ripples’ XRP token overranked some of the world’s largest brands by market cap. Tipping over soft drink company PepsiCo, telecommunications firm AT&T, and taxi app Uber, the XRP token captured the 91st place among the top assets ranked by market cap. XRP joins Bitcoin and Ethereum, which are already among the top 100 assets, as the third cryptocurrency.

However, at press time, XRP has fallen to the 97th position below the same brands–Pepsico, AT&T which it toppled over, according to Infinite Market Cap.

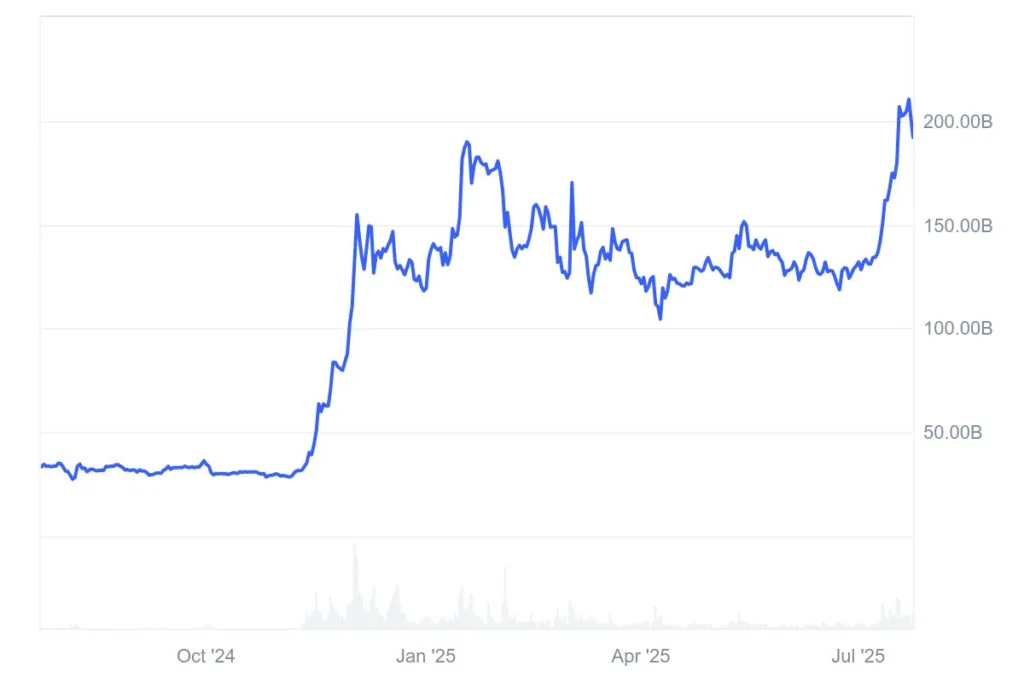

XRP token crosses $185 billion after 6 months

Priced at $3.25 at the time of publication, the token has a market capitalization of $191 billion. The market cap crossed the $185 billion level after almost 6 months.

Matej Janež, Head of Partnerships at crypto privacy firm Oasis, speaking to prominent crypto media platforms, stated that crypto and stocks of companies should not be treated as the same as they are altogether different concepts.

The head said, “A public company’s market cap counts shares that confer a legal claim on earnings and assets. A crypto market cap is the price multiplied by the circulating token count. Both numbers can reveal speculative appetite, but only one comes with enforceable rights to dividends and residual assets.”

XRP token sets up a bull trap

The Wyckoff pattern on the XRP token’s one-day chart is at its final stage of completion. Known as the bull trap, the prices swing high, giving the impression that there is going to be an upward breakout. This makes the investors buy into the market and gets them trapped. It makes a pseudo move upwards, but starts to fall downwards drastically, liquidating many long positions. Once the XRP price starts to fall downwards, it usually will end up in the normal trading range around $2.5.

However, before the XRP token lands below $2.5, there are a few support levels that could come to its rescue. The support levels at $2.9 and $2.5 might come in handy for the XRP token.