Predictions of market crash, ETFs leaking funds and EU taking action on Russia’s invasion of Ukraine, today was filled with a lot of excitement. Read further to find what happened today.

British populist party accepts crypto

Nigel Farage, leader of the British populist party Reform UK, stated that the party is now receiving donations in crypto. However, Farage denied that it was following U.S. President Donald Trump’s playbook. During a crypto conference, Farage positioned himself as the ‘only hope’ for the UK.

Standard Chartered Bank makes bold prediction

Standard Chartered Bank predicted that Bitcoin could briefly fall below $ 100,000, presenting an excellent buying opportunity.

Just a couple of days after Bitcoin hit a new all-time high of around $126,000, it crashed to around $104,000, following Donald Trump’s tariff announcement. However, currently, the flagship token has gained some momentum and has recovered above the 200-day Moving Average. If it continues rising along this line, it will reach $110,000. With such a bullish outlook, purchasing BTC below $100,000 may turn out to be a steal.

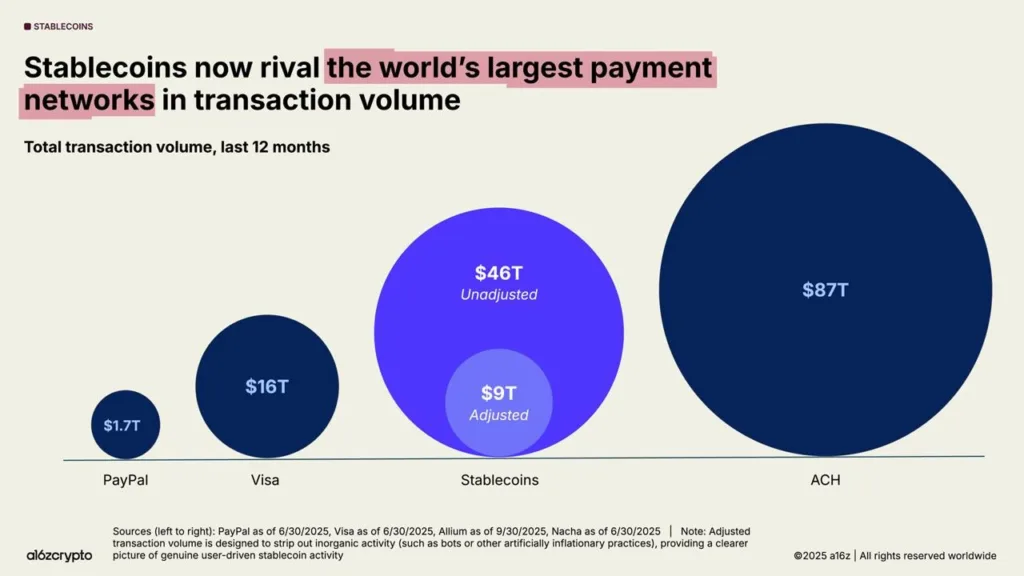

Stablecoin transaction volume triples Visa

Stablecoin transaction volume hit $46 trillion over the past year, which is almost 3X that of Visa’s transaction volume. The stablecoin transaction volume is now closing in on ACH. Increased stablecoin transaction volume often denotes a volatile market; it could be that the traders are moving stablecoins to buy crypto, or hedging and selling risky assets.

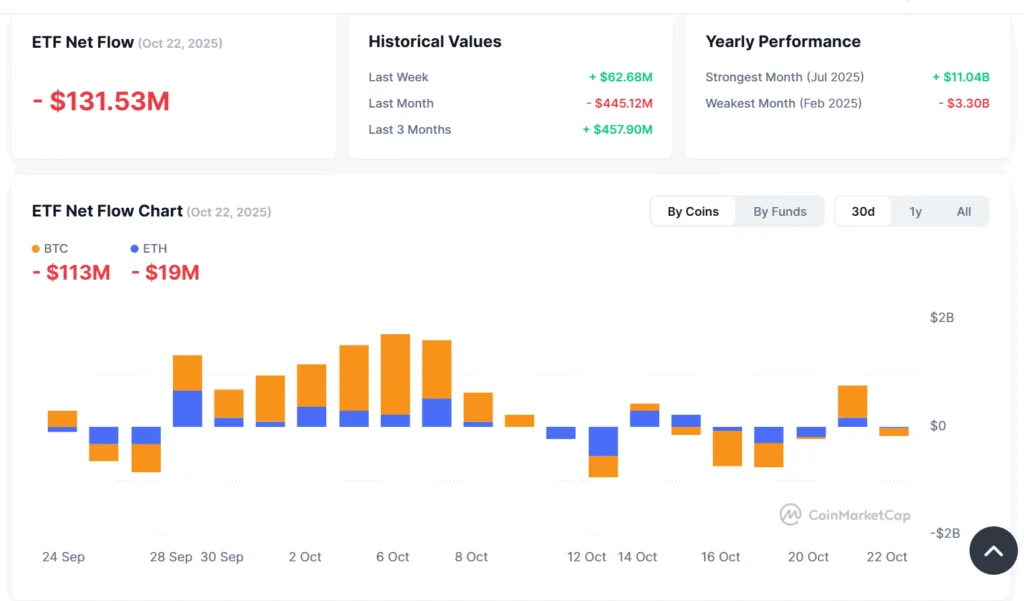

Crypto ETFs leak funds, but the market heals

The crypto ETF has been leaking money, and about $130 million has been moved out of it. Traders sold about $113 million of BTC ETFs, while only $19 million of ETH ETFs were sold out. Although the ETFs are hemorrhaging, when you consider the overall picture of the market, the derivatives market is slowly but surely healing.

Canadian regulator slams largest ever fine

A cryptocurrency exchange was slapped with a fine of about $177 million after the exchange failed to flag about 1000 transactions that were connected to criminal activity. The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) slapped the largest ever penalty by Canada’s financial intelligence agency on Xeltox Enterprises Ltd which operates as Cryptomus.

“Given that numerous violations in this case were connected to trafficking in child sexual abuse material, fraud, ransomware payments and sanctions evasion, Fintrac was compelled to take this unprecedented enforcement action,” director and CEO Sarah Paquet said in a statement about the Cryptomus penalty.

Revolut to inaugurate operations in EU

Revolut will start its crypto operation across the European Union after it secured a licence under the trading bloc’s Markets in Crypto-Assets regulation. The UK challenger bank secured its MiCA licence from the Cyprus Securities and Exchange Commission.

“It’s no secret that we have ambitious plans for the crypto sector in the future, and our MiCA license is fundamental to all of that,” Costas Michael, CEO of Revolut Digital Assets Europe, said in a statement while speaking to a prominent media.

EU blocks Russian stablecoin

The European Union blacklisted the A7A5 stablecoin tied to the Russian state in an attempt to block sectors that fund Russia’s invasion of Ukraine. Russia has been turning to digital assets for funds to avoid sanctions; however, the EU countered Russia’s evasive strategy of turning to crypto with 19 rounds of sanctions.