In life, sometimes you have to remember to forget certain things, like the death of a loved one, and at other times forget to remember so that you have capacity in your brain to recall good things in life. But to NBA star Kevin Durant, he has to remember not to forget his password to access his cryptocurrencies.

NBA star forgets password

NBA star Kevin Durant is unable to access his cryptocurrency holdings as he forgot his password. Durant bought Bitcoin on Coinbase in 2005 after his agent, Rich Kleiman, encouraged him to do so. However, now that Bitcoin has gained appreciated, the duo tried to access the holdings, but neither of them remembered the password. “It’s just there’s just a process we haven’t been able to figure out, but Bitcoin keeps going up. So it’s like, what’s the problem? I mean, it’s only benefited us,” Kleiman stated.

SEC set a generic listing standard

The Securities and Exchange Commission voted to agree upon a generic listing standard for exchange-traded products that hold spot commodities, including digital assets. The SEC adopted this initiative to remove the hassle of projects first submitting a proposed rule change to the Commission pursuant to Section 19(b) of the Exchange Act. With the new standard, exchange will be able to list and trade Commodity-Based Trust Shares that meet the requirements.

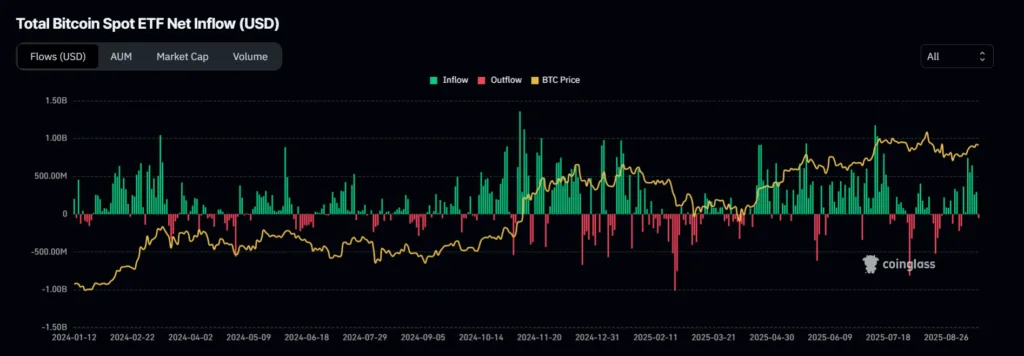

Traders sell ETFs

According to Coinglass, $51 million worth of spot Bitcoin ETF was sold yesterday. The BTC buying momentum has gradually reduced since last week, dropping from nearly $740 million to $292 million.

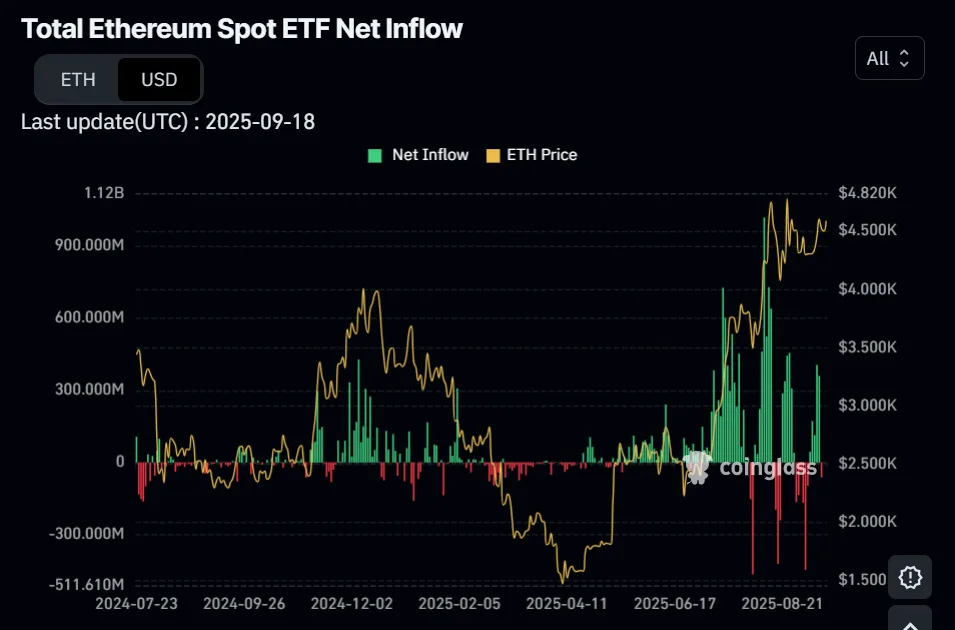

Nearly $1.9 million of the Spot ETH ETF was sold yesterday. With the Fed rates already being accounted for, the traders started selling the ETF, noticing that there could be no more upside to the ETFs.

BNB token hits a new all-time high

Binance token BNB reached four digits after the exchange had confidential negotiations with the Department of Justice (DOJ) and partnerships. BNB reached its new all-time high of $1,005 after the exchange had a discussion with the DOJ to terminate the compliance monitor before the completion of three years, as ordered by the court.

In addition, Binance partnered with global investment leader Franklin Templeton. The duo will explore how Templeton’s expertise in compliant tokenization of securities will deliver innovative solutions with Binance’s global trading infrastructure.

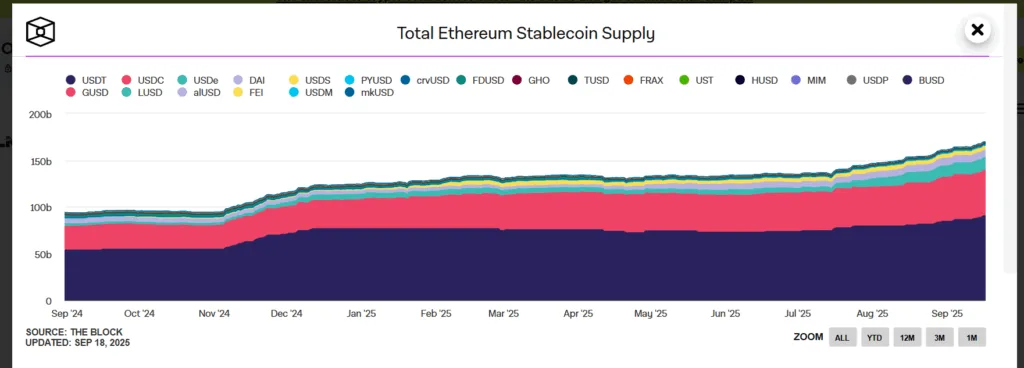

Ethereum stablecoins hit a record $166 million

Stablecoin supply on Ethereum rose from $166 billion as of Saturday, from $149 billion a month earlier. USDT took the top spot as the dominant stablecoin with a supply of $87.8 billion, while USDC took the second spot with $48 billion.

Speaking to a prominent media, Nick Ruck, director of LVRG Research, stated that Ethereum’s record stablecoin supply “signifies a massive increase in institutional liquidity and deepening trust in its infrastructure as the foundational layer for DeFi.”

$121 million worth of ETH Liquidated

More than $189 million worth of long positions were liquidated yesterday, while $159 million worth of short positions were wiped out. When segregating liquidation by coins, more than $121 million worth of Ethereum was liquidated, while about $107 million worth of Bitcoin positions were wiped away.

Fed cuts 0.25%

The Federal Open Market Committee made the first rate cut for 2025 today after 9 long months of Donald Trump persisting with the Federal Reserve Chairman. The Fed cut rates by 0.25% and the interest rates for borrowing will be around 4.00%-4.25%. Chairman Jerome Powell mentioned that if not for Trump’s ever-volatile reciprocal tariffs, the cut would have come sooner.

Crypto insensitive to Fed cut

Crypto markets have hardly moved after the Fed announced rate cuts. Bitcoin fell by 1% further below the $115K while Ethereum also moved very negligibly, printing a one-digit percentage movement. XRP gained 3.2% and is currently trading at $3.12, while Solana gained 5% touching the $247 multiple times in a day. The only token to reach a new all-time high was Binance, BNB, and it was not because of the rate cuts but other factors.

PENGU appreciates by double digits

Solana meme coin for the Pudgy Penguins NFT collection PENGU appreciated by double digits over the past 24 hours to $0.037. Predictors are confident that it’ll climb an extra 34% to $0.05. According to Coingecko, PENGU is up 12% on the day to $0.0377, after rising by 10.2% over the past week. It is now down 45% from its all-time high of $0.06, set in December 2024.

Remember! Forget if you took a long position expecting high profits today after the Fed rate cuts. Of course, you aren’t the only one to miss out, and tomorrow could be a better day full of profits that you will remember to not forget for the rest of your life.