Unrealized profits, including gains from crypto, will be taxed from January 2028, in the Netherlands. This bill was enacted into the legislation after the Dutch House of Representatives passed on the law on Thursday. An X user stated that this stringent law could increase suicide rates.

Netherlands imposes 36% tax on unrealized gains

The Dutch will be taxed 36% annually on the unrealized gains, which include crypto assets from January 2028. The bill, known as the Actual Return in Box 3 Act, was enacted into law after the Dutch House of Representatives passed the legislation on Thursday.

This means that residents holding crypto assets will be forced to pay taxes for profits that are unrealized or just shown on paper.

Despite acknowledging the fact that taxing residents on unrealized profits was illegal, as per the Dutch court, most parliament members supported the bill, stating that delaying the bill would incur a 2.3 billion euro loss to the government every year.

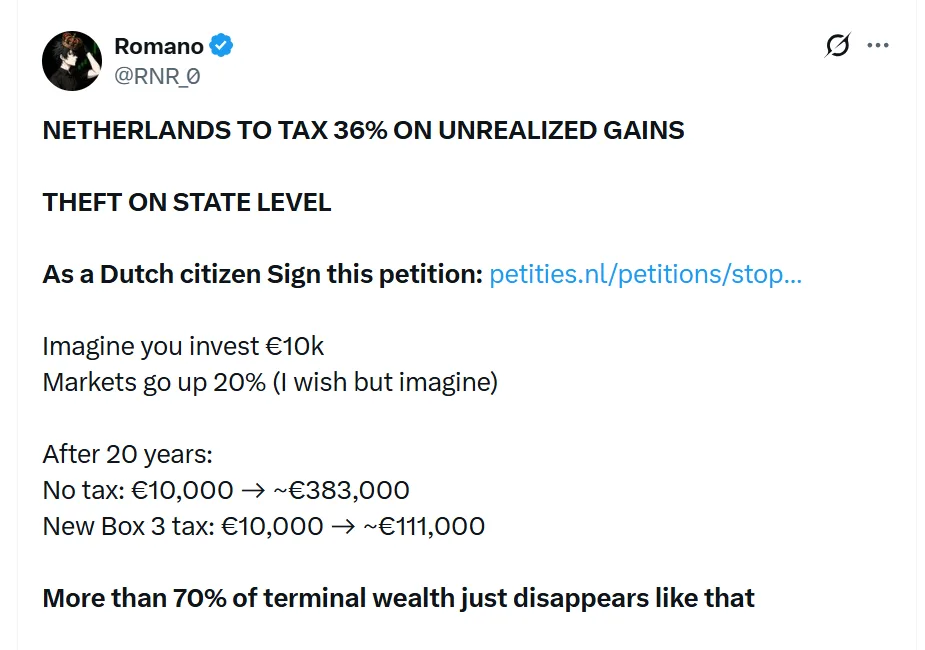

An X user who was livid with the new law, wrote on his account, “THEFT ON STATE LEVEL.”

The user introduced a hypothetical scenario to better explain how futile the new tax system was. The X user wrote, “Imagine you invest €10k and the markets go up 20%. And after 20 years:

With no tax, €10,000 becomes approx. €383,000, while with the New Box 3 tax: €10,000 becomes approx. €111,000. This means that more than 70% of terminal wealth just disappeared.

And this estimate is based on the assumption that the markets are perfect, with no drawdowns and no forced selling to pay tax. With such stifling tax policies, the X user also stated that suicide rates might go higher as the residents will be stressed.