Crypto will test your lust for money and wealth. Its volatility, the risk-reward ratio, is hard to resist. You may be the most pious and staunch person, but when you see crypto gains and the green candlesticks getting big on your position, you are gonna lose your composure, sooner or later. In one such incident, a pastor from Denver defrauded his followers with crypto and now faces charges.

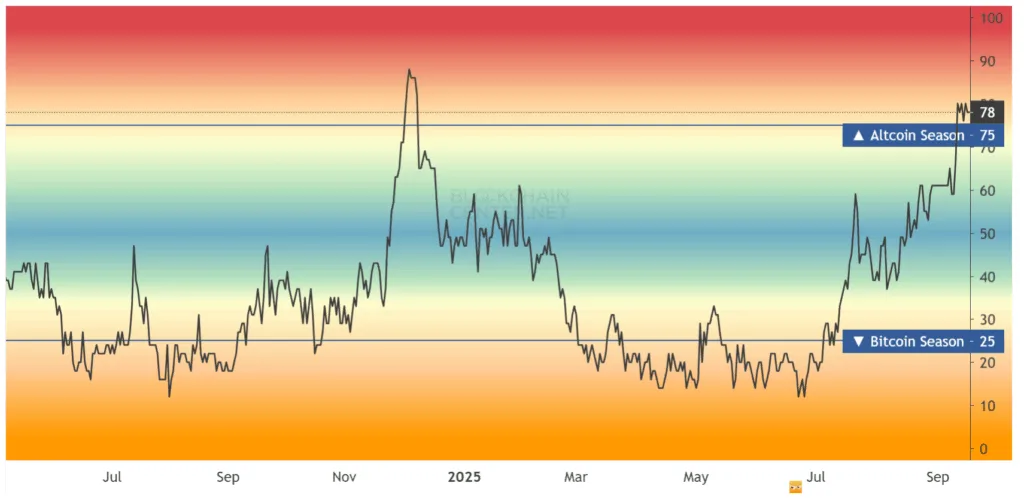

Altcoin Season Index lies on the borderline

The Altcoin Season Index is a tool that depicts the market sentiment and where the money is flowing into. When the ASI goes above 75, it shows that the market has entered the altcoin season, where at least 75% of the top 50 tokens outperform Bitcoin. Currently, the ASI is below the 80 mark, as it is placed at the edge–76, very close to the 75 borderline.

Long position liquidation falls

The total liquidations on long positions were falling throughout the past three days. On September 15, the total long liquidations were $347 million; however, this value dropped drastically, and as of today, only $77 million worth of long positions have been liquidated in the market. The short liquidations have also reduced from $77 million on September 15 to $47 million as of today.

Fear and Greed Index- Neutral

The Fear and Greed Index, which measures the market sentiment, has hardly moved. The Federal Reserve is believed to cut rates today as it gathers for the meeting. Despite such a remarkable event scheduled to happen, the crypto market and traders seemed to be unbothered as of now.

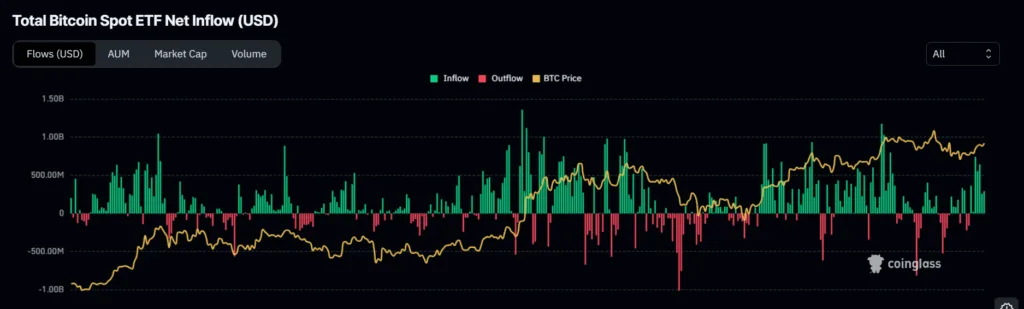

Bitcoin ETFs drop

Since last week, the Bitcoin ETF netflow has been drastically falling. On September 9, the Bitcoin ETFs’ net inflow was $740 million; however, this dropped to $292 million as of yesterday. This goes on to say that the traders are keeping away from entering the market, maybe expecting the Fed rate cuts.

Denver Pastor guilty of misleading flock

A Denver pastor misled his flock by defrauding them with a crypto token. Pastor Eli and Kaitlyn Regalado defrauded their church attendees and were found guilty of violating state securities laws and must repay $3.39 million. According to prominent media sources, “Denver District Court Judge Heidi L. Kutcher ruled in favor of Colorado Securities Commissioner Tung Chan and found that Eligio Jr. (Eli) and Kaitlyn Regalado of Denver, and INDXcoin LLC committed securities fraud in violation of the Colorado Securities Act.”

CME Group to launch options contracts

The CME Group has announced its plan to launch options contracts on XRP and Solana, giving investors and traders exposure to these cryptocurrencies through derivatives. The two options contracts are supposed to be launched on October 13. According to CME, both these products hit unfathomable open interest in August, with more than 540,000 Solana contracts (worth about $22.3 billion) and 370,000 XRP contracts (worth $16.2 billion) already traded.

UK regulator considers tradfi rules for crypto

The United Kingdom’s top financial regulator is considering the application of traditional financial market rules to cryptocurrencies. According to sources, the Financial Conduct Authority (FCA) has opened a discussion and is considering how the Consumer Duty, which would require firms to act to deliver good outcomes for their consumers, should apply to crypto.

“We want to develop a sustainable and competitive crypto sector, balancing innovation, market integrity, and trust,” said David Geale, executive director of payments and digital finance.

Forward industries raise capital for its SOL strategy

Nasdaq-listed company, Forward Industries, filed an equity program to raise capital for a Solana-focused strategy with the U.S. Securities and Exchange Commission (SEC).

The $4 billion at-the-market (ATM) equity program would allow the company to sell shares through Cantor Fitzgerald & Co. to raise capital for its Solana-focused strategy, working capital, and future business expansion.

TaskUS leaks Coinbase data

TaskUS takes bribes to leak Coinbase data. Outsourcing firm TaskUShas been accused of receiving bribes from criminals to leak thousands of Coinbase users’ data. In particular, TaskUs employees were paid money under the table –$200 per picture to photograph customer information displayed on their computer screens. The complaint estimates that the bribes generated at least $500,000, a sum equivalent to the annual salaries of more than 100 employees in India.

The Federal Reserve’s decision on rate cuts is coming out in a few hours, and the markets will change drastically, and so will the traders. Pastors may turn into wolves in sheep’s clothing, so you’d better watch out.