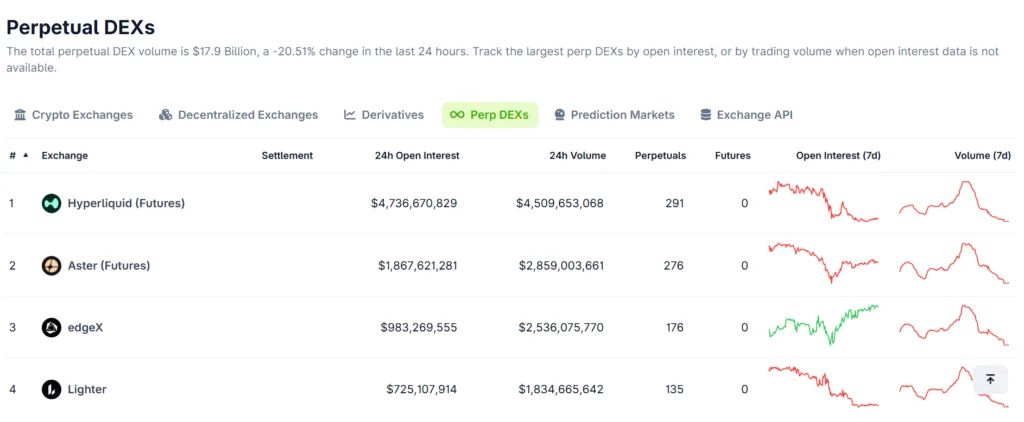

In recent times, decentralized exchanges—Aster and Lighter offering perpetual contracts—had a spike in trading activity, but it has not been reflected in the open interest (OI) or the liquidations, like Hyperliquid. As real leverage with high volumes will have significant growth in OI, with large liquidations, the absence of increment in OI and big liquidation number reveals the high trading activity on Aster and Lighter to be market manipulation.

Hyperliquid has been holding the title among perpetual decentralized exchanges, while ASTER and Lighter have been among the top four. Unlike Hyperliquid, which had a high trading activity along with meaningful increments in OI and liquidation, Aster and Lighter had just a spike in trading activity without any of the other parameters moving by a significant amount compared to the increment in trading activity.

To substantiate this major variation, Coinglass wrote on X, “Aster/Lighter volumes are close to Hyperliquid, while liquidations are only ~1/17 to ~1/37 of Hyperliquid.”

Headline volumes do not tell the real risk

“Headline volume numbers don’t always tell you how much real risk is being taken. In perpetual markets, genuine trading activity usually shows up across volume, open interest, and liquidations together. When volumes look high but liquidations and open interest stay muted, it often points to incentive-driven trading or structural quirks.”

Analyst Lavneet Bansal

HYPE prices are bullish while ASTER struggles

When there is real leverage in the perpetuals market, it often distills into the spot market. However, although HYPE is showing a bullish technical scenario, ASTER is not.

Hyperliquid’s token HYPE has been gaining value as it trades inside an ascending triangle. The ascending triangle is a bullish pattern that has a flat top and an inclined bottom. As the token makes higher lows, the pattern contracts and breaks out.

Despite showing trading volumes almost equivalent to Hyperliquid perps, the ASTER price has not been able to break above the 200-day moving average, a long-term indicator.

Once Aster hit this level, the token was rejected, as there was no real factor driving the surge. With the RSI line falling below the RSI-SMA line, the technical factors suggest that Aster is on the losing side. As such, ASTER may continue making a new lower low.