The Stellar Development Foundation (SDF) announced that it will penetrate the Asian market by integrating the TopNod wallet. The SDF vetted this strategy of collaborating with TopNod wallet after facing stifling competition from Solana, TON, and XRP in the payments and tokenization markets. However, as the prices still keep heading towards 2024 levels, an analyst says that Stellar investing in infrastructure alone doesn’t create momentum.

XLM infrastructure alone wont create momentum

Stellar is a layer-1 blockchain for financial products and services integrated with the TopNod wallet to be better equipped to compete with its rivals like Solana, TON, and XRP, which are also into payment and tokenization. However, according to analyst Lavneet Bansal, “The TopNod integration shows Stellar is still investing in infrastructure, but infrastructure alone doesn’t create momentum.”

He further added that payments and tokenization are distribution businesses; they scale when users, liquidity, and institutions converge on the same network. And although Stellar has some institutional relationships, it hasn’t yet demonstrated broad retail or enterprise adoption.

The real test isn’t the technology; it’s whether these integrations translate into meaningful usage at scale.

Analyst Lavneet Bansal

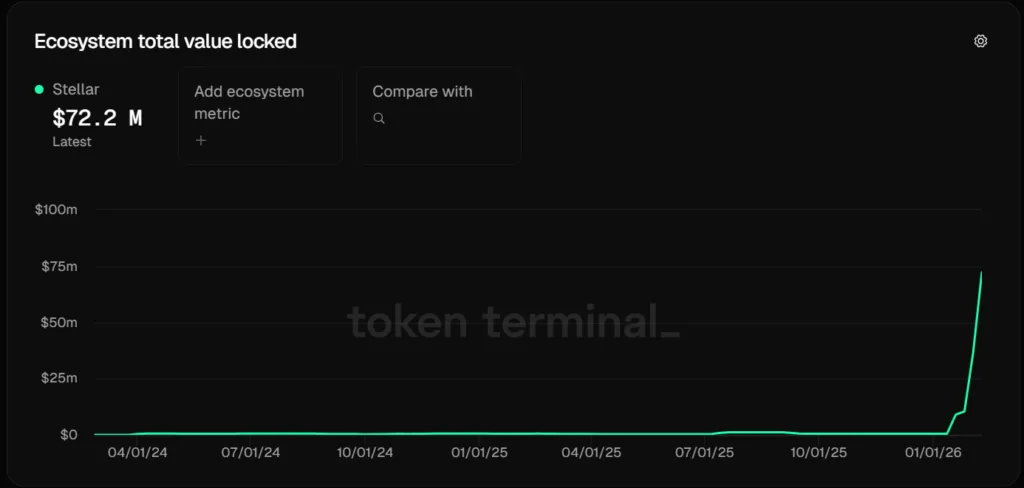

As the real-world asset value on Stellar crossed above the $1 billion level, the total value locked in the network has risen exponentially in recent times. From about $500K in mid-January, the TVL shot up to more than $72 million, at the time of writing.

Total value locked on Stellar rises exponentially

An exponential increase in the TVL expresses that more traders are entrusting their funds to the network, as the TVL is a proxy for people’s confidence and trust in the network.

Despite the on-chain metrics looking stunning, it has not been able to translate them into a price chart. As such, XLM continues to head towards November 2024 levels, as it continues the downward trend for the seventh month. Although it is too early to predict, the Relative Strength Index indicator has changed its downward motion and has once again gone back into the normal range from the oversold region. It would be far-fetched to say that XLM prices have started a bullish reversal, but one thing is certain: the crashing prices of XLM have slowed.