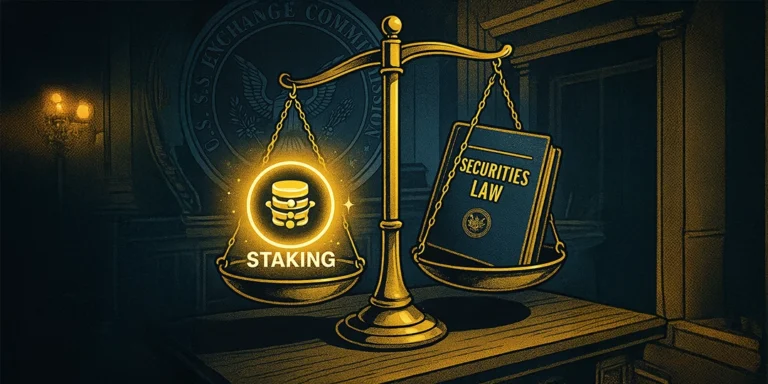

The U.S. Securities and Exchange Commission (SEC) stated that protocol staking will not be considered the sale or offer of securities, given that it meets a few conditions. In the “Statement on Certain Protocol Staking Activities,” released on May 29, 2025, by the SEC, the Division of Corporation Finance stated, “It is the Division’s view that “Protocol Staking Activities” (as defined below) in connection with Protocol Staking do not involve the offer and sale of securities within the meaning of Section 2(a)(1) of the Securities Act of 1933 (the “Securities Act”) or Section 3(a)(10) of the Securities Exchange Act of 1934 (the “Exchange Act”)”.

As such, those participating in protocol staking activities need not register with the “Commission transactions under the Securities Act” and do not even fall within one of the Securities Act’s exemptions from registration in connection with these Protocol Staking Activities.

Proof of Stake (PoS) is a consensus mechanism where a node operator locks in some cryptocurrencies in the network to be able to validate a transaction. Once a transaction has been validated, the operator gets rewarded for minting new tokens and a percentage of the fee from the transactors. However, in the event the node tries to validate a suspicious transaction, then the staked cryptocurrencies will be confiscated.

In a pro-crypto Trump administration, where conditions are turning favorable for the crypto industry, the SEC dropped its lawsuit against Binance, the largest crypto exchange. The case was dismissed after a joint statement signed by the SEC lawyers, Binance, and its cofounder, Changpeng Zhao, was submitted to the Federal Court in Washington.