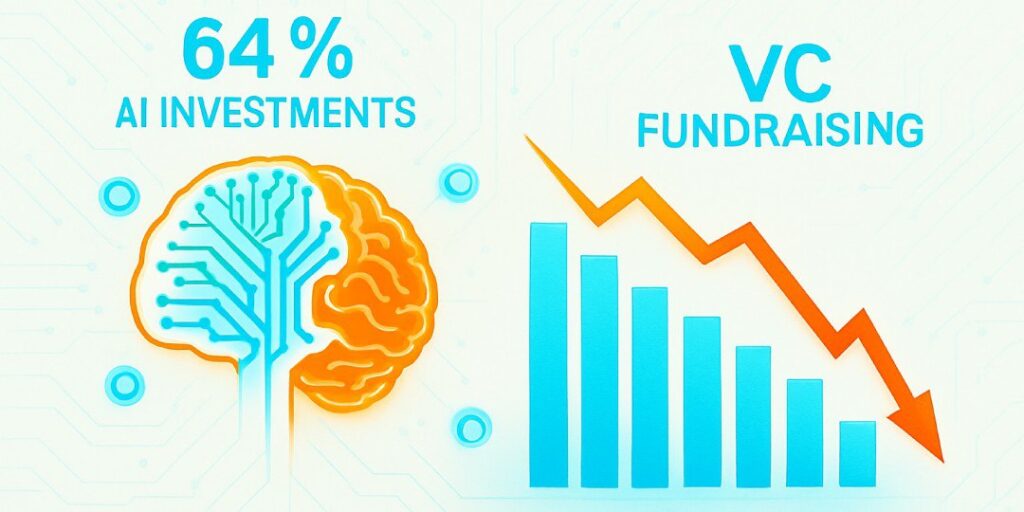

Amid the growing number of AI startups in the US, AI investment funds have ballooned by 64.1% in the first half of 2025, according to market intelligence firm PitchBook. However, Venture Capital (VC) firms faced challenges in raising fresh capital with a 33.7% decline year-over-year. This contributes to a total of a 75.6% surge in startup funding in Q1.

Startup funding in the first half escalated to $162.8 billion, marking a bold performance since the same period in 2021.

Driving energy behind the startup funding

This year’s 75.6% surge in startup funding stems significantly from major AI investments and bets from leading tech firms, specifically from OpenAI’s $40 billion and Meta’s META.O$14.3 billion purchase of a stake in Scale AI.

As mentioned, AI has played a key role in catalyzing startup funds. Besides OpenAI and Meta, several firms have invested over $1 billion in Thinking Machine Labs, Safe Superintelligence, Anduril, and Grammarly.

Davis Treybig, partner at VC firm Innovation Endeavors, stated: “I think it’s downstream of the fact that OpenAI and Anthropic continue to grow at unbelievable rates.” In his words, investors believe that there will be success similar to that of investments in OpenAI and Anthropic. They might see robotics, protein folding models, world models, or video models as key areas to invest in and earn lucrative gains.

VC funding drains

In contrast to the AI investments, VCs could not rally as they raised only $26.6 billion across 238 funds in the first half of the year. This weak environment insinuates a 33.7% drop from last year. The core reason points to fund managers taking a longer time to raise and close new venture capital funds, leading to a disconnection between VC fundraising and the growing startup market, particularly in AI. Moreover, several Limited Partners (LPs) hesitate to provide new funds due to the current weak performance of VC investments and capital constraints. All these major factors contribute to the reason why VC funds are experiencing a dip.