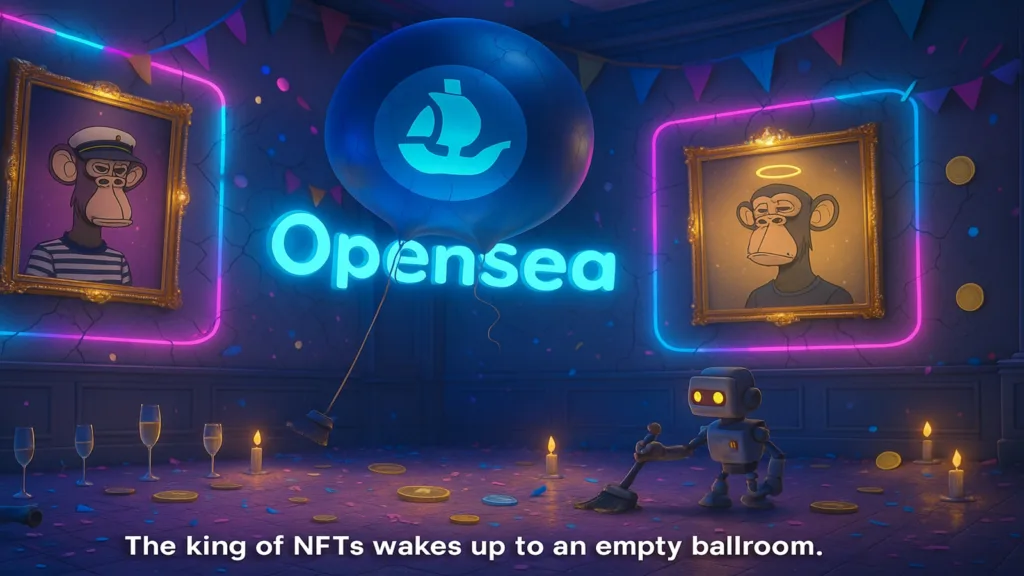

Remember the NFT party? It was a glorious, chaotic fiesta where digital cartoons of bored apes sold for more than a house. The champagne flowed, the music was deafening, and everyone was a genius. And standing at the door, collecting tickets and taking a tidy cut, was OpenSea. They were the undisputed king of the NFT ball.

Then, the music stopped.

The champagne flutes were replaced with empty cups, the glitter with confetti of regret. The party was over, and OpenSea was left in a cavernous hall, holding a velvet rope with nobody left to queue. This, my friends, is the story of what happens next. This is the tale of the great OpenSea pivots.

The ghost town where apes once roamed

Let’s set the scene. The year is 2025, and the once-bustling metropolis of the NFT market looks less like a booming digital city and more like a forgotten wild west town. Trading volumes have tumbled off a cliff, down a stomach-churning 95% from the dizzying heights of 2021. Those prestigious Bored Ape jpegs you used to brag about? Let’s just say their valuation has achieved a state of zen-like oneness with the floor.

And OpenSea? They went from pulling in a cool $125 million a month to what I can only assume was found in the office couch cushions, a paltry $3 million. They had to show more than half their workforce the door. The king was not just dethroned; he was standing in the rain without an umbrella.

So, what’s a fallen king to do? If you can’t beat ‘em, and you certainly can’t join ‘em because they all left, you do the only sensible thing: you open a massive, all-you-can-trade discount warehouse right in the middle of the ghost town. You stop being a specialist and become a supermarket.

The everything-but-the-kitchen-sink emporium opens for business

The report is in, and the strategy is as bold as it is desperate. OpenSea has decided it will no longer just be the place for your digital art. Oh no. It has now hung a giant “OPEN” sign and is welcoming trades of… well, pretty much anything with a blockchain heartbeat.

We’re talking memecoins with the lifespan of a mayfly, serious cryptocurrencies, and yes, the few, the proud, the remaining NFTs, all across 22 different blockchains. They’ve essentially become a digital asset aggregator, a one-stop shop that pools offers from other places like Uniswap, so you don’t have to run around. For this convenience, they take a tiny 0.9% slice. The entire, brilliant, necessary OpenSea pivots from a niche gallery to a chaotic and wonderful bazaar.

In a move that is either brilliantly trusting or utterly satirical of the old system, they’re not asking for your ID. No “Know Your Customer” here. Instead, they’ve outsourced the awkwardness to a blockchain analytics firm to side-eye shady wallets on their behalf. It’s the crypto equivalent of having a bouncer who doesn’t check your ID but instead just knows if you’ve been naughty or nice.

CEO Devin Finzer, with the pragmatic air of a captain who just ordered the lifeboats to be launched, reportedly said, “You can’t fight the macro trend.” And he’s right. The OpenSea pivots are a stark admission that the NFT boom is not just a bust; it’s a historical artifact. They are now chasing the “risk-on” environment, which is a fancy way of saying they’re following the money, wherever it may wander.

A phoenix from the ashes, or just a magpie shiny object?

And the most shocking part? It might be working. In the first two weeks of October, this new bargain bin approach reportedly handled a staggering $1.6 billion in crypto trades. That’s its biggest month in over three years. Even its old rival, Blur, which once stole its crown with fee-free trading, has seen its own activity evaporate. The OpenSea pivots have, for now, injected a jolt of life back into the patient.

The plan now, from their new Miami base of operations (with a lean team of 60), is to go full-throttle. An OpenSea token? Of course. A new mobile app? Naturally. The goal, as Finzer puts it, is to be as easy to use as Robinhood, but where you actually hold your own assets.

The grand, final OpenSea pivots from being the museum of a bygone speculative era to the bustling, slightly chaotic general store for whatever crypto craze comes next. They no longer want to be where you once speculated on pixel art. They want to be where the crypto economy actually shops today. It’s a survival instinct, and for now, it’s a masterclass in adaptation. The king is dead. Long live the shopkeeper