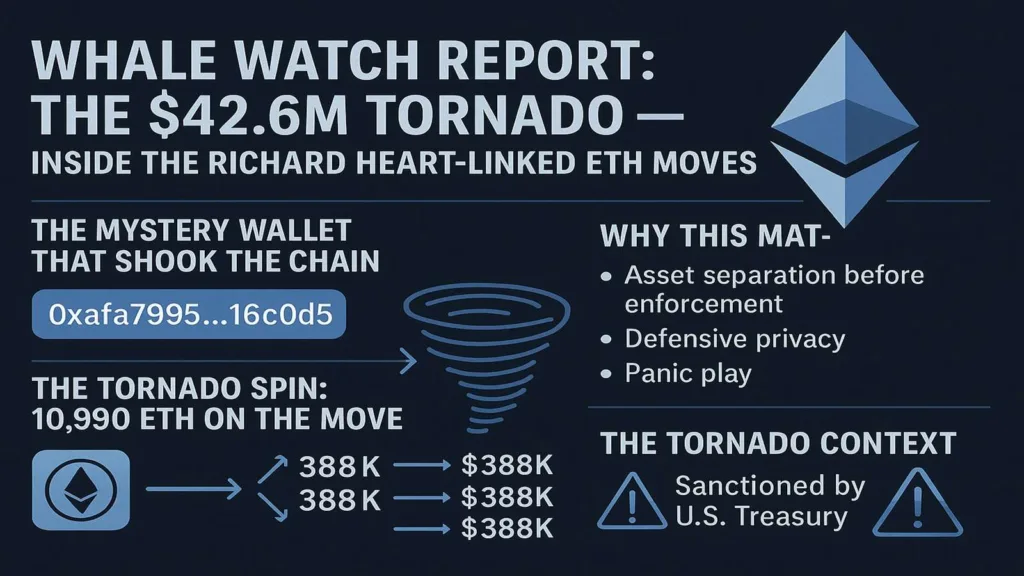

If you’ve been near a blockchain terminal today, you’ve probably seen the sudden $42.6 million Ethereum transfer making waves across crypto intelligence feeds. The wallet 0xafa7995546F…6C0d5, now under Arkham and Lookonchain’s microscope, is allegedly linked to Richard Heart, founder of HEX, PulseChain, and PulseX.

At first glance, it’s just another large Ethereum transfer, until you notice where it’s headed: Tornado Cash.

The Tornado Cash spin: 10,990 ETH on the move

Arkham’s dashboard shows 89.47 ETH ($348K) currently sitting in the wallet, but that’s just the leftover crumbs. Earlier snapshots reveal the address received 10,990 ETH (≈ $42.6M) and quickly began splitting it into 100-ETH batches before routing each through Tornado Cash, a privacy protocol infamous for obfuscating fund origins.

The timing was surgical, dozens of transactions within minutes, all uniform, each valued around $388,000 at current ETH prices.

Lookonchain, a trusted blockchain analytics tracker, confirmed the sequence and even tied it to a larger $608 million movement traced back to wallets historically associated with Heart’s ecosystem.

A wallet suspected to belong to @RichardHeartWin (founder of HEX, PulseChain, and PulseX) just moved 10,990 $ETH($42.62M) to a new wallet — and is now depositing it into #TornadoCash.https://t.co/90MNQuOmT3https://t.co/L38Yp90scj pic.twitter.com/rCHFy3pV24

— Lookonchain (@lookonchain) October 23, 2025

Why this Tornado Cash move matters

Let’s be clear, blockchain doesn’t lie. When a founder whose projects (HEX, PulseChain, and PulseX) are already under global scrutiny starts moving hundreds of millions in Ethereum to a mixer, the market listens.

Analysts interpret this as one of three things:

- Asset separation before enforcement: a classic move to fragment exposure before potential legal or tax actions.

- Defensive privacy: possibly protecting holdings as regulators crack down.

- Panic play: capital flight, moving funds fast to limit tracking before liquidity issues surface.

Whatever the case, the transactions are too deliberate to be a coincidence.

The Tornado Cash context

Tornado Cash itself remains a flashpoint in crypto regulation. Sanctioned by the U.S. Treasury in 2022, it’s become a magnet for controversy and compliance flags. Any major ETH whale using it, especially one with public associations, signals something deeper than just privacy; it signals fear, preparation, or maneuvering.

The community reaction

Crypto Twitter has erupted with speculation. “Why now?” is the question echoing across X (formerly Twitter). Some suggest it’s related to liquidity reshuffling post-ETF rumors. Others believe it’s part of a longer-term exit plan from Ethereum-based exposure.

Either way, the optics are damning: a founder moving funds through a blacklisted protocol after months of silence and ongoing investigations isn’t a vote of confidence.

Final thoughts: The $42m question

The ETH native whale here isn’t a retail player; it’s an architect of one of crypto’s most polarizing empires. Whether this is strategic repositioning or quiet panic, one thing’s for sure: Ethereum’s transparency doesn’t sleep, and every Tornado Cash deposit leaves a storm cloud over the market.

In crypto, timing tells the truth, and this timing screams preparation.