What a week! New all-time highs, new stablecoin, new market sentiment shifting to altcoins. BNB and LINK find new all-time highs, Bitcoin recovers its lost glory, and the total crypto market keeps rising.

Altcoin Season Index shifts to 82

Altcoins are starting to feel the heat as the Altcoin Season Index (ASI) hits 82 on its scale. Any figure above the 75 level on the ASI indicator shows what time it is– it is altseason time.

The indicator in particular denotes that more than 75% of the top 50 tokens have outperformed Bitcoin during the past 90 days.

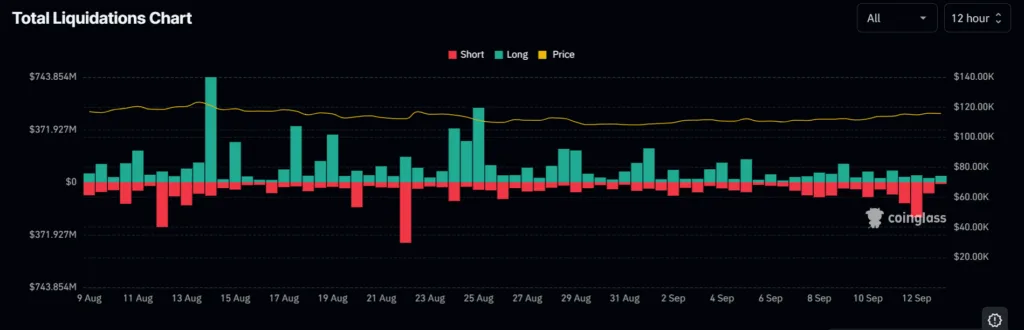

Short liquidations 5X time longs

At the end of Friday, more than $248 million short were liquidated while only $49 million long positions were liquidated. The long/short liquidation ratio was 1:5. In terms of the largest liquidation by coins, Ethereum took the biggest hit, with more than $15 million longs liquidated while $615K shorts were wiped out.

Bitcoin rose above 115K

After 20 days of trading below the $115K price level, BTC has once again found its footing. It could have been the $4.3 billion in BTC options expiring Friday that could have helped Bitcoin. If most of the open interest is in call options (bullish bets), market makers who sold those calls must hedge by buying BTC as expiry approaches — pushing price up.

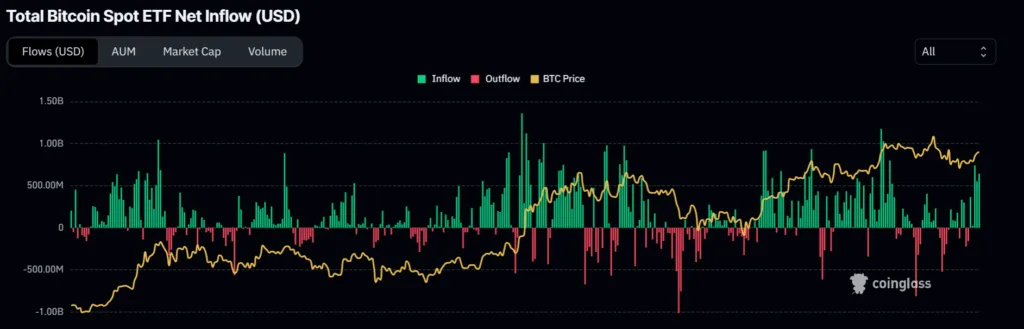

Bitcoin spot ETFs keep rising

Since the last week of August, the total Bitcoin spot ETF has been on the rise. The total Bitcoin spot ETF net inflow hit $642 million yesterday, while the daily total netflow reached 5.57K BTC. Meanwhile, the Ethereum ETF netflow hit $405 million.

Solana Reserve overflows

The Strategic Solana Reserve (SSR) now holds 11.7 million, a 0.7 million increase since September 6. The SSR tracks how much SOL is held by institutional treasuries and large entities. The increasing amount of Solana shows confidence that Solana’s long-term strength is rising.

Chainlink hits a new all-time high

The Total Value Secured (TVS) LINK reached an all-time high of $|100 billion. TVS measures the cumulative value of assets, transactions, and smart contracts that rely on Chainlink oracles. It denotes how much money in the crypto ecosystem depends on Chainlink for data feeds, price oracles, cross-chain services, and automation.

More DeFi protocols, blockchains, and enterprises are integrating Chainlink oracles. Billions of dollars in assets are relying on Chainlink to stay secure.

Tether rolls out U.S.-regulated stablecoin

Tether, the world’s largest stablecoin issuer, announced the launch of a U.S.-regulated digital dollar, USAT. The company confirmed that Bo Hines, former Executive Director of the White House Crypto Council under President Trump, will serve as the inaugural Chief Executive Officer of the new venture.

$BNB market cap hits a new all-time high

Binance exchange’s token BNB hit a new all-time high of $943 with its partnership with Franklin Templeton on Sept. 10 to develop new digital asset initiatives and products. With BNB reaching a new all-time high, the market cap reached $131B.

OKX’s X Layer hit a new ATH

On September 12, OKX’s X Layer blockchain recorded 71,400 active addresses, marking a new high for the network. The milestone pushed the total number of addresses on X Layer to over 4 million.

They also generated $1M in DEX fees, second only to $BNB Chain.

Crypto market cap crosses a significant level

The crypto market cap reached above $4 trillion, showing an increase in investor interest and netflow of capital into crypto. Now that the total market cap has reached above $4 trillion, a crypto analyst stated, “$5.35T is the ceiling. Above it? The structure collapses into oblivion.”

THE CRYPTO ENDGAME IS LOADING…

— Merlijn The Trader (@MerlijnTrader) September 11, 2025

$5.35T is the ceiling.

Above it? The structure collapses into oblivion.

Legends secure exits in silence.

Retail screams bullish at the top.

Every cycle ends the same.

The script doesn’t lie. pic.twitter.com/6zloXGhIKL

As we say goodbye to an eventful week with multiple new all-time highs and shifts in the crypto market, there’s one thing that I want you to take with you. And that is, now is not the time to take your eyes off the market; you blink, you lose.