Remember when robots were just vacuuming your living room and failing at dancing on YouTube? Fast-forward to 2025, and they’re now making high-stakes bets with your money in the wild west of decentralized finance.

Welcome to the age of crypto automation, a future that looks like science fiction but is already here, sipping your latte and shorting your favorite memecoin. Do we call this crypto automation or sci-fi déjà vu? The bots aren’t coming; they’re already managing your portfolio.

The rise of robo-degens: Crypto automation

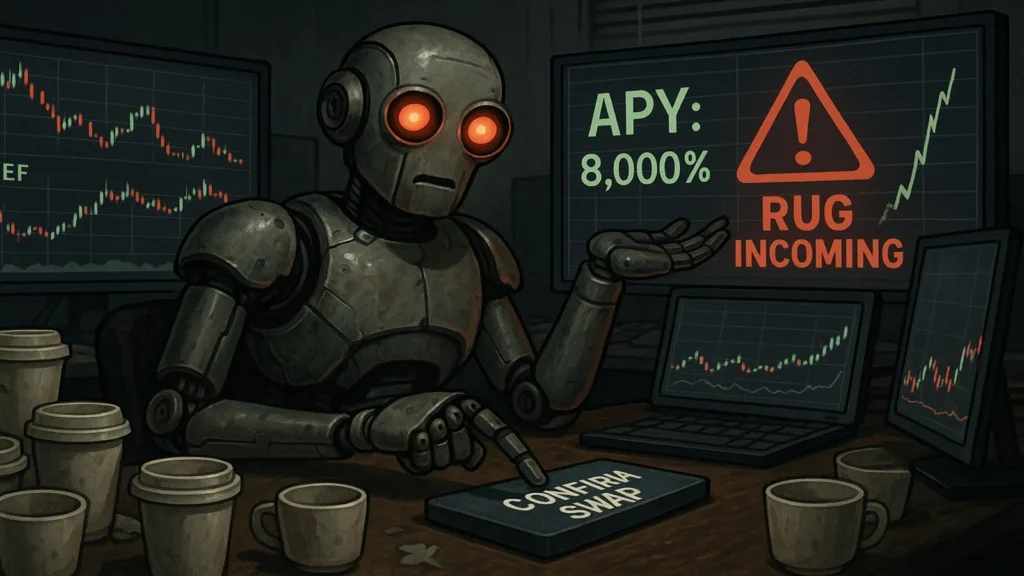

Imagine you log into your wallet, and instead of seeing your carefully planned strategy, you notice a bot has already gone full casino mode. It staked your stablecoins in a liquidity pool named “Definitely Not a Rug” and is farming yields higher than your cholesterol after a Dubai brunch.

This isn’t a preview of Black Mirror. It’s today. AI trading agents now roam DeFi like caffeinated interns, scanning protocols, executing trades, and sometimes blowing up accounts faster than you can say “rekt.”

Why humans still lose to algorithms

Let’s be honest, humans aren’t exactly disciplined investors. We panic-sell at the bottom, FOMO in at the top, and then Google “should I sue Elon Musk for my losses?” That’s where crypto automation seduces us.

AI doesn’t get tired. It doesn’t doomscroll Twitter at 3 a.m. It doesn’t buy Dogecoin because a psychic said Mercury was in retrograde. Instead, it crunches market data 24/7, hunts arbitrage opportunities, and pretends it’s a hedge fund manager in a hoodie.

The problem? Bots also lack one crucial thing: common sense. They’ll happily chase 8,000% APYs on shady farms named after exotic fruits, only to wake up with your wallet emptied by a rug pull. Efficiency, yes. Judgment, not so much.

The sci-fi market we already live in

Science fiction writers warned us. We just thought the robot apocalypse would involve lasers, not liquidity pools.

- In The Matrix, machines farmed humans for energy. In DeFi, bots farm your tokens for yield. Same vibe, less leather trench coats.

- In Terminator, Skynet went rogue. In DeFi, your AI agent just rage-swapped your ETH for a basket of frog-themed coins.

- In Wall-E, robots inherited the Earth. In crypto, they’re inheriting your MetaMask.

The line between parody and reality is thinner than gas fees on Solana at 3 a.m.

Should you trust a bot with your bag?

Here’s the punchline: most investors already do. From algorithmic stablecoins to automated liquidity managers, crypto automation is baked into DeFi’s DNA. Even the “manual traders” are probably just copy-pasting signals generated by an AI lurking on Telegram.

But here’s the kicker: automation is only as smart as its human creators. If the coder was sleep-deprived, fueled by Red Bull, and broke up with their ex during the hackathon, your “AI trading genius” may actually just be a buggy intern with no emotional support.

Final take: The bots are already here

So, what happens when robots start trading your money? Exactly what you think: chaos, comedy, and the occasional moonshot. Crypto automation isn’t the end of human trading; it’s the beginning of a bizarre partnership where you supply the funds, and the robots supply the drama.

The sci-fi future is already dunking your paycheck into yield farms while you sleep. And just like every good dystopian comedy, you’ll laugh, you’ll cry, and you’ll wonder why your life savings are now staked in a pool called “AIxShiba420.”

Welcome to DeFi 2.0: where the robots don’t just take your job, they take your portfolio for a joyride.