Today, on the Ethereum price forecast, a record 2.4 million ETH is poised to exit Ethereum’s staking contracts, sending a clear signal to the market. To understand where the price is headed, we must first understand the profound implications of this withdrawal queue. Let’s break down the potential scenarios for what happens next.

Exit queue meets institutional beef

When validators start to queue massive exits, that’s a warning light. Right now, the exit line stretches beyond 41 days. That’s not trivial. Some smaller validators are losing faith or cashing out profits.

But on the flip side, institutions like Grayscale have staked hundreds of thousands of ETH recently. That institutional confidence acts like a counterbalance. The tension between exits from retail validators and inflows from big players will define the next phases.

So, in thinking about an Ethereum price forecast, it leans into this tug-of-war: can institutional demand absorb or overshadow the exit pressure?

Reading the pattern: Past cycles as signposts

When a blockchain network faces liquidity stress but remains structurally strong, it primes for a sharp rebound if the fundamentals stand. Now, Ethereum is not getting abandoned. Active validators remain, DeFi activity still hums, and developers keep building.

Moreover, past bullish runs have featured “capitulation first, then surge” behavior. That fits this moment. If withdrawals trigger short-term dips, those could set the stage for a rebound.

Technical observers already point to a few setups:

- The “Power of 3” pattern suggests ETH could reach $5,000 if momentum holds.

- Some models envision breakouts to $6,000 or beyond if support zones hold.

- Others see $8,000–10,000 as a stretch target in an aggressive scenario.

There have been enough peaks and corrections to know the extremes are possible, but unlikely without strong fundamentals backing them.

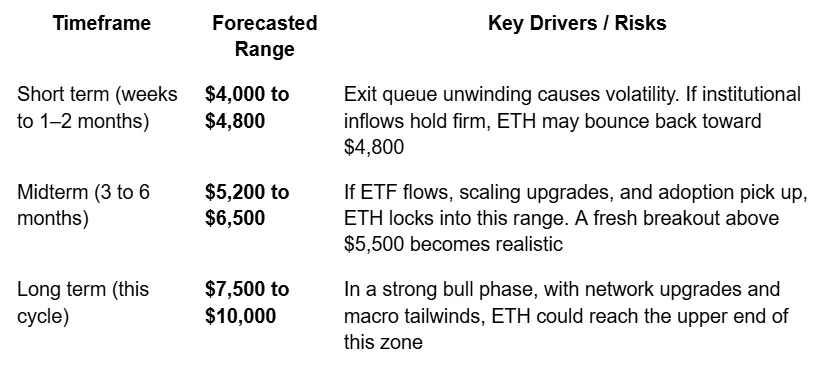

Ethereum price forecast: A layered prediction

Here’s how the Ethereum price forecast could likely unfold, in stages:

Note: For the long term, it leans toward conservative relative to some hype voices. Over decades, it’s been proven that overconfidence leads to surprises.

What could derail this Ethereum price forecast?

- If massive exit trades flood the market before institutional demand absorbs them

- Unexpected regulation or negative policy actions

- A failure in a major technological upgrade or a security breach

- Macro shocks (interest rates, economic crisis) that drive out risk assets

If any of these hit, ETH could revisit $3,500–$3,800 in a stress scenario.

Ethereum price forecast or fore-crash?

The Ethereum price forecast is not a straight line upward. There might still be friction, volatility, and drama. But because the network still hums, institutions believe, and because cycles tend to surprise us upward after stress, ETH might climb through $5,000+ and likely flirt with $7,500–$10,000 in this cycle.

When the exit queue finally winds down, and if institutions continue to step in, we may look back at this moment as a turning point. That moment will define the next Ethereum price forecast, not just as numbers on charts, but as proof that resilience and structure matter in crypto.