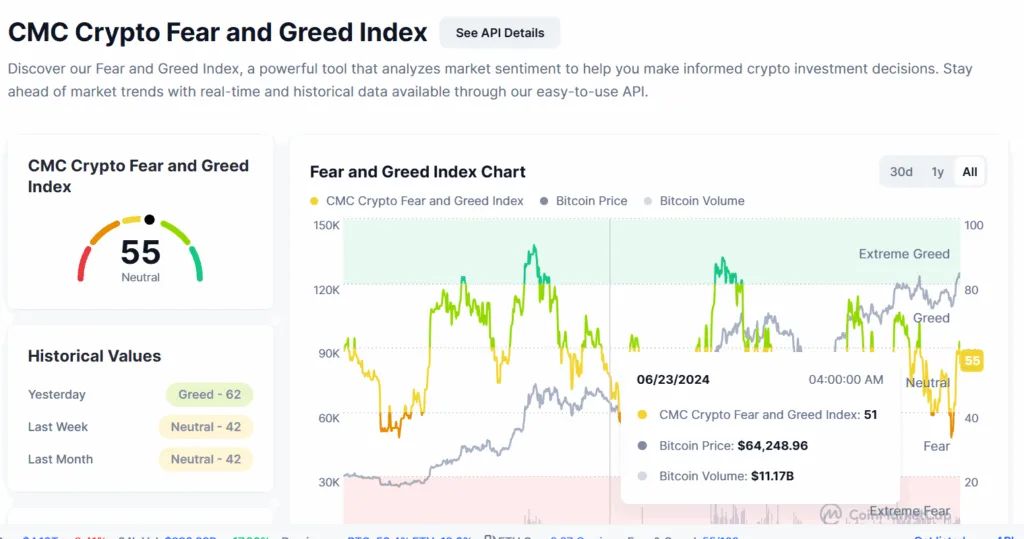

As the crypto market wavers from the fear zone to neutral zone, and the value on the Fear and Greed Index fluctuates between 50 and 65, uncertainty is as large as life. With BTC reaching above $124K, many traders got into long positions only to see their positions get erased. This is just the overall picture of what happened today; read further to get an in-depth understanding.

PancakeSwaps’ X account compromised

Decentralized exchange PancakeSwap’s X account was compromised when a bad actor used it to promote a scam coin. The hacker made use of the X account to promote a token called ‘Mr. Pancake. However, the exchange later on notified that it was working on resolving the issue.

Fear and Greed Index back in neutral zone

CoinMarketCap Fear and Greed Index has moved from the greed zone back into the neutral zone. Yesterday the indicator showed 62, and today it moved and fell back to 55. The Fear and Greed index is a tool that gauges the sentiment of the traders in the crypto market.

BTC supply in profits hits 95%

According to Glassnode, more than 95% of Bitcoin’s circulating supply has returned to profit after the flagship crypto broke above the $117K level. Usually, the profits in Bitcoin move in sync with the BTC prices.

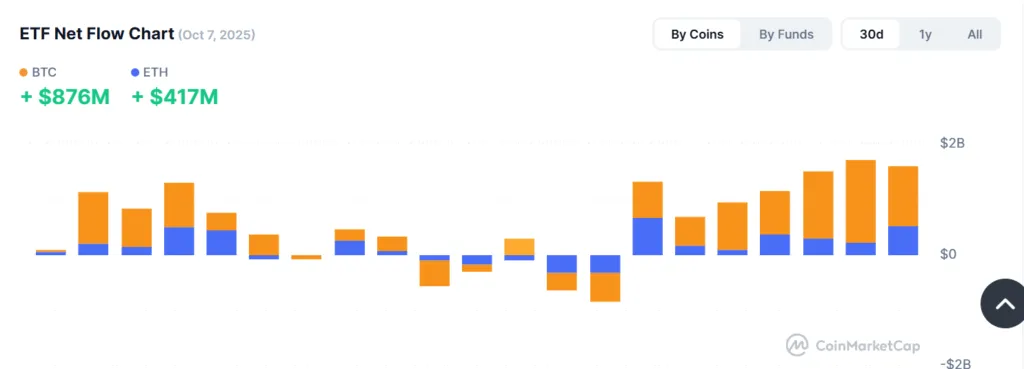

BTC ETF net inflows are twice of ETH

The crypto ETF netflow has been on the rise since the last week of September, and today it hit $1.29 billion. In particular, the BTC ETF netflow has been rising along with the rise in crypto inflows. Today, about $876 million flowed into BTC ETFs, while only $417 million flowed into ETH ETFs.

TRUMP memecoin producer to raise $200 million

The company behind the TRUMP memecoin, Fight Fight LLC, is seeking to raise about $200 million to build a treasury to help the depreciating price of TRUMP. Thereafter, the company has plans to buy the TRUMP token, which has lost more than 90%.

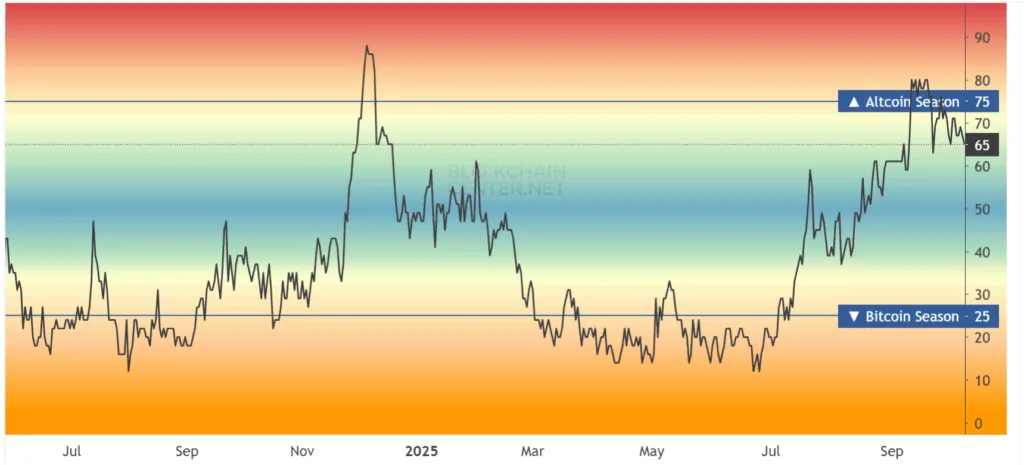

Altcoin Season Index falls

Since the last week of September, the Altcoin Season Index (ASI) has been hovering below the 75-threshold level of altcoin season. The ASI line is currently reading a value of 65, and it will need to hold this level if the ASI line is to maintain the overall uptrend.

When the ASI crosses above 75, it shows that more than 75% of the top cryptocurrencies are outperforming Bitcoin.

Coinbase offers staking service in New York

Popular crypto exchange Coinbase stated that it has started to offer crypto staking services in New York. With the nod from the state regulators, New Yorkers can now stake Ethereum, Solana, Cosmos, Cardano, Avalanche, Polygona, and Polkadot on Coinbase. The highest, most-paying programs— staking Cosmos pays an estimated 16% APY. The Ethereum staking program earns an estimated annual yield of 1.9%.

New Yorkers have lost out on millions of dollars of staking rewards available to others. That ends today. https://t.co/Q0bdKpOLDO

— paulgrewal.eth (@iampaulgrewal) October 8, 2025

Market catches long positions off guard

At the end of yesterday’s trading session, more than 462 million worth of long positions were liquidated while only about $143 million worth of short positions were wiped out. With BTC hitting a new all-time high, many traders seem to have entered long positions, but with the prices crashing, their positions were forced to be liquidated. This is the largest amount liquidated in long positions since September 26.

In the coming days, the ASI and the Fear and Greed Index will keep on fluctuating, and those joining the market late will be caught.