September has earned a reputation as one of the weakest months for crypto, and that view comes from both historical performance and market behavior. Statistically, Bitcoin and Ethereum have often posted negative returns in September across multiple years, which has cemented the idea of a “September curse.”. With this in mind, let’s see what the prices of today are.

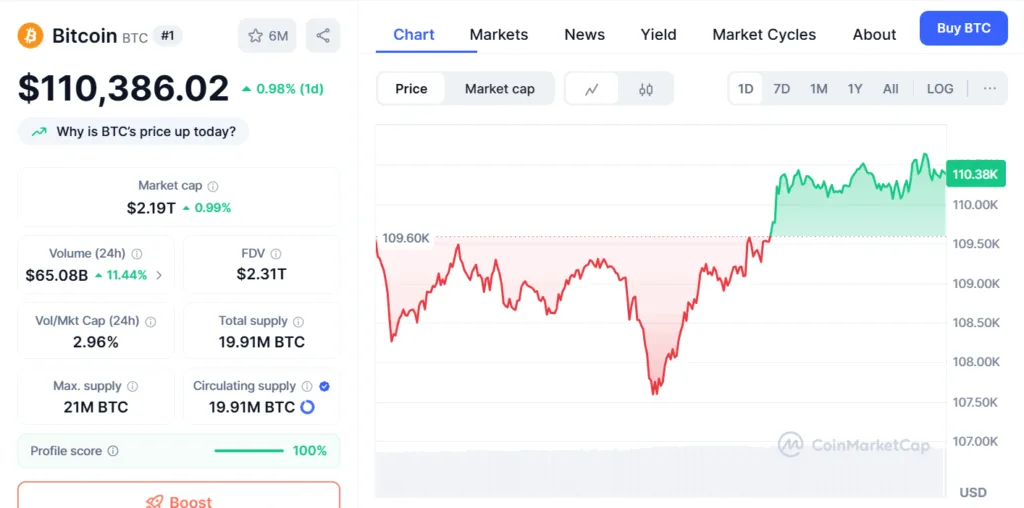

Bitcoin (BTC) price today

Price: $110,386

24-hour price change: 0.98%

24-Trading volume change: 11.44%

The last 24 hours have been quite dramatic for Bitcoin. It crashed below the opening market price of $109K and reached almost $107.5K, before recovering again. After recovering and reaching $110K, the prices are holding steady and are moving sideways. If BTC holds above the $110K, the bulls will build the pressure and press on towards higher altitudes.

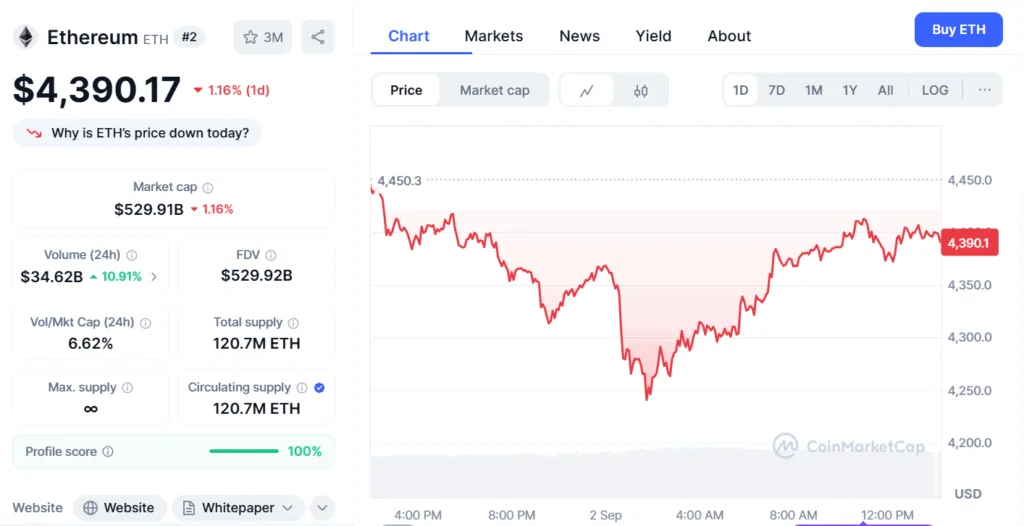

Ethereum (ETH) price today

Price: $4,390

24-hour price change: -1.16%

24-Trading volume change: 10.91%

Caught under the tight grips of the bears, Ethereum is struggling to rise above the daily opening market price of $4,450. After hitting its daily lowest price of $4,250, the coin was making higher highs and higher lows until it hit close to $4,400, where the bears interfered with the upward motion. A break above this level will be the beginning of a rally that could take ETH to new all-time highs.

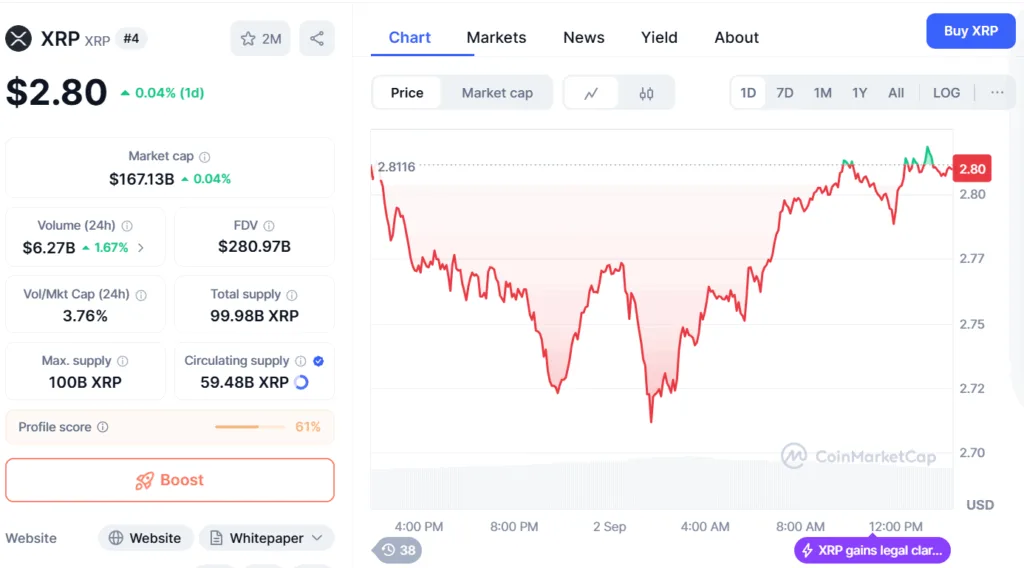

XRP price today

Price: $2.8

24-hour price change: 0.04%

24-Trading volume change: 1.67%

Ripple Labs’ token, XRP, just popped its head above the daily opening market price of $2.811, but the bears slapped it back to $2.8. XRP recovered well, rising from the $2.72 level in just a matter of hours. At the time of publication, XRP is searching for a support level. If bears keep adding more pressure on XRP, the token will crash to $2.77.

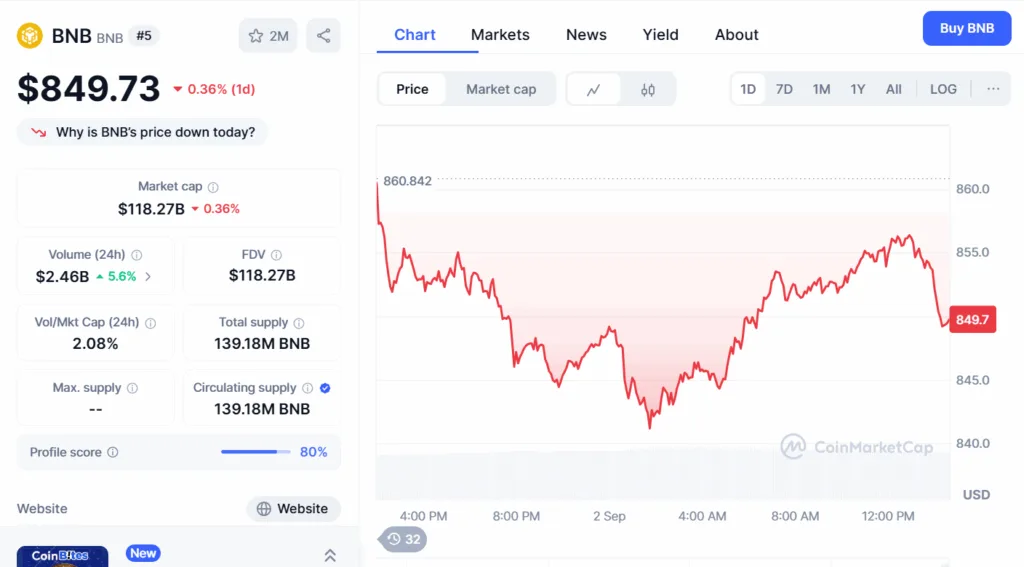

Binance (BNB) price today

Price: $849.73

24-hour price change: -0.36%

24-Trading volume change: 5.6%

Binance exchange’s token, BNB’s woes continue as the token is stuck in dire straits, printing $849 on the daily chart. BNB is struggling to keep up after the Venus (XVS) exploit, where it lost $30 million worth of crypto. Investigations are still ongoing on Venus, which operates as a leading cryptocurrency lending protocol on the BNB Chain, enabling users to lend and borrow digital assets.

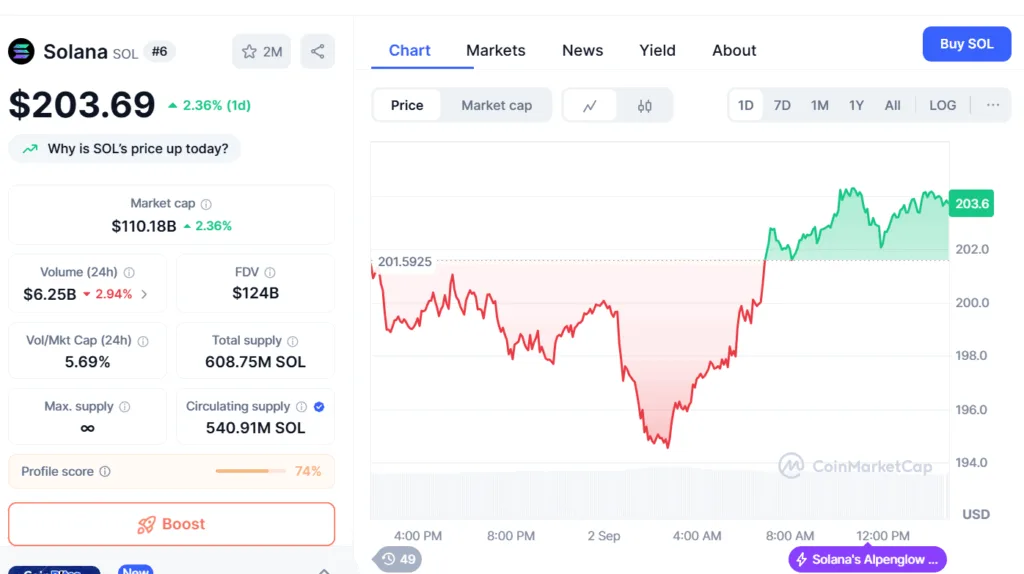

Solana (SOL) price today

Price: $203.69

24-hour price change: 2.36%

24-Trading volume change: -2.94%

With a price of approximately $203, Solana is consolidating between $202 and $203.6. After hitting $203, the token is heading downwards, and the bears seem to be in control. However, the bulls and the bears will have an intense battle when the token reaches its daily opening market price of $202.

Apart from the BNB token, the rest of the coins and tokens are more or less moving sideways. This shows that the market is stagnant and lower volatility signals indecision, as buyers and sellers are relatively balanced.

During consolidation, traders behave in different ways: short-term range traders take advantage of the predictable moves by buying near support and selling near resistance, while trend traders typically stay patient, waiting for a breakout above resistance or below support to catch the next big move. Long-term holders often view this period as neutral, choosing to remain inactive until a clear trend emerges. In essence, consolidation is the market “resting,” and traders either exploit the range or prepare for the breakout that will end it.