During times when the crypto market is crashing and looking for support levels, and investors scramble for safe haven assets, Hyperliquid’s token HYPE has been on a roll. The token has gained more than 30% during the past month courtesy of the partnership with Ripple and the reduction of the token unlock.

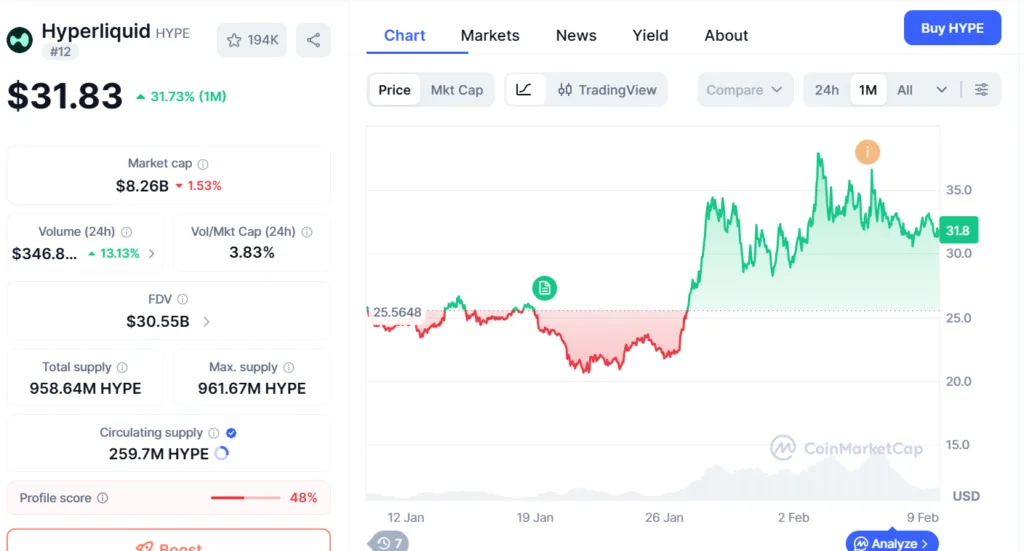

HYPE has been showing impressive gains even though the crypto market on the whole is crashing. As shown in the chart below, the token was trading at approx. $25 during mid-January; however, as the month progressed, the token initially started to crash almost to $20.

But towards the end of January, HYPE gained momentum and rose above $35. This price action was coincidental with the HIP-4 protocol proposal. With the HIP-4 protocol proposal, which would add an outcome-based trading on its platform, exposing traders to fixed risk, the token started to rise as excitement drove the prices.

HYPE rides high with Ripple’s integration

Even in the current scenario, the price of HYPE is appreciating after Ripple’s prime brokerage firm, Ripple Prime, integrated the decentralized exchange onto its platform.

Nima Beni, founder of Bitlease, revealing his thoughts to a prominent media outlet, stated that Hyperliquid is holding “because it’s built on usage, not hype.”

The founder further mentioned, “When liquidity tightens, the difference between real products and narrative-driven tokens becomes obvious.”

Token unlock strategy plays in favor of HYPE

Apart from the partnership that kept the price soaring, HYPE used its token unlock strategically. The network also announced that it would reduce 88% of the tokens released for February from January’s unlock. On January 29, the network unlocked 1.2 million tokens, but with its new strategy, the platform cut the supply for February by 88% to 140,000 HYPE tokens, removing $34 million in monthly sell pressure.

HYPE is about to break out from the symmetrical triangle. The token was rejected at the 50-day moving average. However, when HYPE completes the pattern, the token will once again break out and hit $35.