Grayscale’s Chainlink ETF was received with much interest as inflows and trading volume surged during the first day. However, despite the inflow of funds into the exchange traded product, LINK is still struggling to get going.

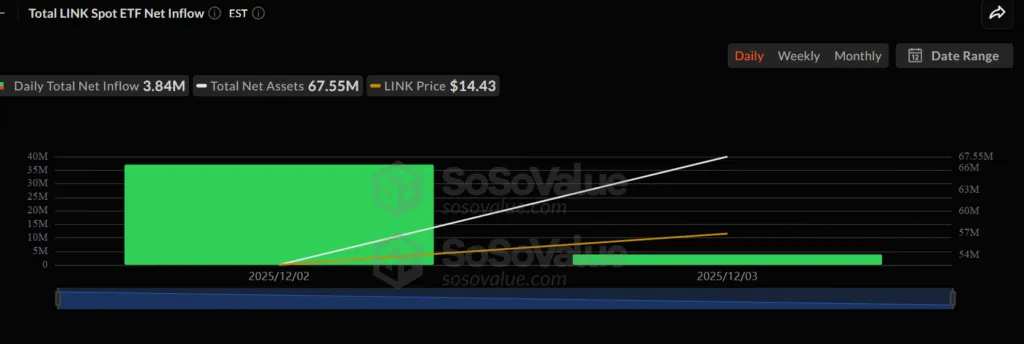

The launch of Grayscale’s Chainlink ETF (GLNK) on New York Stock Exchange was received with open arms from the LINK community. With receptive investors the cumulative inflows into the ETF hit $41 million while the trading volume hit $13 million during the first day, said Eric Balchunas, Bloomberg’s senior ETF analyst. The total net asset hit $66.5 million.

Despite the cumulative inflows hitting $41 million and the trading volume reaching $13 million, James Seyffart stated that it is not a “blockbuster” success.

Analyst Lavneet Bansal speaking to Altcoin Desk stated: “Chainlink’s ETF debut wasn’t a blockbuster, but it was a strong signal. Even in a sluggish market, $41M on day one shows that institutions still want regulated ways to access crypto, especially infrastructure assets like Chainlink, as it is not a hype asset. It powers data, oracles, and tokenization rails. and that’s exactly the kind of exposure institutional allocators are comfortable testing through ETFs.

I wouldn’t overhype it, but it does tell us something important: institutional appetite hasn’t disappeared, it’s simply shifting toward compliant, familiar wrappers.”

LINK is struggling to get out of the downward trend it has been fluctuating in, since the last 4 months. Not even the excitement of the ETFs nor the inflow of funds could get LINK going once again. The main reason for the downfall to continue was the death cross.

The 50-day Moving Average crossed the 200-day MA below making a death cross. When this happens the prices usually crash further.

With the death cross happening at the wrong time, LINK is still trading inside a falling wedge, continuing its four-month trend. Currently, the token is testing the upper trendline, and it has been rejected. Even in the event that the token breaks out of the pattern, it has a strong resistance level at the 50-day Moving Average (MA) at $15.

However, the falling wedge is a bullish sign that will eventually produce a breakout, relieving all the pressure building inside. As such, when the breakout happens, LINK will surge by the height of the falling wedge at its widest. Given that the token follows this rule of breakout, it will hit $22.