Solana (SOL) prices have fallen to 2024 December levels with declining ETF demand and open interest. However, as the Solana market is oversold, the prices could appreciate.

Solana prices crashed to December 2024 levels as the broader macroeconomic factors impacted the overall crypto market. As the impact of the rising unstable geopolitical conditions took over, investors stepped away from uncertainty and volatility in the crypto market in search of safe haven assets.

Traders step back with extreme fear

The Fear and Greed Index, which gauges the overall market sentiment, crashed to the depths of the extreme fear level. This indicator went into deep extreme fear levels which had not been seen during the past three and a half years.

During these extreme fear levels, investors stay away from the market, maintaining a risk-averse strategy to keep volatility to a minimum. As investors kept the crypto market at bay, the overall crypto market crashed, and Solana too succumbed to the effects.

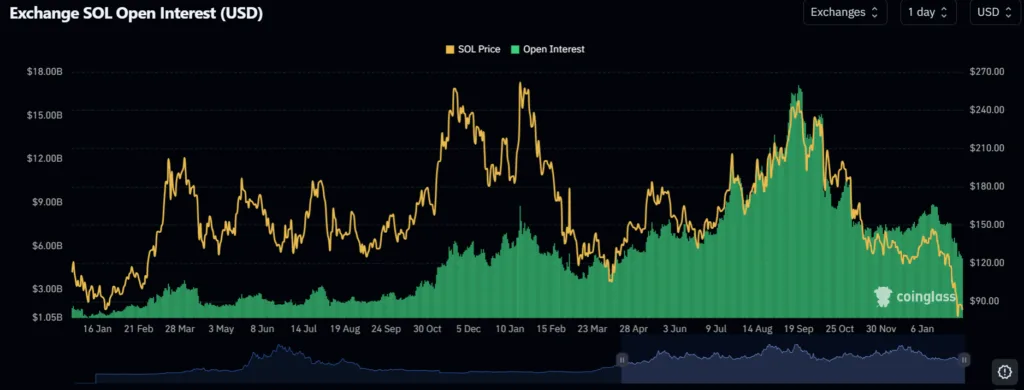

Open interest thins to a third from September 2025 level

The open interest (OI), or the number of open contracts in the futures markets, has dropped drastically. From hitting $17 billion in September of 2025, the OI crashed to $5 billion as of the time of writing.

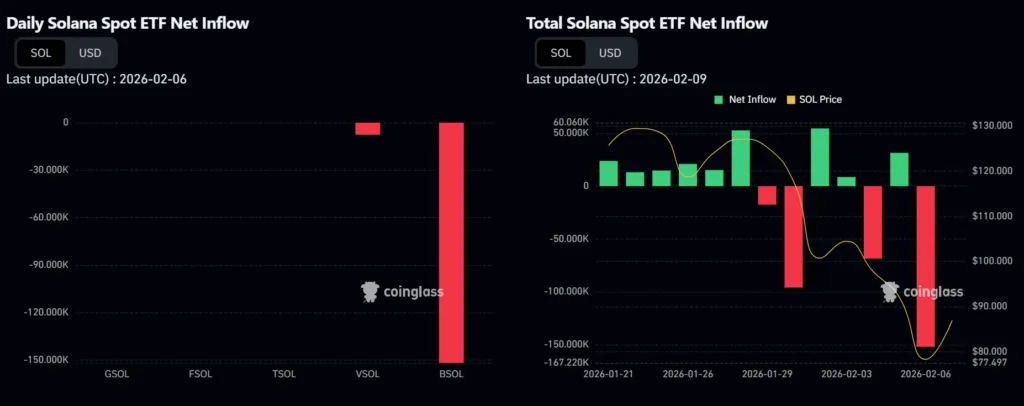

Even the SOL derivatives market took the brunt of the macroeconomic factors. The SOL ETFs started to bleed profusely. From recording an inflow of $2.9 million last Thursday, funds flowed out of SOL ETFs on Friday, reaching almost $12 million. Bitwise Asset Management’s ETF BSOL suffered the most, as it lost 12 million.

With OI crashing and the funds being pulled out of Solana ETFs, the prices crashed to 2023 December levels. With the effects of the adverse market conditions and the ETF leakage, Solana discontinued its consolidation phase and started to crash.

SOL is oversold and recovery should follow

The crash was bad and was almost a near free fall as the prices dropped instantly from above $100 to $70 before staging a recovery. Currently priced at $83, the coin is oversold, as the Relative Strength Index has sunk below 30. When a token goes into oversold territory, traders see an opportunity to buy a coin at a discounted rate. Provided the traders buy the dip, SOL will be bracing for a recovery.