As the overall crypto market is drenched in fear, there are a few tokens that are showing abnormal behavior. Despite fear crippling the market, Zcash tested $650 resistance level twice, while ASTER tested $1.13 thrice, and UNI knocked on $9.7 once.

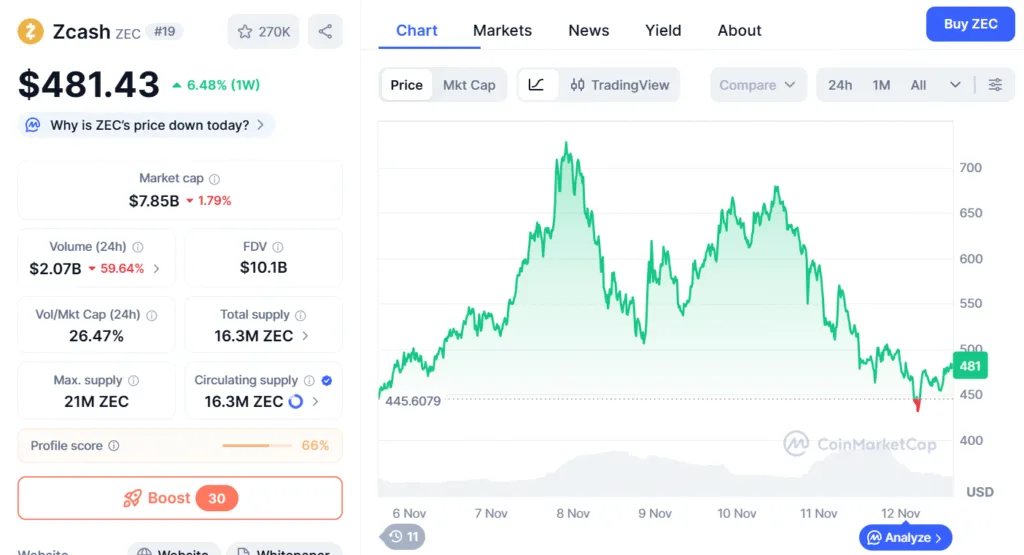

Zcash cracks above $650 but fails to hold above

Zcash is a privacy-oriented cryptocurrency built on Bitcoin’s foundation. The project gives the leverage for users to get full privacy (shielded transactions) or standard transparency. Its innovation lies in using zk-SNARK cryptography to secure transaction details while maintaining validity. If privacy and control are important to you, Zcash is a noteworthy option — but it also comes with its unique risks and regulatory considerations.

On the weekly chart, Zcash has made a double top, and it is now on a downtrend. The token is now priced at $481 after gaining more than 6%. Last week has been a wild ride for Zcash as the token fluctuates between a wide range of $440 and $700. However, as the token is once again rising, it will find resistance at $500, a psychological level.

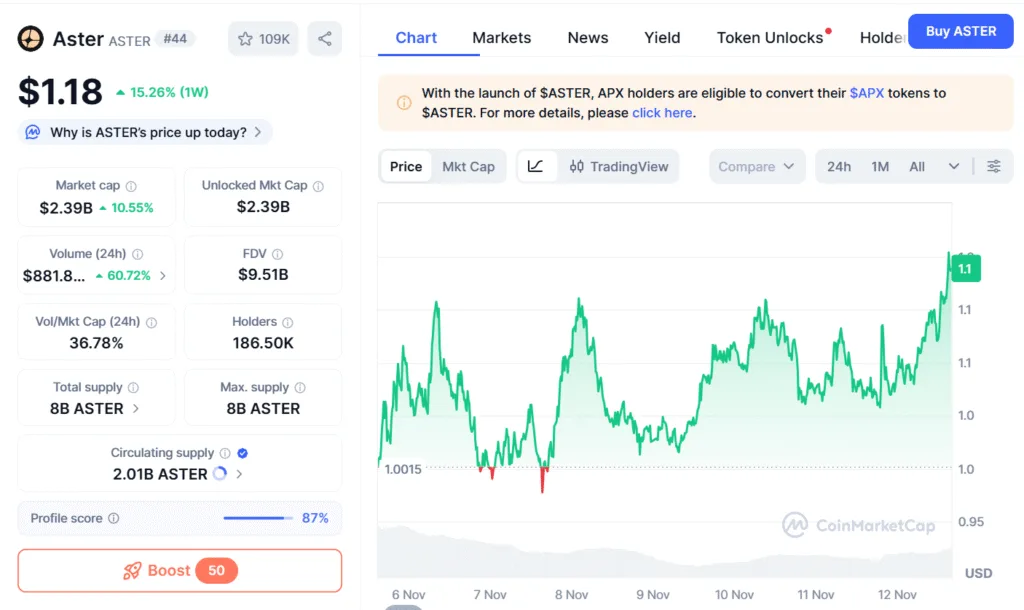

Aster tests resistance three times

ASTER is the native utility and governance token of the Aster ecosystem — a decentralized exchange (DEX) platform focused on spot + perpetual trading across multiple blockchains.

The platform supports advanced features like high-leverage trading (up to 1001×), hidden orders, multi-chain support (BNB Chain, Ethereum, Solana, Arbitrum), and yield-enabled collateral. ASTER token holders can participate in governance (voting on protocol upgrades, fees, treasury), get trading fee discounts, and take part in staking or reward programs.

Moving into ASTER’s price movement, the prices have been jagged. During the past week, the token tested the $1.13 resistance level three times and failed to cross above it. However, with the fourth attempt, the token made a breakthrough after gaining more than 15% during the past week. With a 60% increase in volume during the past 24 hours, there is about $880 million worth of trading going on. When the volume increases with price in unison, it shows an increase in demand, projecting higher prices in the future.

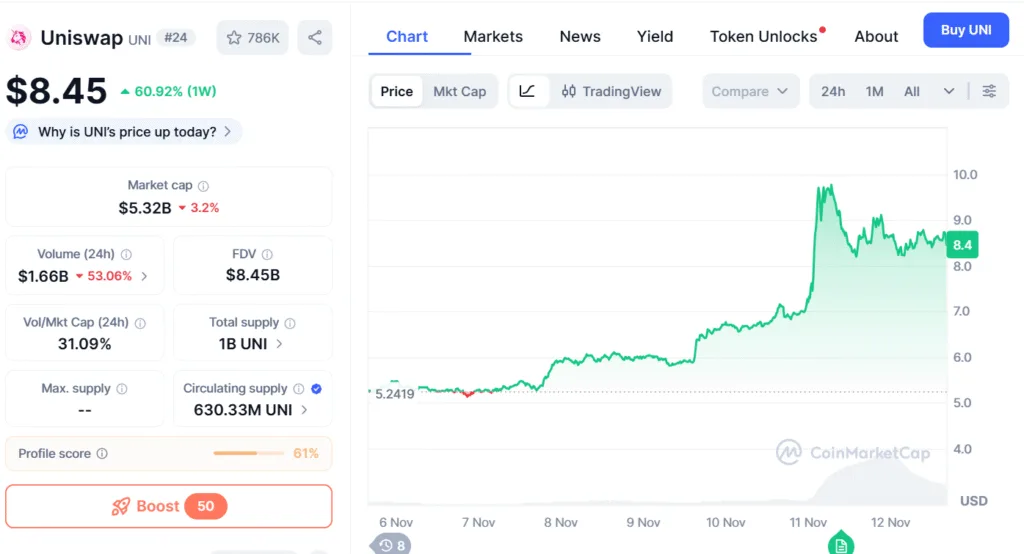

Uniswap crashes after reaching $9

Founded by Hayden Adams in 2018, Uniswap is a decentralized exchange that is built on the Ethereum blockchain. Unlike traditional exchanges that use order books, Uniswap uses an automated market maker model. The governance token of the exchange, UNI, is now priced at $8.5 after gaining about 63% during the past week.

Since November 6, the token rose slowly but steadily. However, yesterday, after reaching $9.4, the token once again started to crash, making lower highs. The next support level that UNI would be landing is $8, given that the bears keep the pressure in the market.

All three tokens tested their respective resistance levels but failed to establish their prices above it. Zcash is currently gaining momentum, as the traders buy the dip while ASTER has retraced. Meanwhile, UNI is making lower highs while the bulls defend the $8 horizontal support level. Overall, the bears are dominating the market as each of these tokens traverses different stages of their price action.