Subject: Binance Whale Wallet address 0x193405…9f8A4282

Total Assessed Value: ~$219 Million USD

Profile Classification: Top-Tier Binance Whale

Last Activity Window: Recent 30-day period

This report provides a strategic breakdown of a significant Binance whale wallet. The subject’s activity demonstrates a sophisticated balance of long-term core asset holding and active yield generation, serving as a viable model for high-value portfolio management. Its movements are a key indicator of capital flow sentiment within the BNB Chain ecosystem.

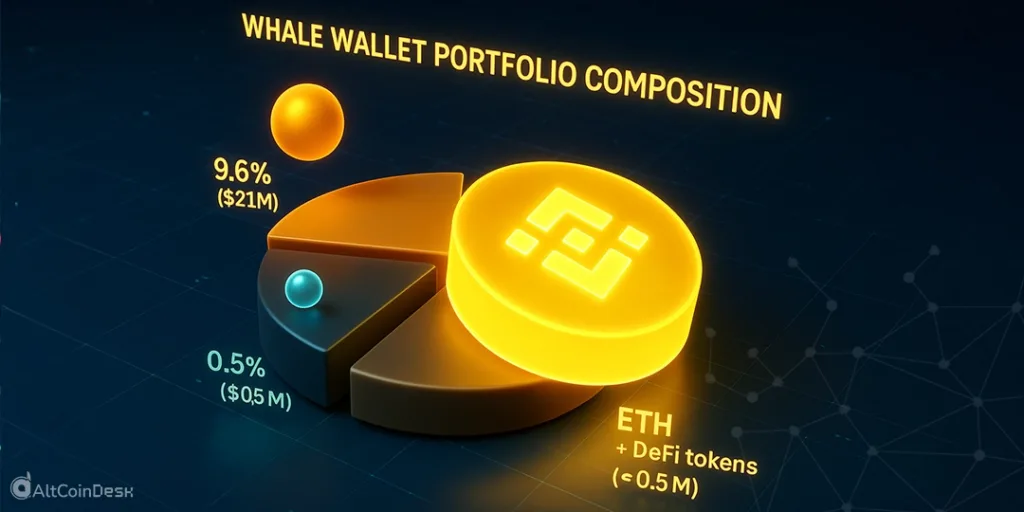

Portfolio composition & allocation

The wallet’s structure shows a clear preference for dominance and stability with calculated risk exposure.

- Primary Holding (90.4%): BNB

- Quantity: ~200,000 tokens

- Value: ~$198 Million

- Analysis: This massive allocation indicates supreme confidence in the BNB ecosystem and anchors the wallet’s value.

- Secondary Holding (9.6%): Diversified Assets

- BTCB: 184,000 tokens (~$21M)

- ETH, XVS, & other DeFi tokens: (~$0.5M)

- Analysis: BTCB provides Bitcoin-correlated stability. The minor DeFi allocations suggest a small, experimental, risk-tolerant segment.

Active strategy & on-chain activity

The subject is not passive. Its interactions reveal a strategy of constant capital utilization.

- Primary Protocol Engagement: Venus Protocol (Lending/Mining)

- Activity: Consistent use of assets for collateralization, lending, and participating in liquidations.

- Interpretation: This Binance whale is employing an institutional-grade strategy to generate yield on otherwise idle assets. This signals that DeFi is a critical tool for major players seeking ROI beyond mere appreciation.

Exchange correlation & capital movement

Tracking inflows and outflows to centralized exchanges (CEX), primarily Binance, reveals intent.

- Observed CEX Flows:

- Total Inflows (to Binance): ~$48 Million

- Total Outflows (from Binance): ~$98 Million

- Strategic Interpretation:

- Net Outflow (~$50M): A strong signal of accumulation and a mid-to-long-term holding stance. Capital is being moved off-exchange for staking, yield farming, or secure custody.

- Inflow Patterns: Large deposits typically precede major purchases or provide liquidity for rapid market action. Monitoring these inflows can provide early signals of impending market orders.

Balance history & market sentiment

The wallet’s net balance has trended steadily upward since Q4 2024, despite market volatility.

- Behavior: The entity uses market downturns as accumulation opportunities, demonstrating a contrarian investment philosophy.

- Sentiment Indicator: The consistent growth in holdings, avoiding panic selling, is a strong bullish indicator for the core assets within its portfolio.

Conclusions & market implications

- Conviction in Core Assets: The subject’s portfolio weight signals a powerful vote of confidence in BNB and Bitcoin’s long-term value.

- Yield is Paramount: Even for the largest holders, active capital management via DeFi protocols is a standard operating procedure.

- Follow the Capital: The net movement of assets off CEXs suggests this whale is positioning for a longer horizon, not short-term trading. A reversal of this flow would be a critical metric to watch.

For analysts and investors, monitoring the activity of wallets like Binance whale address 0x193405…9f8A4282 has proven to be essential. Their strategies often preview broader market trends. Emulating the principles of their actions, accumulating key assets during fear, and leveraging DeFi for yield is a more sustainable approach than attempting to mimic their exact trades.

Remember, do your own research!