We can all agree that assets don’t move in straight lines; they tell stories. And right now, Ethereum is weaving one of the most compelling narratives in digital asset history. With Ethereum price prediction conversations dominating trading desks, the question isn’t whether ETH will move, but where, when, and how dramatically.

Ethereum is standing at a familiar crossroads, that tension between technological promise and market reality. Let’s analyze and explore what really matters for ETH as we approach 2026.

The bullish catalysts: What’s fueling the optimism

The institutional story for Ethereum has fundamentally changed in 2025. We’re no longer talking about hypothetical “what ifs” but measurable flows. Spot Ethereum ETFs have attracted a staggering $27.6 billion in assets by August 2025, with BlackRock’s iShares Ethereum Trust alone capturing 90% of Q2 inflows.

This represents a structural shift in how institutions access Ethereum. The introduction of in-kind creation and redemption mechanisms in July 2025 aligned these products with traditional commodity ETFs, enhancing liquidity and reducing the supply of liquid ETH on exchanges. This supply crunch creates natural upward pressure, contributing to Ethereum’s 40% price surge this past summer.

The upgrade engine: Fusaka and beyond

Ethereum’s development pipeline remains its secret weapon. While Bitcoin evolves slowly, Ethereum’s core contributors keep shipping. The upcoming Fusaka upgrade, with testnets rolling through October and a mainnet release targeted for December 3rd, 2025, represents the next evolutionary leap.

Developers are focused on critical improvements to blob performance, helping the network handle data more efficiently. When the Ethereum network processes data more efficiently, transaction costs decline, and user experience improves, ultimately driving adoption and value.

The yield transformation

Perhaps the most underappreciated story is Ethereum’s transformation from a speculative asset to a yield-generating infrastructure tool. Staking yields of 3-6% have attracted $1.6 billion in corporate treasury allocations in August alone.

This creates a fundamentally different value proposition than we saw in previous cycles. Institutions aren’t just buying ETH for price appreciation; they’re incorporating it into treasury strategies as a productive asset. This structural demand creates a more stable price foundation than pure speculation.

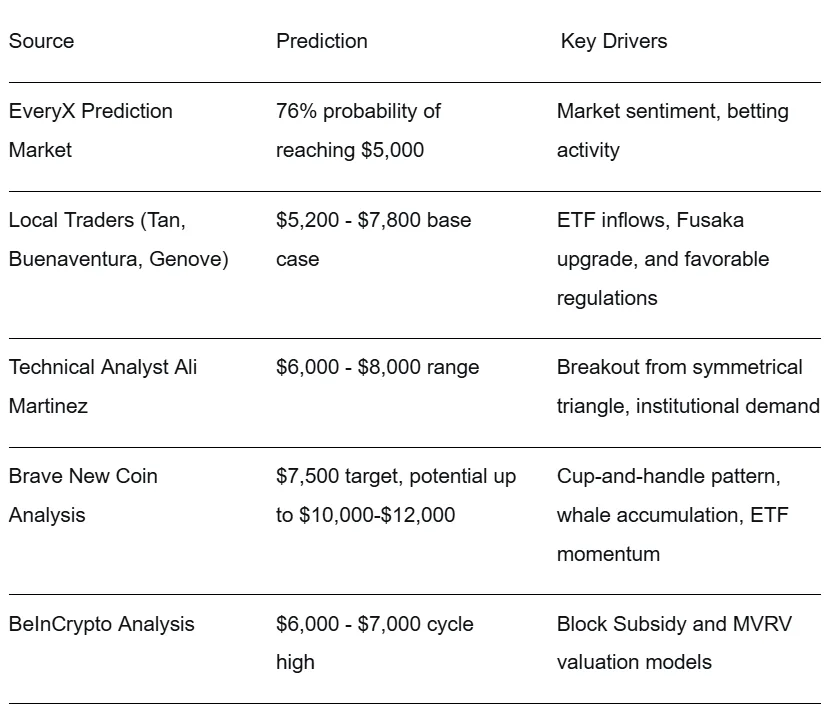

Ethereum price prediction: The consensus range

Forecasting for Ethereum’s trajectory through 2025’s final quarter:

This Ethereum price prediction consensus isn’t built on hope; it’s grounded in measurable on-chain data and institutional flow patterns that I’ve tracked across market cycles.

The signs of caution: Reading the warning lights

Despite the bullish setup, we cannot ignore the headwinds. The SEC has delayed Ethereum ETF approvals until October 2025, creating regulatory uncertainty that has contributed to market volatility.

Meanwhile, broader macroeconomic conditions are flashing warning signs. The Excess Credit Spread, a key indicator I’ve watched for decades, has turned positive, suggesting financial market instability that historically pressures risk assets like ETH. We’re in a 50-50 position, with some indicators pointing to a top and others showing neutrality.

📉 The bear case scenario

The bear case is what separates professionals from permabulls. If Ethereum breaks below key support at $2,500, we could see a retracement toward the $1,500-$2,800 range. The triggers? Regulatory setbacks, large-scale holder sell-offs, or macroeconomic pressures from global liquidity tightening.

The recent 17-34% price drops in blue-chip NFT collections like Pudgy Penguins and Bored Ape Yacht Club remind us that Ethereum’s ecosystem isn’t immune to market corrections.

Third, the Fusaka timeline, clear progress toward the December upgrade could catalyze developer activity and investor confidence, creating a positive feedback loop.

The final trade

The Ethereum price prediction conversation is more about a fundamental transformation in how institutions and users interact with the network. The path to $6,000 looks more probable than not, but we’ll likely see volatility around key regulatory decisions and the Fusaka implementation. The $10,000+ scenarios require a perfect alignment of ETF inflows matching Bitcoin’s post-ETF rally, sustained bullish macro conditions, and successful upgrade implementations.

The beauty of this market has always been its unpredictability. But from where I stand, with 25 years of watching technology assets mature, Ethereum‘s story has stronger fundamentals today than at any point in its history. The road may be bumpy, but the destination continues to brighten.

Please note: This article represents the author’s personal views and should not be considered financial advice. The cryptocurrency market is highly volatile, and investors should conduct their own research before making any investment decisions.