The tenth month on your calendar is more than just a month. Just like December is a season for holidays, October is quite popular for Halloween. In the crypto arena, this month has been renamed by combining Up+October and called ‘Uptober’. It is called uptober because the dead crypto market gains life once again, and the price starts to ascend. 9 out of the 10 uptobers have produced a spike in Bitcoin prices. So what’s the Uptober hype about?

September’s curse magnifies October rally

During September, the crypto markets fall as institutional investors cut risk exposure after the summer and rebalance their portfolios. September historically coincides with volatility in interest rates, inflation data, and central bank decisions, which makes the crypto market hemorrhage.

In countries like the U.S., the fiscal year ends in September for many companies and funds. In addition, investors sometimes sell underperforming assets. With so much happening in the month of September, the crypto market crashed deep into the mire.

Nice to see BTC and ETH moving the past few days.

— Edgy – The DeFi Edge 🗡️ (@thedefiedge) September 30, 2025

We've been through enough pain we need Uptober 😭

As the market crashes severely, even a small green bullish candlestick will be revered as a miracle. Just like every bitter thing is sweet to a hungry soul, the dearth of profits in September will make the crypto October look like glittering gold.

Emotions run wild

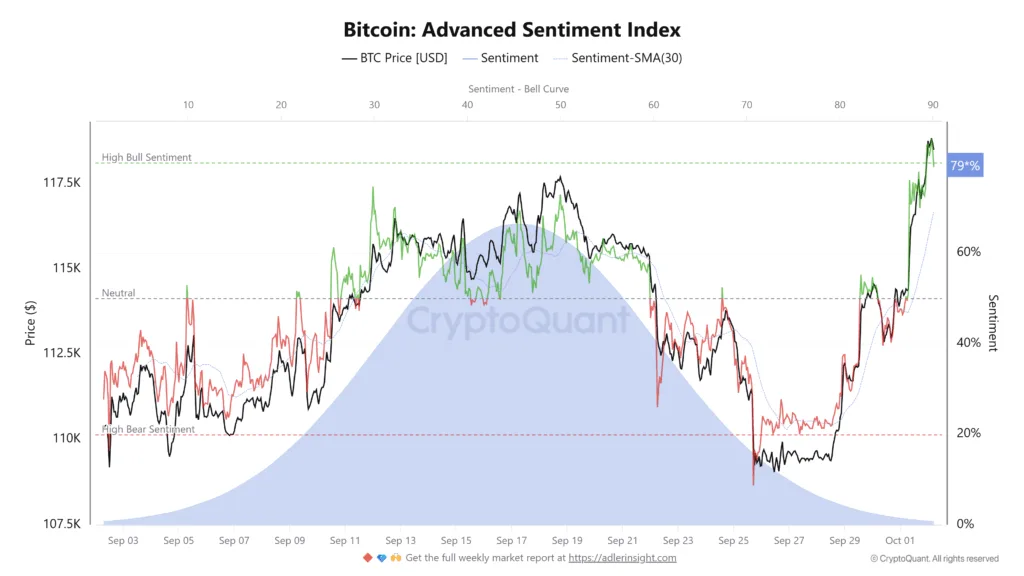

The Advanced Sentiment Index is a tool that measures the mood of the crypto futures or derivatives market. In the future markets, the traders’ risk appetite and confidence, and their gut feeling about the price, will be revealed. When the net longs vs the net short positions are compared, one could get a rough idea about what the market sentiment feels like.

On the Advanced Sentiment Index (ASI), the number has crept above the neutral threshold of 50% and hit 79% showing increased optimism in the market and a stronger belief in the continuation of the uptrend.

High Bull Sentiment on futures.

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 2, 2025

Uptober. pic.twitter.com/2okEPf3QbY

The Fear and Greed Index indicator, which gauges the mentality of the investors and traders, hardly moved above 50, the neutral level on its scale, during September. In fact, the highest it reached was just around 51. However, it’s just 2 days into October, and the Fear and Greed Index already reads 51 on its scale, establishing an uptrend. This shows that the traders are open to entering the market, and as the days go by, traders will eventually become greedy to book profits, and there will be a buying frenzy.

Retail traders take the bait

Speaking to a prominent media outlet, a senior research analyst at Nansen stated, “Retail traders often cite seasonal memes like Uptober on social media as part of the market’s cultural identity. These narratives can influence short-term sentiment and trading behavior at the margins.”

In contrast to retailers, professional traders usually make decisions based on fundamentals, macro conditions, liquidity, and technical setups, rather than calendar-based memes. So, historically, October could have been Uptober; however, that does not necessitate that this October would be one too.