The altcoin season index falls from 100 to 63 and recovers to 98. However, the Bitcoin dominance holds steady, and the Fed rate cut for December hits 78% and much more happened today.

Altcoins Season Index falls but recovers

Altcoin Season Index crashed from 100 to 67 and then recovered to 98. The Altcoin Season Index is an indicator that is used to predict the market status. Whether it is Bitcoin season or altcoin season. After falling way below the altcoin season territory, the ASI is back at 98, raising confusion in the crypto community.

Bitcoin dominance stagnates while prices fall

Despite Bitcoin crashing and falling to $111K, the Bitcoin dominance has been steady. The Bitcoin dominance, which shows the Bitcoin market cap against the total market cap stayed at 57%. When Bitcoin’s price falls but its dominance remains steady, it means the decline isn’t isolated to BTC alone — the broader crypto market is also falling at roughly the same pace

Market liquidates more than $100 million

On September 22, 2025, more than $1.65 billion in long positions were liquidated. This amount dropped drastically to $102.5 million yesterday. The short positions liquidated during the last 24 hours were around $50 million.

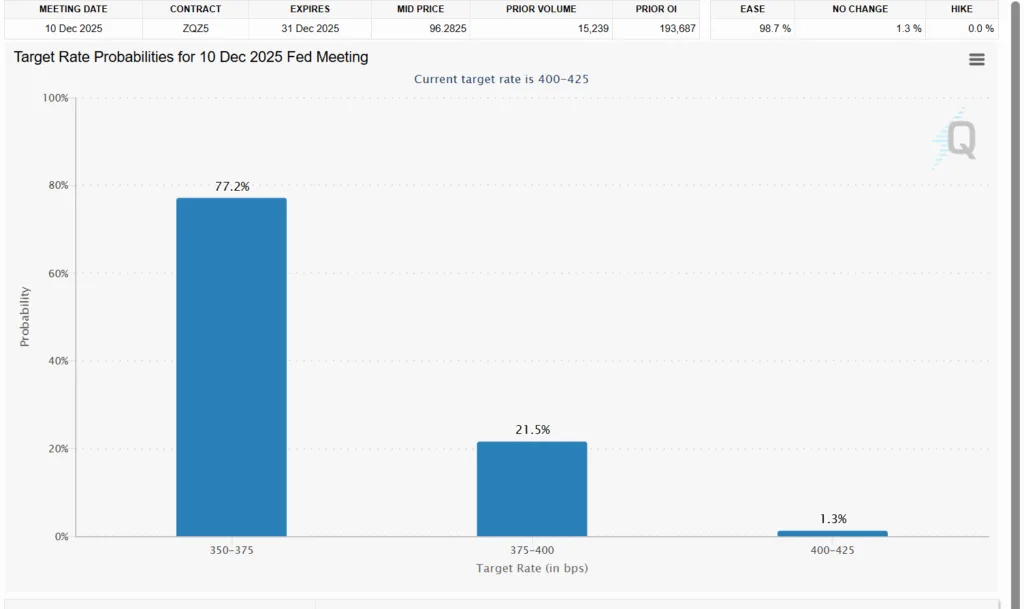

Fed rate cuts for December are out

After the first Federal Reserve rate cut in September, the masses are looking forward to yet another interest rate cut by December 2025. According to the CMEgroup Fed Watch group, the markets priced a 78.6% chance that the Fed cuts rates to 3.50%–3.75% by the Dec. 10 meeting.

AgriFORCE switches focus

AgriFORCE Growing Systems renamed its company to AVAX one after it transitioned its focus into an AVAX-focused digital asset treasury company. SkyBridge Capital founder Anthony Scaramucci, leading the strategic advisory board, plans to raise $550 million from outside investors to acquire AVAX tokens.

The SEC and CFTC will hold a roundtable

In a pivotal step “toward building more coherent and competitive U.S. markets,” the SEC and CFTC will host a joint roundtable on Sept. 29. In the roundtable conference, the duo will discuss regulatory harmonization priorities

“By working in lockstep, our two agencies can harness our nation’s unique regulatory structure into a source of strength for market participants, investors, and all Americans, “ stated the SEC Chairman Paul S. Atkins and CFTC Acting Chairman Caroline D. Pham

Stablecoin supply hit an all time high

Stablecoin supply reaches an all-time high of $283.2 billion while monthly stablecoin senders hit a record of 25.2 million users.

The stablecoin total supply reached an all-time high of $283.2 billion. It’s not just the stablecoin supply but also the number of stablecoin senders that climbed to 25.2 million, a record number. In addition to this, startups that are focused on stablecoins have raised a mammoth $621.81 million to date in 2025.

Bitcoin miner expands capital strategy

America’s Bitcoin Miner, CleanSpark, Inc., announced the expansion of its capital strategy. As such, it will increase its Bitcoin-backed credit facility with Coinbase Prime by $100 million.

“We are proud to expand our relationship with Coinbase Prime as we continue to add megawatts to our portfolio and take steps toward alternative use cases for some of our data centers,” said Matt Schultz, CleanSpark’s Chief Executive Officer and Chairman. “We see tremendous opportunity to accelerate mining growth while simultaneously optimizing our assets, particularly those near major metro centers and in our immediate pipeline, through the potential development of high-performance compute campuses.”

Crypto ETFs enter negative zone

The total crypto ETF netflow sank into the negative territory yesterday and reached -$445 million. More than $369 million worth of BTC ETFs were sold, while $76 million worth of ETH ETFs were sold.

As the market enters a very dodgy situation, the crypto community is confused. Falling Bitcoin prices and recovering ASI after being below the altcoin season keep the crypto traders on the edge of their seats. One minute the market is bullish and the next minute it is bearish. Now is the time to be very alert to market situations, as it is more volatile than ever.