The altcoin valuation when compared against gold has gone into levels seen during the 2021 Covid pandemic. The altcoin market valuation seems to have broken down from being bullish on the shorter time frame; however, it still holds the bullish trend on the longer time frame. Even the altcoin season index is at a pivotal point.

Popular crypto and Bitcoin enthusiast Michael Van de Poppe spotted that the altcoin market has slipped into low levels that were seen during the pandemic when compared to the valuation of gold. The Relative Strength Index (RSI) indicator crashed into the oversold region, showing a value of 25. When the RSI drops below 30, it often shows that the market has crashed enough and it is time for a recovery.

When considering the altcoin market cap in general, it has broken below the falling wedge. The falling wedge is a bullish pattern. Instead of breaking above the upper trendline of the falling wedge, the market cap crashed below and lost the $1 trillion support level. When the market cap crashed, it is evident that the bear market is in.

Bullish trend is visible on weekly chart

Even on the weekly chart, the altcoin market cap has crossed below the bullish trendline by a small margin. But the RSI indicator on the chart is on the verge of crossing into the oversold territory. When the RSI goes into this territory, the altcoins will be set for a recovery. As such, though the altcoin market cap is just below the trendline, it will bounce back above.

ASI is at a critical point

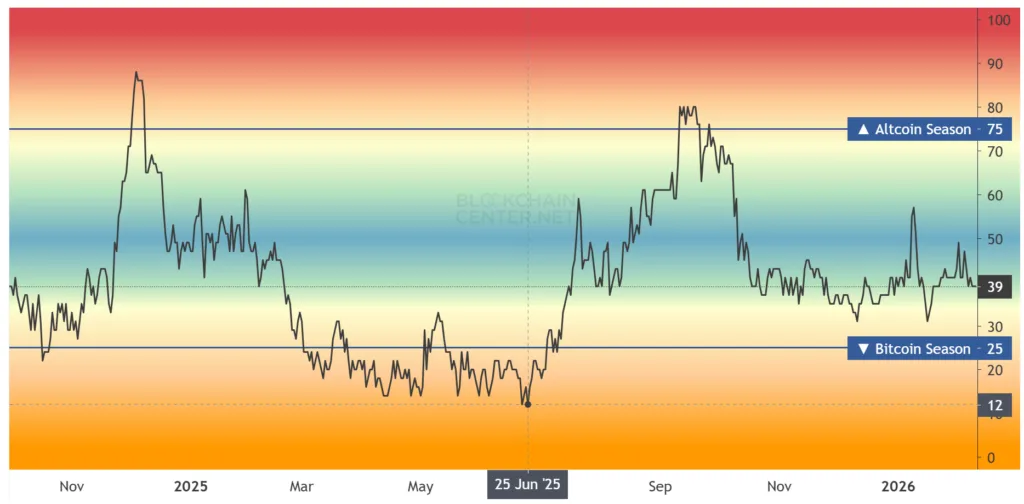

The altcoin season index (ASI), which gauges the performance of the altcoins, is also maintaining its bullish trend, although the latest action seems to be moving sideways.

Historic data shows that if the Altcoin Season Index follows that 2024 pattern, there is a high chance that the ASI will once again go into the altcoin season territory