The XRP coin is having quite an eventful end to the year. Following the launch of the Canary Capital spot XRP exchange-traded fund (ETF) earlier this month on November 13, the coin has been witnessing rising interest from institutional investors, as indicated by recent exchange data.

300 million XRP left Binance since October

Leading cryptocurrency exchange Binance is seeing plummeting XRP reserves since at least October 2025. XRP reserves on the trading platform have now dropped to 2.7 billion coins, fast approaching all-time low territory.

At a more granular level, about 300 million XRP have left Binance since October 6, marking one of the largest exoduses in the coin’s history. Rapidly depleting XRP reserves on exchanges is a bullish signal for the coin’s price trajectory.

The coin is also replicating its trajectory from past years, consolidating in a range for a long time before a parabolic move to the upside. Crypto analyst STEPH IS CRYPTO commented on XRP’s price action.

The analyst shared the following chart, comparing XRP’s current price action to that witnessed in 2017. They highlighted the ‘liquidity wick’ which temporarily derailed the coin’s bullish momentum, followed by a sharp reversal that pushed XRP’s price to a new all-time high (ATH).

If XRP in 2025 follows its price trajectory from 2017, then it may surge as high as $16 by the end of 2026. In fact, unlike 2017, this time around, XRP has a far higher acceptance among institutional investors.

Although, the cryptocurrency also has a far bigger market cap compared to 2017, which will require a lot of capital to pour into having an effect on price at the same magnitude as was witnessed in 2017.

XRP ETFs – the bullish catalyst

As mentioned earlier, Canary Capital’s spot XRP ETF announced the cryptocurrency’s entry into the institutional space. Since then, several XRP ETFs have launched, while many are on the verge of going live, pending certain regulatory approvals.

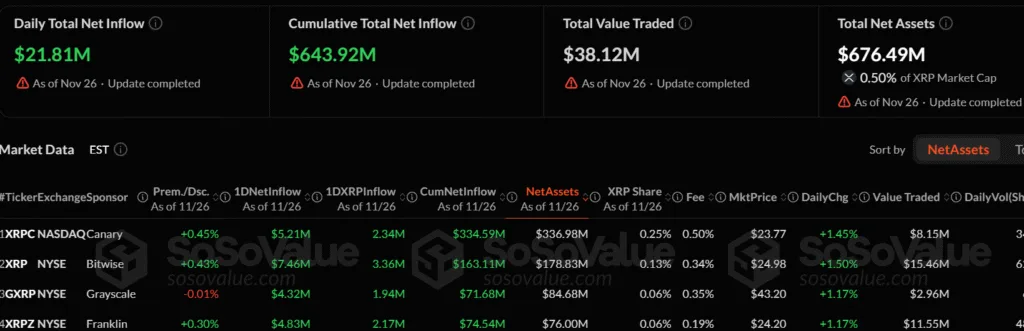

According to data from SoSoValue, US-based spot XRP ETFs have total net assets worth $676 million. Besides Canary Capital, there are also spot ETFs from Bitwise, Grayscale, and Franklin Templeton, giving institutions more options to gain exposure to XRP.