Here is an overview of cryptocurrency market developments for the week ending 22 Aug 2025, including Bitcoin (BTC), Ethereum (ETH), notable altcoin performers, and key events that may influence prices in the near term.

Bitcoin started wrong but recovers magnificently

Bitcoin began the week on a weak footing, slipping below $113,000 after meetings between U.S. and EU officials. It later recovered to the $114,000 area but still ended with daily losses; its market capitalization slid to $2.265 trillion, and dominance dropped below 58%. Mid‑week, risk appetite improved and BTC stabilised between $113K and $115K as traders shrugged off stock‑market declines.

On the daily chart, the bulls have taken control. Although BTC prices are falling, there is still hope as it is falling inside a bull flag. The fall is a prerequisite before a spike. Once Bitcoin breaks out of this pattern, it will surge towards $125K. But when is the breakout?

It will be sooner than some think. Here’s why.

Bullish indications: BTC has risen above the 50-day EMA, which is a very bullish sign that shows there is still demand for it.

Bulls outpower the bear: The last red candlestick shows that despite the bear’s efforts to crash the price below the 50-day EMA, the buyers are still keeping the price afloat.

Favorable technical conditions: The RSI indicator, which shows if the market is overbought or oversold, indicates a neutral outlook. As such, BTC is neither overpriced nor underpriced. This means there is room for price gains.

Why gains and not losses when the market is neutral? It is very difficult for BTC to break below the 50-day EMA support than to break above the weak $116.9K resistance level.

Hong Kong’s Mingcheng Group announced plans to purchase $483 million in BTC. On-chain data from Iconomi noted that large investors (so‑called whales) are accumulating BTC, while retail interest is fading, resulting in a consolidating market around $113 091.

Ethereum targets $5,400 as ETF inflows and staking take over

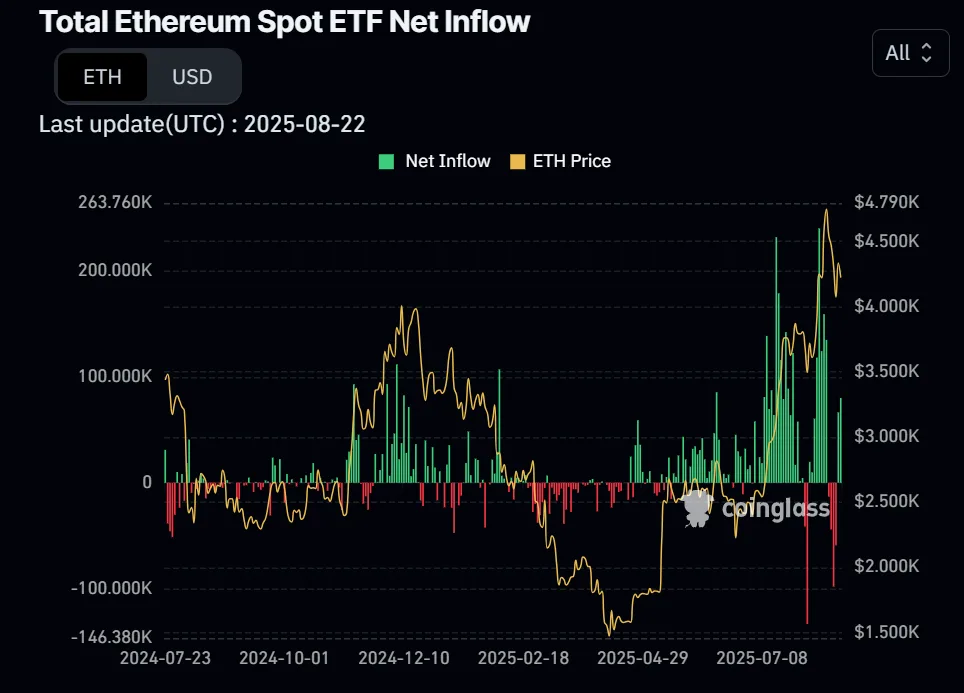

ETH traded weaker early in the week, slipping below $4,200 before rebounding off $4,070. Thereafter, ETH started to gain value and it reached. Thanks to the investors confidence in ETH. Inflows into spot‑ETH exchange‑traded funds was (over $1 billion for July and August) and exchange balances at nine‑year lows due to staking.

Traders viewed ETH as a “productive reserve asset” because of staking yields. Meanwhile, analyst who goes by the pseudonym Titan of Crypto stated, that $5,400 was on the ETH’s cards on the 4hour chart.

Altcoins that gained value and why

| Altcoin (weekly gain*) | Factors behind the rise | Evidence |

| Cardano (ADA) – ≈18.5 % gain | ADA rallied on on‑chain activity and smart‑contract upgrades, which increased adoption and speculation. | ADA rose 18.53 % to about $0.926 with heightened transaction volume and upcoming upgrades. |

| Arbitrum (ARB) – ≈14.1 % gain | As a layer‑2 scaling solution for Ethereum, Arbitrum attracted DeFi projects and users seeking lower fees and faster transactions. | Coindoo reported ARB rising 14.10 % to $0.4784, while AInvest noted a 15 % weekly gain linked to surging adoption. |

| Hyperliquid (HYPE) – ≈12.9 % gain | This decentralized perpetual‑futures exchange token benefited from strong trading volumes and unique platform features, attracting traders amid altcoin season optimism. | HYPE climbed 12.94 % to $45.90. |

| Chainlink (LINK) – ≈12 % gain | LINK’s role as the leading blockchain oracle and its cross‑chain interoperability drove demand. Partnerships with DeFi protocols and enterprise integrations highlighted its utility. | A prominent media cited a weekly gain of 12.30 %, while AInvest reported LINK up 16 % for the week and 12.62 % in 24 hours as altcoins flourished. |

Some altcoins lagged: XRP fell about 5 % to $2.88 due to risk aversion, Cardano also experienced a one‑day drop of over 8 % mid‑week before rebounding over the week, and tokens like Stellar, Hedera, Litecoin, and Polkadot declined.

Upcoming events and potential price effects

- Jackson Hole central bank symposium (late August 2025): Investors are watching whether Federal Reserve Chair Jerome Powell hints at monetary policy changes. Tighter policy could pressure risk assets, while dovish signals may support crypto prices.

- Ethereum ETF flows: Record inflows into spot‑ETH ETFs have been a major tailwind. Sustained inflows would signal institutional confidence and could support ETH prices; outflows might trigger profit‑taking.

- Bitcoin consolidation breakout: Technical analysts note that BTC must break above $114 k–$115 k to confirm the next leg of its bull run. Failure to hold this area could lead to deeper corrections.

- Altcoin resilience and network upgrades: The market is closely watching Ethereum’s upcoming “Dencun” upgrade and Solana’s performance. Solana’s technical pattern could target $260, though low network activity is a risk. Continued innovation on layer‑2s (e.g., Arbitrum and Optimism) and cross‑chain protocols (Chainlink CCIP) may drive further gains.

- Macroeconomic data and regulation: CPI readings, employment data, and any regulatory announcements (such as U.S. crypto legislation or the EU’s digital‑euro progress) could introduce volatility. Analysts warned that inflation data and central‑bank policy remain crucial for Bitcoin’s stability.

Takeaway

In the week to 22 Aug 2025, Bitcoin consolidated around $113 k–$115 k amid capital inflows and corporate interest, while Ethereum regained the $4,200 level and benefited from record ETF inflows and is currently trading at $4,700. Several altcoins—including Cardano, Arbitrum, Hyperliquid, and Chainlink—registered double‑digit weekly gains due to network upgrades, scaling adoption, and growing DeFi activity. Looking ahead, macroeconomic announcements, the Fed’s Jackson‑Hole meeting, ETH‑ETF flows, and pending network upgrades are likely to shape crypto price direction.