Amidst the crypto market carnage that has shaved the market’s total market cap to $2.4 trillion from a high of $4.3 trillion in October 2025, two sectors have suffered more than others – decentralized finance (DeFi) and artificial intelligence (AI) tokens.

DeFi and AI tokens get wiped out

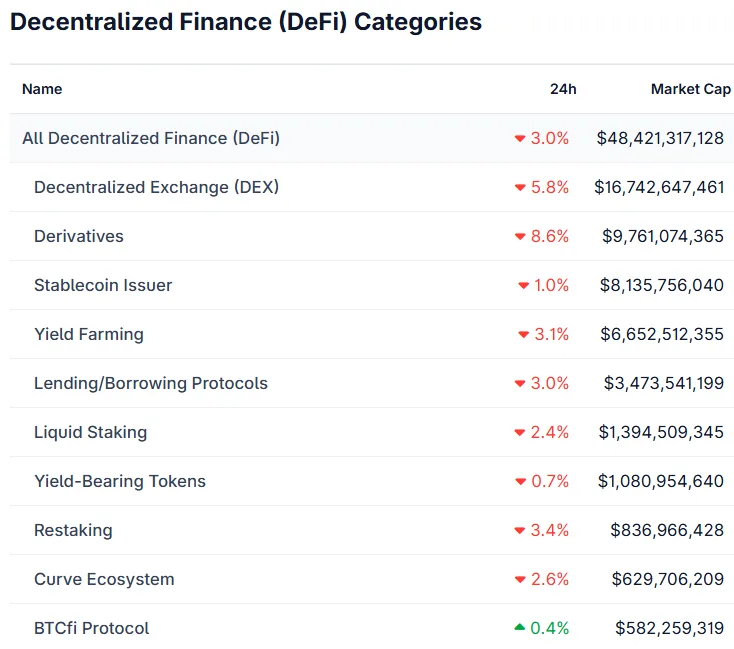

According to data from CoinGecko, the DeFi sector has taken a strong hit during the ongoing crypto market turmoil. The total DeFi market cap has tumbled to $48.4 billion, a 3% fall over the past 24 hours.

Among the different DeFi verticals, the decentralized derivatives sub-sector recorded the highest losses, standing at more than 8% over the past 24 hours. Decentralized exchanges (DEX) and re-staking protocols ranked second and third, with losses to the tune of 5.8% and 3.4% over the past 24 hours, respectively.

Data from DefiLlama shows that the total value locked (TVL) in Ethereum protocols has tumbled from a local high of $171.5 billion in October 2025 to almost $97 billion at the time of writing.

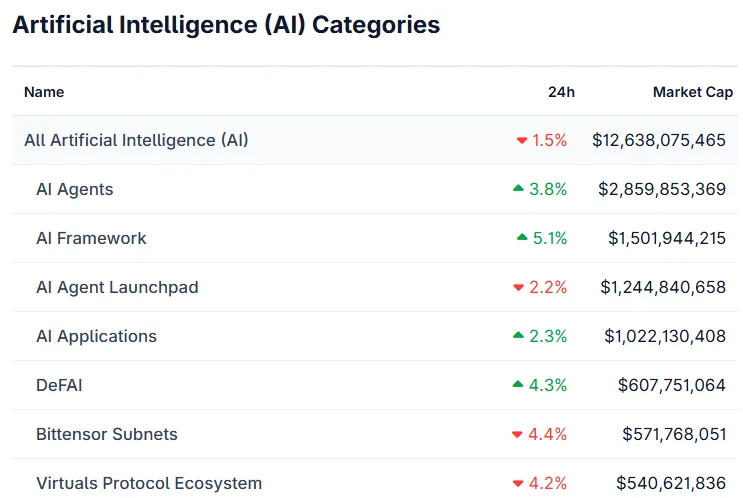

AI tokens did not fare too differently from DeFi tokens. CoinGecko data shows that the total market cap of top AI-based tokens has receded to $12.6 billion, down 1.7% over the past 24 hours.

Perp DEXs continue to shine

Among the AI categories, AI agent launchpads recorded the most losses, losing 2.2% in valuation over the past 24 hours. On the contrary, categories like AI framework and DeFAI recorded gains worth 5.1% and 4.3%, respectively.

In terms of AI tokens, decentralized storage protocol Arweave is down 25.8% over the past week, while GPU network Render is down 16.8% in the same period. That said, some analysts predict that 2026 could end up being a good year to gain exposure to AI cryptocurrencies.

Further, the rising popularity of perpetual DEXs like Hyperliquid and Aster is a reminder that there is still market and user appetite for privacy-oriented financial protocols. Although not all analysts are as bullish on perp DEXs potential to overtake their centralized counterparts.