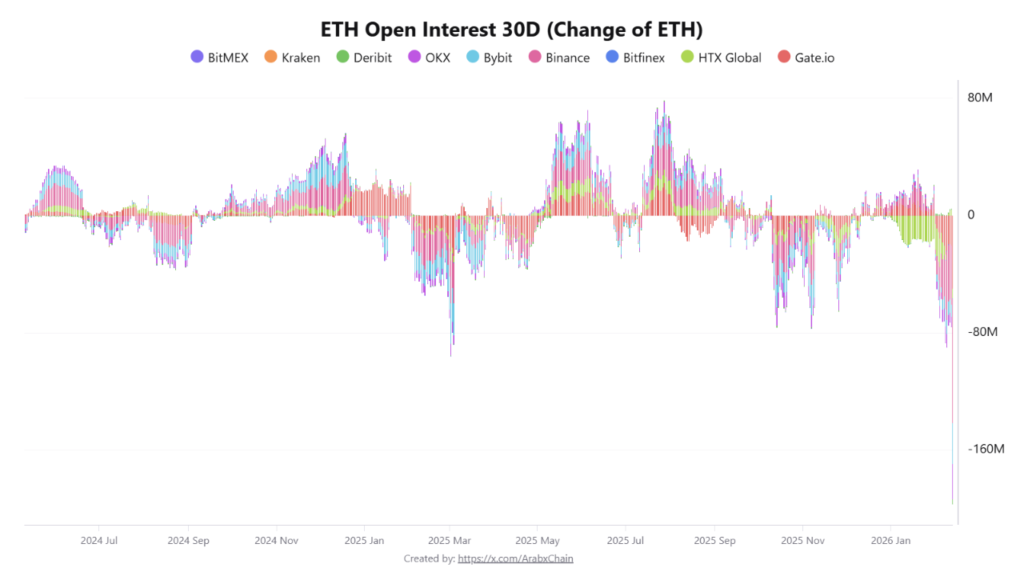

Exchange data across major trading platforms on the Ethereum 30-day open interest change shows that the derivatives market is undergoing a clear phase of deleveraging and risk adjustment. The downward trend of Ethereum OI is concentrated mostly on major exchanges.

Ethereum 30-day OI on a downward trend

Leading cryptocurrency exchanges such as Binance, Gate.io, OKX, and Bybit are all seeing a downward trend in ETH open interest. In simple words, traders on these exchanges are pulling capital out from futures positions.

Notably, Binance has seen a decline of approximately 40 million ETH over the past 30 days, while Gate.io’s ETH OI tumbled by over 20 million. Similarly, OKX saw its OI fall by 6.8 million ETH.

Bybit crypto exchange saw its OI decrease by 8.5 million ETH. In total—across the four cryptocurrency exchanges—the total ETH OI crashed by 75 million ETH.

Over the past month, all crypto exchanges—including the ones with small trading volumes—have experienced a total contraction of more than 80 million ETH. The decline in ETH OI shows that traders using high leverage are reducing their exposure rather than opening new positions.

This behavior displayed by traders could either be out of caution or due to pressure from volatile price movements in the underlying assets. Past data also shows that such market transitions usually coincide with periods where short-term makes way for a conservative approach.

Market showing ‘clean-up’ of weak positions

CryptoQuant analyst Arab Chain remarked that the drop in ETH OI across exchanges can be considered the ‘clean-up’ of weak positions, which can reduce the possibility of sharp, forced cascading liquidations in the future.

That being said, the Ethereum 7-day liquidation average recently hit the highest level since 2021, hinting that a bullish reversal may be on the horizon. At press time, ETH trades at $1,954, down 0.7% in the past 24 hours.