Although Ethereum (ETH) price has fallen by 13.4% over the past week, market data suggests that traders are already excessively optimistic about an impending recovery in the digital asset. As a result, there’s an increased threat of further correction for the cryptocurrency.

Binance ETH derivatives show long bias

Fresh data from Binance cryptocurrency exchange shows that the Ethereum open interest (OI) on Binance has dropped significantly from around $8 billion to close to $3.9 billion. The decline began on January 14.

The strong fall in Binance ETH derivatives OI shows an almost 50% reduction in total outstanding derivative contracts. Meanwhile, the cumulative volume delta (CVD) has been on an uptrend since February 4.

For the uninitiated, CVD measures the net difference between buying and selling volume over a period, showing whether aggressive buyers or sellers are dominating the market. A rising CVD indicates that more volume is coming from buyers, while a falling CVD signals selling pressure from shorts.

From February 4, the Binance ETH derivatives CVD increased from $2.4 billion to $4.15 billion. The surge shows that most of the closed positions were shorts, meaning that ETH traders are overwhelmingly bullish on the digital asset now.

Ethereum revenue hits a high

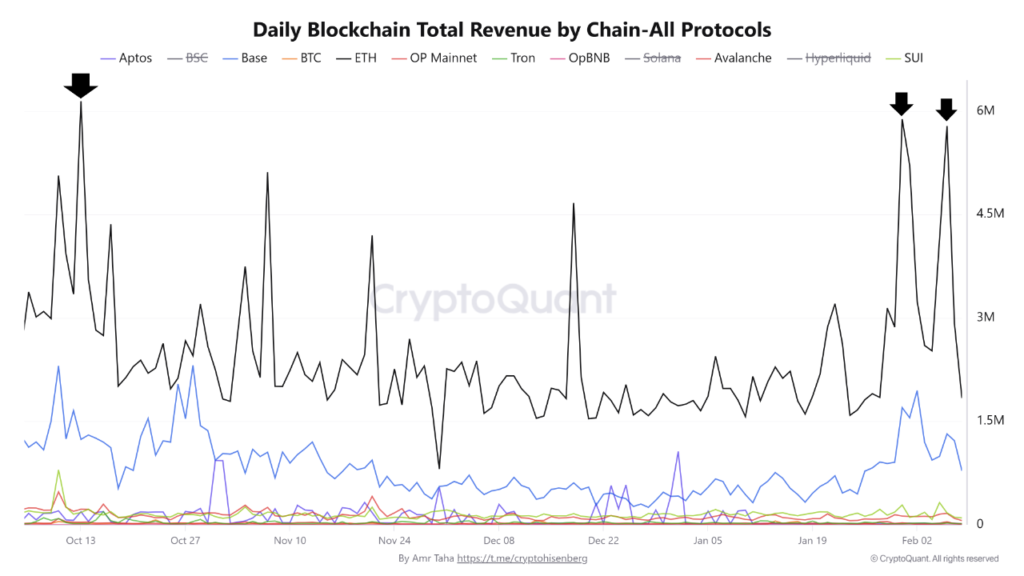

Meanwhile, Ethereum revenue – stemming from interaction with smart contracts, gas fees, and swaps on decentralized exchanges (DEX) – climbed to $5.8 million on February 6. The last time Ethereum protocol revenue climbed around these levels was on January 31, when it hit $5.88 million.

Notably, the rise in protocol revenue earlier this year happened at the same time when ETH price fell from more than $2,700. In the same vein – in October 2025, Ethereum revenue increased beyond $6 million, followed by ETH’s correction from its above $4,250.

Despite these cautionary signs, recent on-chain movements show that whales are silently accumulating ETH at current prices, seeing the range as an attractive buy zone. Recently, ETH withdrawals from exchanges topped 220,000—the highest level since October 2025.