Speaking at Consensus 2026, Hong Kong, Fundstrat’s head of research, Tom Lee, made a bold claim, saying that Ether (ETH) is likely to exhibit another so-called V-shaped recovery after retesting the $1,890 price level.

Ethereum to show V-shaped price recovery

Ether, the native coin of the Ethereum blockchain, is down 6.8% over the past week, trading at $1,964 at the time of writing. Currently, the cryptocurrency is more than 60% below its all-time high (ATH) of $4,946, established in August 2025.

The digital asset’s latest slump has spooked several prominent investors, barring Tom Lee. Speaking at Consensus 2026, Lee said that he expects ETH to rebound following the recent price pullback.

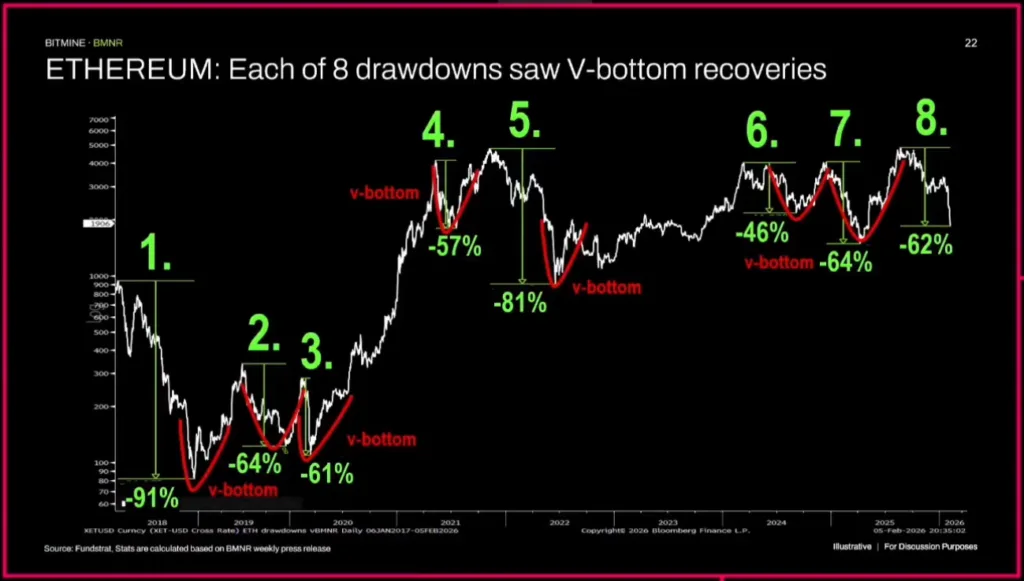

Lee remarked that he understands that ETH investors are likely frustrated with the recent subpar price action. However, he brought attention to the fact that since 2018, ETH has fallen more than 50% eight times.

In all eight instances, ETH recovered in price stronger than earlier. In fact, ETH declined a mammoth 64% between January 2025 and March 2025 and made a swift recovery that was just as fast as the decline.

Lee added that nothing has changed in terms of Ethereum’s fundamentals. To note, the smart contract platform saw two major upgrades last year, the Pectra upgrade and the Fusaka upgrade in December, strengthening the protocol’s technical capabilities.

ETH is hovering around the bottom

Speaking at the conference, Lee said that BitMine market analyst Tom Demarc had highlighted the $1,890 price level as a potential market bottom. However, the digital asset is likely to tap this level twice, with the second time being an ‘undercut.’

We think Ethereum is really close to the bottom, and I think it’s just like the fall of 2018, fall of 2022, and April 2025. You don’t really have to worry about the bottom. If you’ve already seen a decline, you should be thinking about opportunities here instead of selling.

Tom Lee, Fundstrat

An increasing amount of ETH continues to get staked on the Ethereum network, isolating a large chunk of the total supply from active circulation and bolstering the ‘supply crunch’ narrative that can potentially ignite a new bullish rally for ETH.