Co-founders of crypto projects get rid of Ether as the coin crashes below $2,000, a psychological support level. The wide market selloff comes in the wake of the geopolitical tension escalating and developing into a military confrontation. With a possible confrontation developing on the horizon, investors are avoiding exposing themselves to volatility.

As the narrative in the geopolitical condition gets more intensive and the crypto markets take the brunt, there is a pattern of co-founders of projects selling their Ethereum holdings. In particular, the co-founder of Ethereum, Vitalik Buterin, and the co-founder of Aave, Stani Kulechov, started to sell their ETH holdings.

Buterin offloads 3K ETH

Buterin’s sell-off comes just a few days after he withdrew a portion of his personal holdings for the development of the network, as he claims. Buterin wrote on X, “I have just withdrawn 16,384 ETH, which will be deployed toward these goals over the next few years.”

However, as the crypto market began to crash with the U.S. and Iran standoff, Buterin started to sell his ETH. According to Lookonchain, “Vitalik has sold 2,961.5 $ETH ($6.6M) at an average price of $2,228 – and the selling is still ongoing” within the last 3 days.

Even the co-founder of Aave was seen offloading his Ethereum holdings into the market.

ETH is technically overbought, and recovery is due

As the tension building in the Middle East spilled into the crypto market, Bitcoin crashed to $65K, while Ethereum lost a major resistance level at $2,170.

After losing this support level, the coin dropped below the $2,000 psychological resistance level. However, as shown in the chart below, Ethereum is oversold and is due for a market correction, whereby the prices could rise.

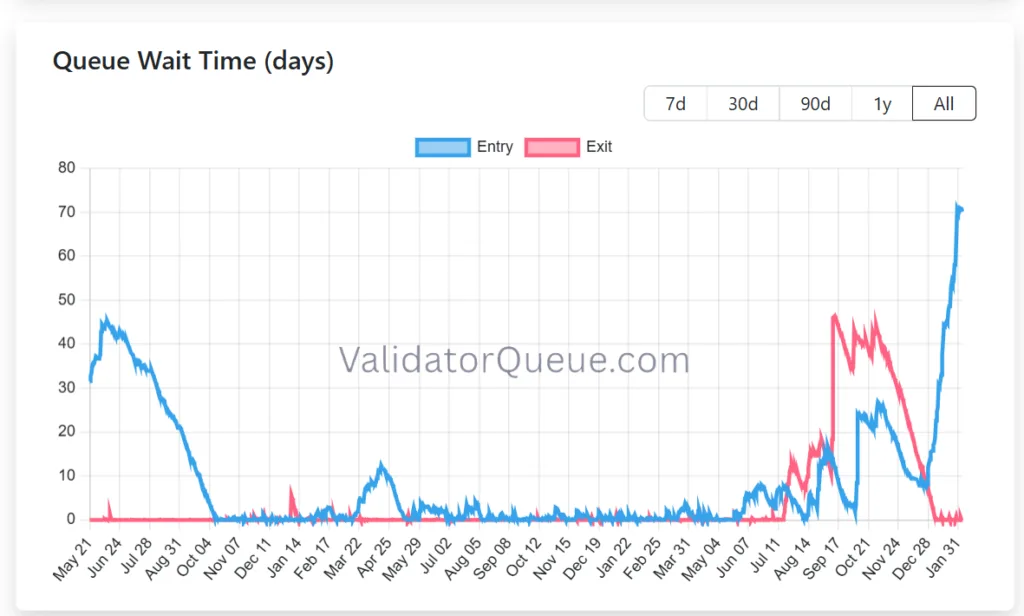

Not only is Ethereum technically poised for a recovery, but even the fundamentals look solid. For instance, there are many ETH holders who want to become validators. With the entrance being congested, the queue wait time has hit 70 days.

A long validator queue shows the interest of the ETH community to earn rewards from staking as well as the long-term confidence in ETH. Although ETH prices look grim, they should recover once the overall situation alleviates.