After a high of $4,800 in October 2025, Ethereum has fallen by more than 60%. The digital asset is now exchanging hands just above $1,900, as the sentiment toward ETH remains bearish. That said, all is not lost for ETH just yet.

Ethereum may surprise the bears

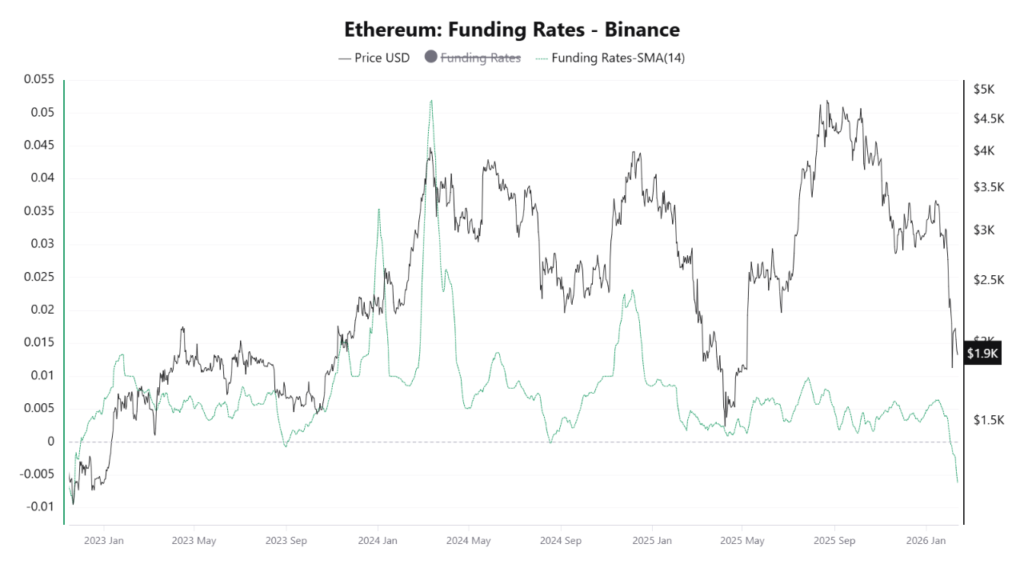

The Ethereum derivatives market is flashing a rare contrarian signal, as the 14-day simple moving average (SMA) of the cryptocurrency on the Binance trading platform has fallen to -0.006.

Negative funding rates mean short sellers are paying longs to hold positions, showing that the overall bias toward the asset is to the downside. However, when negative funding gets extreme, it shows the possibility of a short squeeze if the price increases.

For the uninitiated, a ‘short squeeze’ happens when an asset’s price rises unexpectedly. This forces short sellers to buy back their positions to limit losses. This buying pressure pushes the price even higher.

Notably, the current Binance funding rate on the Ethereum derivatives market of -0.006 is the lowest recorded value since December 2022. In simple words, it shows that bearishness toward ETH has reached an extreme peak not seen in the last three years.

The funding rate being so deep in the negative territory means that short sellers are negatively dominating ETH’s price action, paying an extraordinary amount of premium to keep their positions open at such low price levels.

Will ETH see a price reversal?

CryptoQuant analyst CryptoOnchain noted that extremely negative funding rates at major price support levels typically tend to precede a massive short squeeze.

When the wider crowd is so convinced that the price will fall further, it usually moves in the opposite direction and liquidates the overconfident bears. The below chart shows that ETH may be replicating the bottom formation of late 2022, laying the foundation for a sharp price recovery.

Various exchange metrics support the bull case for ETH. ETH withdrawals from exchanges recently reached 220,000 – the highest point since October 2025. The trend shows that long-term investors are holding ETH rather than selling it.